Answered step by step

Verified Expert Solution

Question

1 Approved Answer

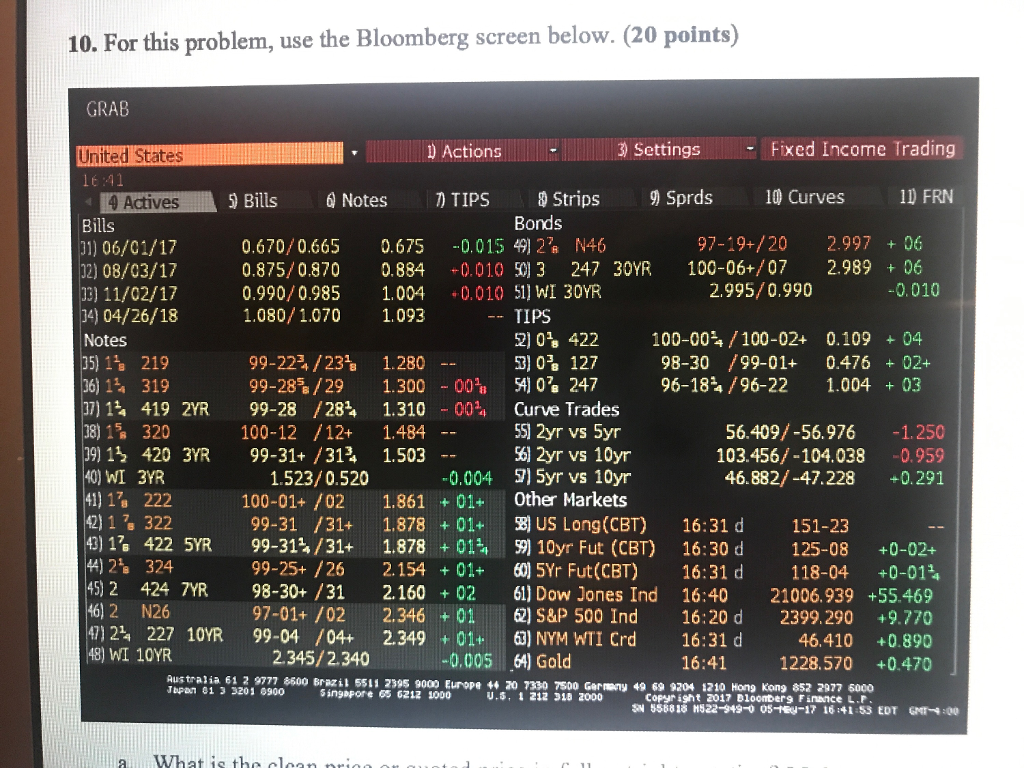

a. What is the clean price or quoted price in full-outright notation? Make sure to show your work . b. What is the accrued interest?

a. What is the clean price or quoted price in full-outright notation? Make sure to show your work.

b. What is the accrued interest? Make sure to show your work.

c. What is the dirty price (full price or invoice price)? Make sure to show your work.

d. What is the total income from the bond?

10. For this problem, use the Bloomberg screen below. (20 points) GRAB D Actions Fixed Income Trading 3 Settings United States ID FRN 4 Actives 5 Bills Notes TIPS 9 Strips 9 Sprds 10 Curves Bonds Bills 97-19 20 2.997 06 0.670/0.665 0.675 0,015 49) 2 N46 31) 06/01/17 0.875/0.870 0.884 C. 010 3 247 30YR 100-06 07 2.989 06 12) 08/03/17 2.995/0.990 0.990/0.985 1,004 0.010 51) WI 30YR 11/02/17 1.080 1.070 1.093 14) 04/26/18 TIPS 2) 0% 422 100 00% 100-02+ 0.109 04 Notes 99-22 /231a 1.280 3) 0+ 127 98-30 99-01+. 0.476 02+ 219 99-285 29 1.300 00 54] 0's 247 96-184/96-22 1.004 03 319 37) 1 419 2YRA 99-28 /28 1.310 00 Curve Trades 56.409/ -56.976 -1.250 320 100-12 /12+ 1.484 55 r vs 5yr 19) 13 420 3YR 99-31+ /31 1.503 2yr vs 10yr 103,456/-104.038 -0.959 WI 3YR 0,004 9) 5yr vs 10yr 1.523/0.520 46.882/ 47.228 0.291 100-01+ 02 1,861 01+ Other Markets 322 99-31 /31 1,878 01+ US Long (CBT) 16:31 d 151-23 422 5YR 99-31 /31+ 1.878 01 10yr Fut (CBT) 16:30 d 125-08 +0-02+ 324 99-25+ /26 2.154 01+ 60) 5Yr Fut (CBT) 16:31 d 118-04. 0-01 45) 2 424 7YR 98-30+ /31 2.160 02 61) Dow Jones Ind 16:40 21006.939 +55.469 2 N26 97-01+ /02 2,346 01 6) S&P 500 Ind 16:20 d 2399.290 +9.770 47) 2. 227 10YR 99-04 /04+ 2.349 01 6) NYM WTI crd 16:31 d 46.410 +0.890 480 WI 10YR 2.345/2.340 0,005 .6Al Gold 16:41 1228.570 +0.470 Australia 2 9777 8600 Brazil ss 000 Europe 7500 Germany 49 69 g204 1210 Hong Kong iss2 2g77 5000 81 3 3201 8900 Singapore 65 6212 1000 U.S, 1 212 318 2000 Copyright 2017 Bloomberg Finance LP WWhat is th loan 10. For this problem, use the Bloomberg screen below. (20 points) GRAB D Actions Fixed Income Trading 3 Settings United States ID FRN 4 Actives 5 Bills Notes TIPS 9 Strips 9 Sprds 10 Curves Bonds Bills 97-19 20 2.997 06 0.670/0.665 0.675 0,015 49) 2 N46 31) 06/01/17 0.875/0.870 0.884 C. 010 3 247 30YR 100-06 07 2.989 06 12) 08/03/17 2.995/0.990 0.990/0.985 1,004 0.010 51) WI 30YR 11/02/17 1.080 1.070 1.093 14) 04/26/18 TIPS 2) 0% 422 100 00% 100-02+ 0.109 04 Notes 99-22 /231a 1.280 3) 0+ 127 98-30 99-01+. 0.476 02+ 219 99-285 29 1.300 00 54] 0's 247 96-184/96-22 1.004 03 319 37) 1 419 2YRA 99-28 /28 1.310 00 Curve Trades 56.409/ -56.976 -1.250 320 100-12 /12+ 1.484 55 r vs 5yr 19) 13 420 3YR 99-31+ /31 1.503 2yr vs 10yr 103,456/-104.038 -0.959 WI 3YR 0,004 9) 5yr vs 10yr 1.523/0.520 46.882/ 47.228 0.291 100-01+ 02 1,861 01+ Other Markets 322 99-31 /31 1,878 01+ US Long (CBT) 16:31 d 151-23 422 5YR 99-31 /31+ 1.878 01 10yr Fut (CBT) 16:30 d 125-08 +0-02+ 324 99-25+ /26 2.154 01+ 60) 5Yr Fut (CBT) 16:31 d 118-04. 0-01 45) 2 424 7YR 98-30+ /31 2.160 02 61) Dow Jones Ind 16:40 21006.939 +55.469 2 N26 97-01+ /02 2,346 01 6) S&P 500 Ind 16:20 d 2399.290 +9.770 47) 2. 227 10YR 99-04 /04+ 2.349 01 6) NYM WTI crd 16:31 d 46.410 +0.890 480 WI 10YR 2.345/2.340 0,005 .6Al Gold 16:41 1228.570 +0.470 Australia 2 9777 8600 Brazil ss 000 Europe 7500 Germany 49 69 g204 1210 Hong Kong iss2 2g77 5000 81 3 3201 8900 Singapore 65 6212 1000 U.S, 1 212 318 2000 Copyright 2017 Bloomberg Finance LP WWhat is th loanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started