Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) What is the duration of a 1-year, 10,000 loan, with an interest rate of 10% where accrued interest and half the principal is

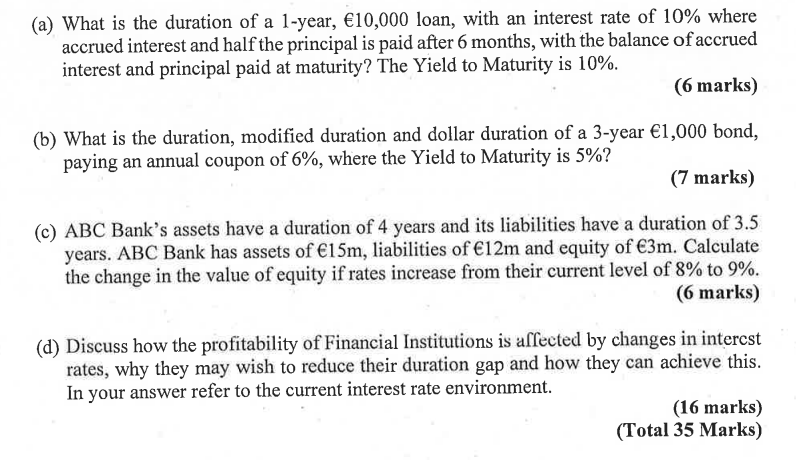

(a) What is the duration of a 1-year, 10,000 loan, with an interest rate of 10% where accrued interest and half the principal is paid after 6 months, with the balance of accrued interest and principal paid at maturity? The Yield to Maturity is 10%. (6 marks) (b) What is the duration, modified duration and dollar duration of a 3-year 1,000 bond, paying an annual coupon of 6%, where the Yield to Maturity is 5%? (7 marks) (c) ABC Bank's assets have a duration of 4 years and its liabilities have a duration of 3.5 years. ABC Bank has assets of 15m, liabilities of 12m and equity of 3m. Calculate the change in the value of equity if rates increase from their current level of 8% to 9%. (6 marks) (d) Discuss how the profitability of Financial Institutions is affected by changes in intercst rates, why they may wish to reduce their duration gap and how they can achieve this. In your answer refer to the current interest rate environment. (16 marks) (Total 35 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started