Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. What is the duration of Acron's equity? - duration of the assets is _ years - duration of the liabilities is _ years -

A. What is the duration of Acron's equity?

- duration of the assets is _ years

- duration of the liabilities is _ years

- duration of equity is ___ years

b.

- duration of assets is __ years

- duration of equity is ___ years

- we would expect Acron's equity to (drop or rise) by approx. ___ %

C.

- they should (sell or buy) $_____ million worth of 10- year STRIPS

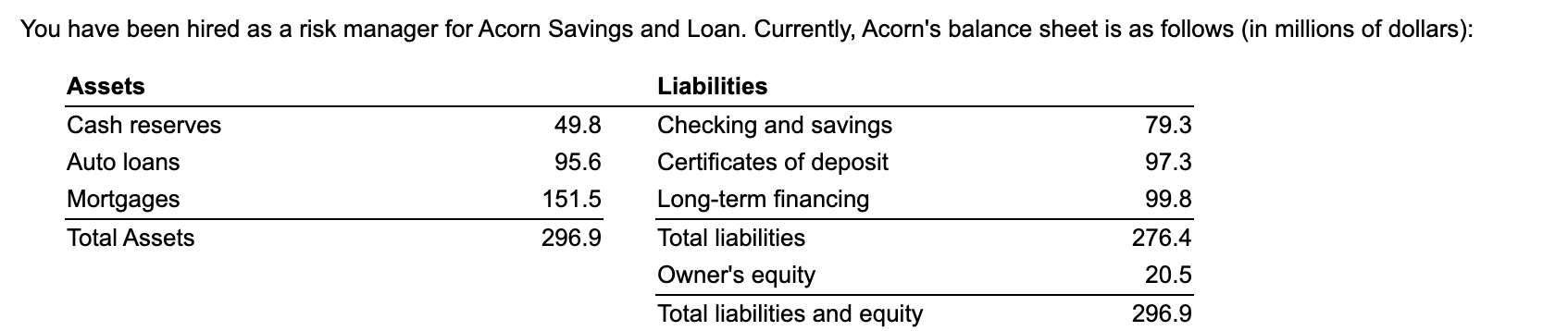

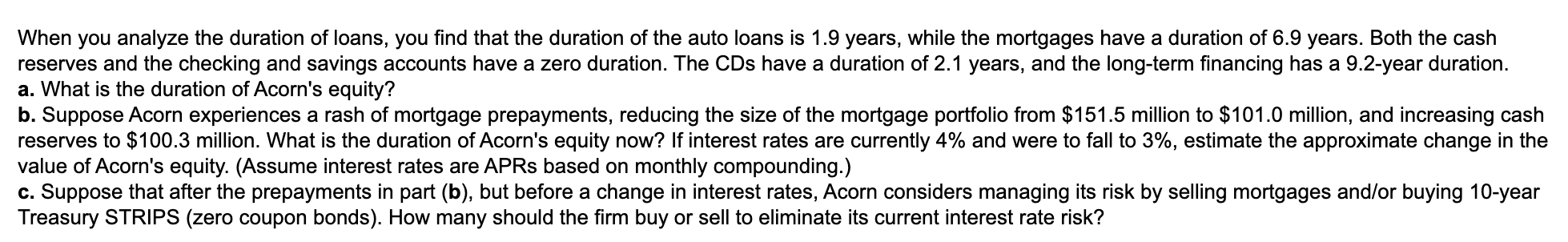

You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn's balance sheet is as follows (in millions of dollars): Assets Cash reserves Auto loans 49.8 95.6 151.5 296.9 Mortgages Total Assets Liabilities Checking and savings Certificates of deposit Long-term financing Total liabilities Owner's equity Total liabilities and equity 79.3 97.3 99.8 276.4 20.5 296.9 When you analyze the duration of loans, you find that the duration of the auto loans is 1.9 years, while the mortgages have a duration of 6.9 years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of 2.1 years, and the long-term financing has a 9.2-year duration. a. What is the duration of Acorn's equity? b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $151.5 million to $101.0 million, and increasing cash reserves to $100.3 million. What is the duration of Acorn's equity now? If interest rates are currently 4% and were to fall to 3%, estimate the approximate change in the value of Acorn's equity. (Assume interest rates are APRs based on monthly compounding.) c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero coupon bonds). How many should the firm buy or sell to eliminate its current interest rate riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started