Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is the initial price of a 182-day, $200,000 Government of Canada T-bill that yields 4.04% per annum ? ? ? ? ? ?

a. What is the initial price of a 182-day, $200,000 Government of Canada T-bill that yields 4.04% per annum ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ??

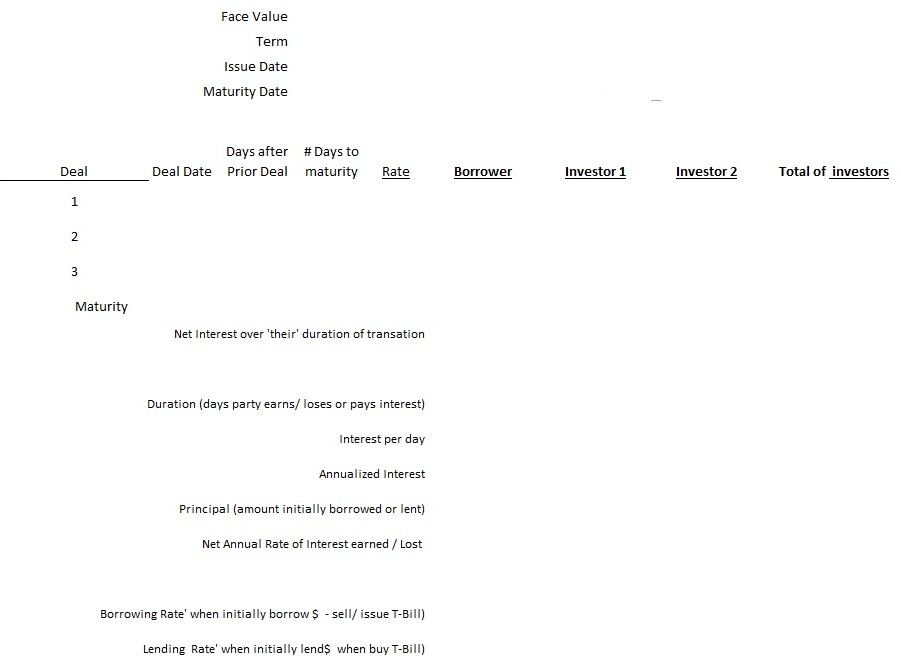

b. Assume the Treasury Bill in the question above was bought by Investor 1. Investor 1 then sold the T-Bill 30 days after issuance for $196,000 to Investor 2. Assume the answer to question a. was $197,000. ? Complete the T-Bill trading worksheet

Deal 1 2 3 Maturity Face Value Term Issue Date Maturity Date Deal Date Days after #Days to Prior Deal maturity Rate Net Interest over 'their' duration of transation Duration (days party earns/loses or pays interest) Interest per day Annualized Interest Principal (amount initially borrowed or lent) Net Annual Rate of Interest earned / Lost Borrowing Rate' when initially borrow $ -sell/issue T-Bill) Lending Rate' when initially lends when buy T-Bill) Borrower Investor 1 Investor 2 Total of investors

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Initial price Yield For 182 daysAnnu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started