could you please help me with the computations and filling this first table? thank you!

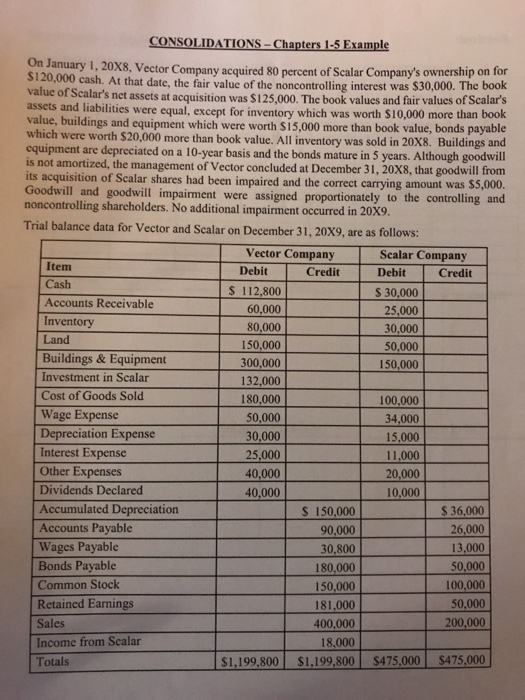

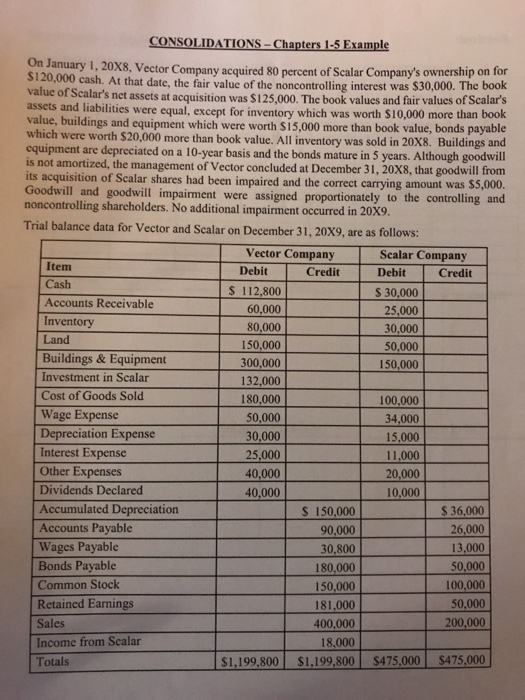

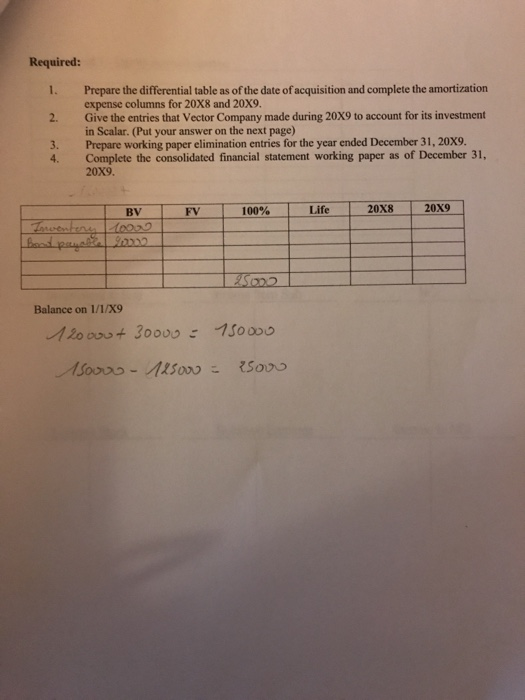

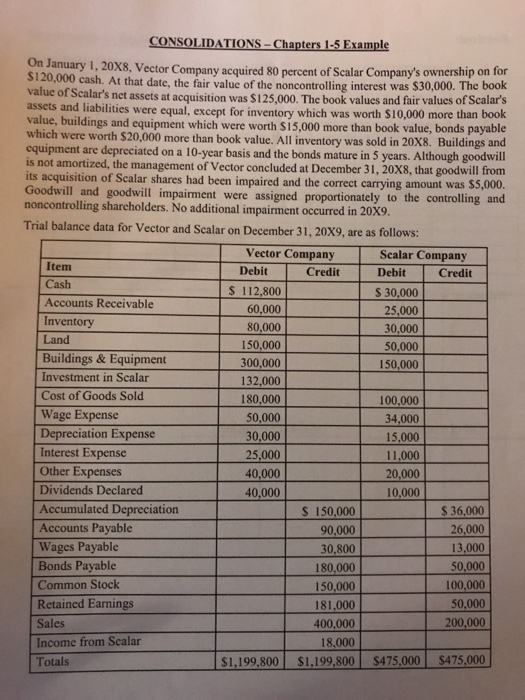

CONSOLIDATIONS-Chapters 1-5 Example On January S120,000 cash. A value of Sca assets and liabilities were 1, 20x8, Vector Company acquired 80 percent of Scalar Company's ownership on for t that date, the fair value of the noncontrolling interest was $30,000. The book lar's net assets at acquisition was $125,000. The book values and fair values of Scalar's equal, except for inventory which was worth $10,000 more than book alue, buildings and equipment which were worth Si5,000 more than book value, bonds payable which equipment are depreciated on a 10-year basis and the bonds mature in 5 years. Although goodwill is not amortized, the management of Vector concluded at December 31, 20X8, that goodwill from its acquisition of Scalar shares had been impaired and the correct Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. No additional impairment occurred in 20X9 Trial balance data for Vector and Scalar on December 31, 20x9, are as follows: were worth $20,000 more than book value. All inventory was sold in 20X8. Buildings and carrying amount was $5,000. Vector Company Scalar Company Debit Item Cash Accounts Receivable Inventory Land Buildings & Equipment Investment in Scalar Debit Credit Credit S 112,800 S 30,000 25,000 30,000 50,000 150,000 60,000 80,000 150,000 300,000 132,000 180,000 50,000 30,000 25,000 40,000 Wage Expense Depreciation Expense Interest Expense Other Expenses 100,000 34,000 15,000 11,000 20,000 10,000 Accumulated Depreciation ccounts Payable Wages Payable Bonds Payable Common Stock Retained Earnings Sales Income from Scalar Totals S 150,000 90,000 30,800 180,000 150,000 181,000 400,000 18,000 S 36,000 26,000 13,000 50,000 100,000 200,000 $1,199,800 $1,199,800 $475,000 $475,000 Required: 1. Prepare the differential table as of the date of acquisition and complete the amortization 2. Give the entries that Vector Company made during 20x9 to account for its investment 3. Prepare working paper elimination entries for the year ended December 31, 20X9. expense columns for 20X8 and 20X9. in Scalar. (Put your answer on the next page 4. Complete the consolidated financial statement working paper as of December 31, 20x9 100% | Life 20x8 20X9 BV FV Balance on 1/1/X9