Answered step by step

Verified Expert Solution

Question

1 Approved Answer

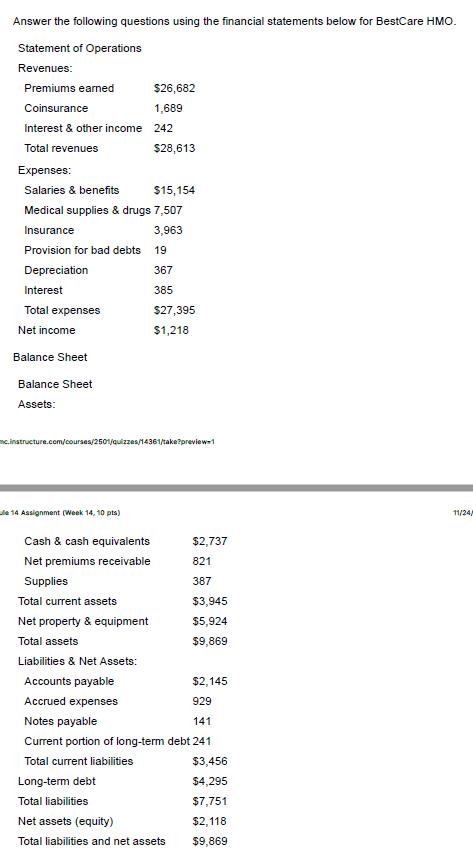

a) What is BestCare's return on assets? (Enter answer as a percent, excluding %.) b) What is BestCare's current ratio? (Round to nearest hundredth place.)

a) What is BestCare's return on assets? (Enter answer as a percent, excluding "%".)

b) What is BestCare's current ratio? (Round to nearest hundredth place.)

c) What is BestCare's days cash on hand? (Round to nearest tenth place.)

d) What is BestCare's average collection period? (Round to nearest tenth place.)

e) What is BestCare's debt ratio?

f) What is BestCare's times interest earned (TIE) ratio? (Round to nearest tenth place.)

g) What is BestCare's fixed asset turnover ratio? (Round to nearest tenth place.)

Answer the following questions using the financial statements below for BestCare HMO Statement of Operations Revenues Premiums earned $26,682 1,689 242 $28,613 Interest & other income Total revenues Salaries & benefits Medical supplies & drugs 7,507 Insurance Provision for bad debts 19 Depreciation Interest Total expenses $15,154 3,963 367 385 $27,395 $1,218 Net income Balance Sheet Balance Sheet Assets e14 Assignment (Week 14, 10 pts) 11/24 $2,737 821 387 $3,945 $5,924 $9,869 Cash & cash equivalents Net premiums receivable Supplies Total current assets Net property & equipment Total assets Liabilities & Net Assets Accounts payable Accrued expenses Notes payable Current portion of long-term debt 241 Total current liabilities $2,145 929 141 Long-term debt Total liabilities Net assets (equity) Total liabilities and net assets $3,456 $4,295 $7,751 $2,118 $9,869

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started