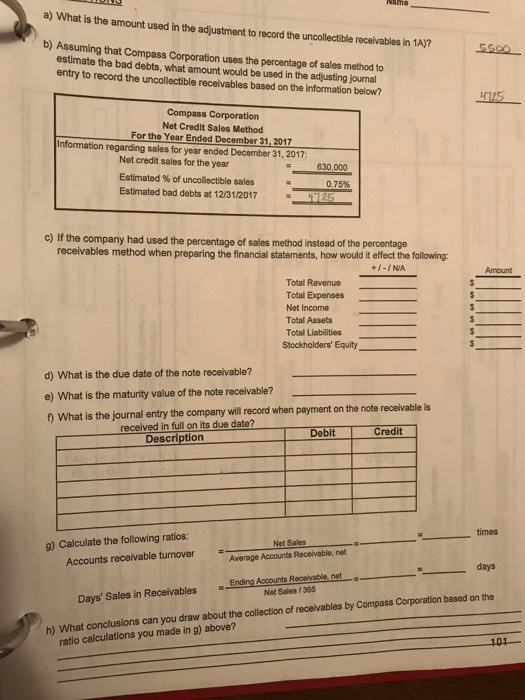

a) What is the amount used in the adjustment to record the uncollectible receivables in 1A)? b) Assuming that Compass Corporation uses the percentage of sales method to estimate the bad debts, what amount would be used in the adjusting jouna entry to record the uncollectible receivables based on the information below? 5500 Net Credit Sales Method For the Year Ended December 31,2017 Information regarding sales for year ended December 31,2017 Net credit sales for the year Estimated % of uncollectible sales Estimated bad debts at 12/31/2017 0.75% c) If the company had used the percentage of sales method instead of the percentage receivables method when preparing the financial statements, how would it effect the following +-INIA Amount Total Revenue Total Expenses Net Income Total Assets Total Liablities Stockholders' Equity d) What is the due date of the note receivable? e) What is the maturity value of the note receivable? 2) What is the journal entry the company will record when payment on the note receivable s received in full on its due date? eDitCredit times g) Calculate the following ratios N Sales = Accounts receivable tumover Average Accounts Recelivable, net Ending Ascounts Recevable, netdays Net Sales /365 Days' Sales in Receivables h) What conclusions can you draw about the collection of receivables by Compass Corporation based on the ratio calculations you made in g) above? a) What is the amount used in the adjustment to record the uncollectible receivables in 1A)? b) Assuming that Compass Corporation uses the percentage of sales method to estimate the bad debts, what amount would be used in the adjusting jouna entry to record the uncollectible receivables based on the information below? 5500 Net Credit Sales Method For the Year Ended December 31,2017 Information regarding sales for year ended December 31,2017 Net credit sales for the year Estimated % of uncollectible sales Estimated bad debts at 12/31/2017 0.75% c) If the company had used the percentage of sales method instead of the percentage receivables method when preparing the financial statements, how would it effect the following +-INIA Amount Total Revenue Total Expenses Net Income Total Assets Total Liablities Stockholders' Equity d) What is the due date of the note receivable? e) What is the maturity value of the note receivable? 2) What is the journal entry the company will record when payment on the note receivable s received in full on its due date? eDitCredit times g) Calculate the following ratios N Sales = Accounts receivable tumover Average Accounts Recelivable, net Ending Ascounts Recevable, netdays Net Sales /365 Days' Sales in Receivables h) What conclusions can you draw about the collection of receivables by Compass Corporation based on the ratio calculations you made in g) above