Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is the cost of each alternative? b. What is the NPV of each alternative? c. Which alternative should Firm Alpha choose? d. What

a. What is the cost of each alternative?

b. What is the NPV of each alternative?

c. Which alternative should Firm Alpha choose?

d. What are some important factors in deciding whether to use stock or cash in an acquisition?

e. Explain what defensive tactics the managers of Firm Beta could use to resist acquisition.

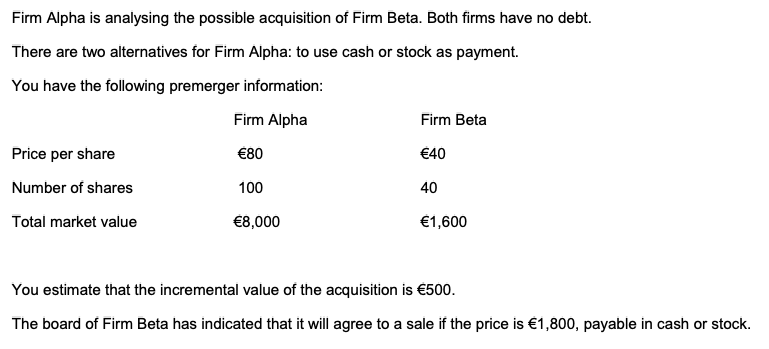

Firm Alpha is analysing the possible acquisition of Firm Beta. Both firms have no debt. There are two alternatives for Firm Alpha: to use cash or stock as payment. You have the following premerger information: Firm Alpha Firm Beta Price per share 80 40 Number of shares 100 40 Total market value 8,000 1,600 You estimate that the incremental value of the acquisition is 500. The board of Firm Beta has indicated that it will agree to a sale if the price is 1,800, payable in cash or stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started