a) What was the main problem with Supor's marketing channels? What were the causes of this problem? If you were the corporate decision-maker, how would you have resolved Supor's channel problem?

b) Conduct some research and provide an example of another brand/company which has faced channel conflict issues. Briefly describe their situation and how they managed the conflict.

kINDLY PROVIDE APA REFERENCES AND INTEXT CITATIONS

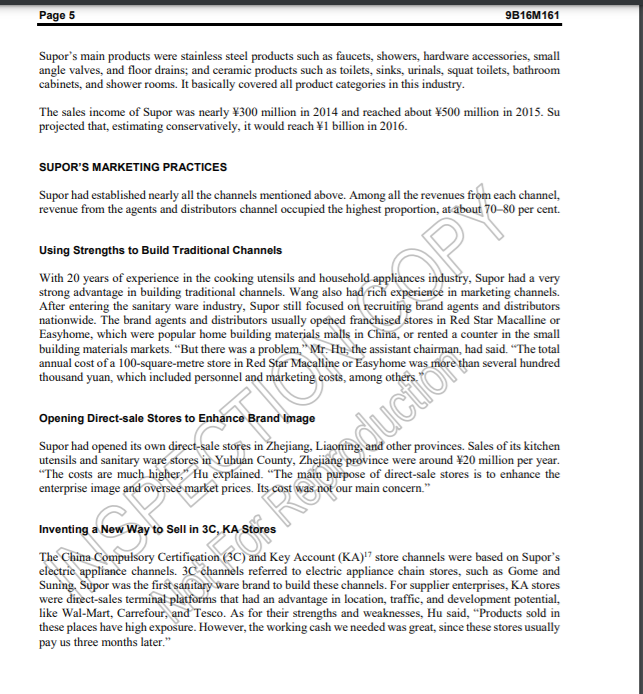

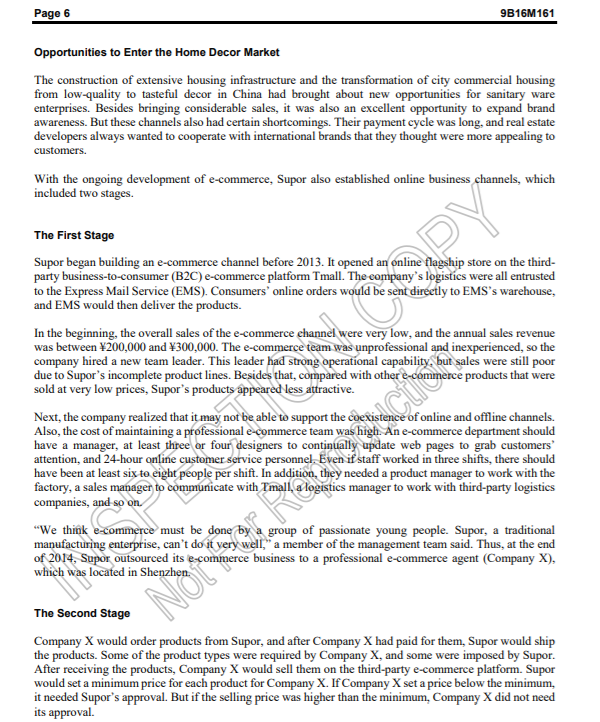

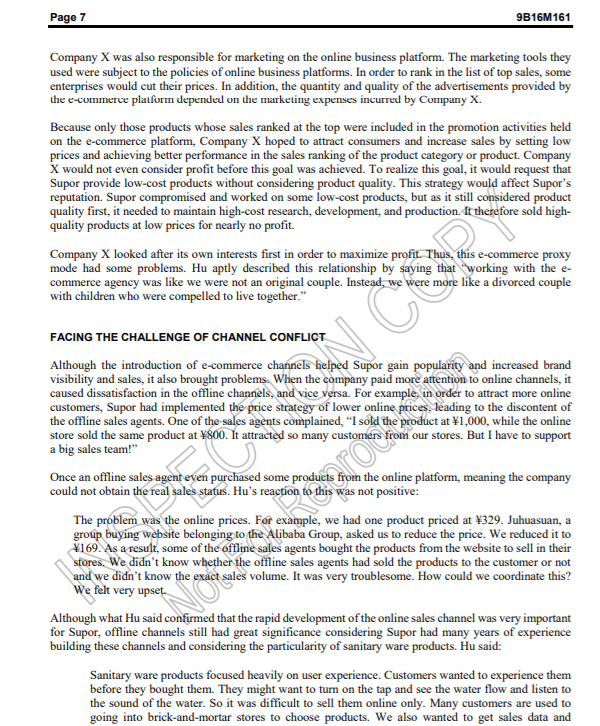

9B16M161 SUPOR: HOW TO RESOLVE CHANNEL CONFLICT Miao Cul, Viwel Du, Jinggin Su, Sitara Aziz, and Vi Hu wrote this case solely to provide material for class discussion. The authors do not intend to Wustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, NGG ON1; (1) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com Copyright @ 2016. Richard Ivey School of Business Foundation Version: 2016-09-29 On November 18th, 2015, Supor Sanitary Ware Co., Lid. (Supor) was recognized as both one of China's Top Ten Ceramic Sanitary Ware Brands and one of China's Top Ten Hardware Faucet Brands, which were known as the "Oscar" awards in the sanitary ware industry After this achievement, Zengfu Su, the chairman of Supor Group, recalled the development of Supor. Although it was a newcomer to the industry, it had developed rapidly and beenrecognized by the industry. Su always focused on improving the product and technology because of his strong technical background. He once said, "Our products are produced with superior production processes and have very low costs. We are not worried about their market. " Supor's products were best sellers, however, what was unexpected was that the online sales channel that was supposed to help expand the market had a negative impact on the offline sales channels. So Su faced the challenge of how to reduce the conflicts between online and offline sales channels and bring them into harmony instead of competition with each other. THE CHINESE SANITARY INDUSTRY or The Development of the Chinese Sanitary Ware Industry The sanitary ware industry was part of the building materials industry and downstream of the real estate industry, to which it was closely related. The Chinese sanitary ware industry experienced rapid growth from 2003 to 2006. Due to the financial crisis in 2008, the real estate industry experienced a downturn, and sales of sanitary ware products were significantly affected. With the improvement of the economic situation in China and globally since 2009, the demand for sanitary ware products increased. According to the China Planning Academy of Building Materials Industry and the Ministry of Industry and Information Technology (MIT), the output of sanitary ware products in China increased from 129 million units in 2006 to 170 million units in 2010, an average annual compound growth rate of 7.14 per cent. The gross value of industrial output in the Chinese sanitary ware industry increased from V22.309 billion in V = CNY = Chinese Yuan. US$1 = V8.07 on December 31, 2005.Page 2 9816M161 2005 to V52.051 billion' in 2013.' The number in 2009, influenced by the 2008 financial crisis, was V22.838 billion, with a growth rate of -4.65 per cent (see Exhibit 1). However, in recent years it had begun to increase; in 2013, the growth rate was 21.38 per cent. In 2014, according to the statistics from the China Building Ceramics & Sanitaryware Association, the China Building Decoration Association, and other associations, the sales volume for six major sanitary ware categories reached more than 1.48 billion units (see Exhibit 2).* Fierce Competition in the Chinese Sanitary Ware Industry Before 2003, Kohler was the leading brand in the high-end sanitary ware market in China. Between 2003 and 2007, TOTO experienced a meteoric rise. TOTO, Kohler, and American Standard became the three pillars of the industry. After 2009, the most active foreign brands in the domestic market were TOTO and INAX from Japan; American Standard, Kohler, and Delta from the United States, Duravit and Grohe from Germany; and Roca from Spain." As for domestic brands, some of them could compete with the foreign brands. For example, the sales volume of Arrow had reached about V1/2 billion. The situation of several foreign brands dominating the Chinese sanitary ware market was changing, and competition became increasingly fierce. Major International Brands Kohler: Kohler was founded in 1873 and was the oldest and one of the largest family companies in the United States. It had nearly 120 sales offices in Beijing, Shanghai, Guangzhou, and other international brand battlegrounds. It ranked first in terms of the sales network. Its ceramic sanitary ware products dominated the Chinese high-end market. TOTO: TOTO was established in 1917 and was Japan's leading sanitary ware producer." It entered the Chinese market in 1994 and established branches in Beijing, Nanjing, and Dalian successively. It occupied the high-end sanitary ware products market quickly with high customer brand loyalty. Its share of the project channel ranked first. Roca: Roca was a Spanish brand and contained the famous Swiss brand Laufen. Although it entered the Chinese market relatively late, it developed quickly because of its attractive design and fashionable style." Roca had nearly 400 exclusive shops in China. In terms of the engineering channels, Roca cooperated with many large real estate companies, such as Vanke and Evergrande.* Major Domestic Brands FOU Arrow: Arrow belonged to the Guangdong Lehua Ceramic Sanitary Ware Co., Lid., and was the largest sanitary ceramics manufacturing and sales enterprise in China. It had the highest sales volume amongPage 3 9816M161 the Chinese sanitary ware brands. It was also one of the most powerful and influential comprehensive sanitary ware brands." Faenza: Faenza Bathrooms was founded in 1999. The brand occupied an important position in the mid- range market. Its sales in the public building decor market occupied about 36 per cent of total sales. These sales mainly came from star class hotels in lower-tier cities. The market share in first-tier cities was relatively small. Dongpeng: Dongpeng was founded in 1994 and located in Shiwan Town, which had been honoured as the "Pottery Capital of Southland." It focused on research and development (R&D), manufacturing, sales, and service." Dongpeng was dependent on its water-saving king, nanometer sanitary, and Oscar series products, which led the industry, and it had become a pioneer in water-saving and environmental protection products. The Sales Channels of Sanitary Ware Products in China PY The main sales channels of sanitary ware products in China were as follows: . Brand agents and distributors: The vast majority of sanitary ware brands, including well-known brands such as Kohler and Toto, had established this channel. Self-built direct-sale stores: These could provide a unified standard of service quality, enhance the brand image, and monitor prices." However, the cost was very high. Home decor and public decor channels: The sales volume through these channels was usually high, and they provided a good opportunity to promote brand image. Many brands had built cooperative relationships with real estate companies Shopping malls and supermarkets: These were the main retailing formats. Customer purchases of sanitary ware products from these places were usually random. E-commerce channels: With the development of e-commerce, especially the further development of the mobile Internet, more and more enterprises started to build online sales channels. In 2014, sanitary ware enterprises occupied five spots among the top ten household building material brands, according to the sales rankings of China's most popular online retail platform, Taobao." Statistics showed that the online household building materials business turnover experienced three years of uninterrupted growth. In 2011, the online household building materials business turnover was 128.2 billion, accounting for more than 2.34 per cent of the total. In 2012, the numbers reached 145 billion and 3 per cent respectively, and in 2013, the numbers reached 170 billion and 3.74 per cent respectively."SUPOR Entering the Sanitary Ware Industry Supor Group was founded in 1994. Initially, Supor's new standard pressure cooker occupied half of the market. It soon became the leader in the cookware industry. As the company grew, Supor gradually became a diversified business group that included industries such as the container terminal, pharmaceutical, real estate, and import and export trade industries. At the same time, Supor was the largest cooking utensil R&D manufacturer in China and the second largest in the world. It was also the first listed company in the Chinese cookware industry. Su, the chairman of Supor Group, was from Yuhuan County, Zhejiang province, and had been elected as a delegate in the tenth National People's Congress. Su had a strong technical background and enjoyed working on improving products and processes. In his spare time, he liked to research the market, which had led him to discover an opportunity. He told his fellow workers that the output value of the domestic cookware industry was about V25 billion, of which Supor accounted for nearly 50 per cent, while the market size of the sanitary ware industry was at least V250 billion. If Supor could make up 10 per cent of it, its income would be more than that of the cookware industry. After further investigation, he found that there was no leading company in the seemingly booming domestic sanitary ware industry. This industry had experienced 10 years of growth, and the next decade would see enterprises in this industry become bigger and stronger. He was eager to seize the opportunity in the coming decade. In 2007, when Su was nearly 70 years old, he led the Supor Group in beginning a new undertaking and went into the sanitary ware industry at a high starting point since Supor had rich experience in the cookware industry. He had a clear vision of the market segment Supor was about to enter. He decided that the company would sell high-quality products at low prices because the low- and medium-quality product markets were huge. If it sold the products between V10,000 and 120,000, or even at the world's highest price, the sales volume would not be high. proat Supor Sanitary Ware Co., Ltd. The sanitary ware industry was Supor Group's most important industry and was also the key to Supor Group's strategic shift, With over 20 years' experience in stainless steel cookware manufacturing, Supor established a stainless steel sanitary ware research and development base in Zhejiang in May, 2008. It then set up the world's largest stainless steel faucet production base, which covered about 860,000 square metres, in Shenyang in 2010. By the end of 2013, Supor's investment had reached more than US$320 million. With 11 automatic production lines operating together, it could produce 0.7 million sets of stainless steel faucets monthly. Apart from the stainless steel sanitary ware project, Supor also constructed a ceramic sanitary ware production base in Faku County, Liaoning province. It was officially launched in April 2011, and by the end of 2013, the company had invested about US$65 million. Yongqi Wang, a well-known manager in the furniture industry, joined Supor Sanitary Ware Co., Ltd. in March 2015, serving as president. Su, chairman of the Supor Group, spoke highly of him. "After Mr. Wang joined, we became more confident that he would lead Supor's sanitary ware industry with a brand-new look," he said. 16Page 5 9816M161 Supor's main products were stainless steel products such as faucets, showers, hardware accessories, small angle valves, and floor drains; and ceramic products such as toilets, sinks, urinals, squat toilets, bathroom cabinets, and shower rooms. It basically covered all product categories in this industry. The sales income of Supor was nearly V300 million in 2014 and reached about 1500 million in 2015. Su projected that, estimating conservatively, it would reach V1 billion in 2016. SUPOR'S MARKETING PRACTICES Supor had established nearly all the channels mentioned above. Among all the revenues from each channel, revenue from the agents and distributors channel occupied the highest proportion, at about 70-80 per cent. Using Strengths to Build Traditional Channels With 20 years of experience in the cooking utensils and household appliances industry, Supor had a very strong advantage in building traditional channels. Wang also had rich experience in marketing channels. After entering the sanitary ware industry, Supor still focused on recruiting brand agents and distributors nationwide. The brand agents and distributors usually opened franchised stores in Red Star Macalline or Easyhome, which were popular home building materials malls in China, or rented a counter in the small building materials markets. "But there was a problem, " Mr. Hu, the assistant chairman, had said. "The total annual cost of a 100-square-metre store in Red Star Macalline or Easyhome was more than several hundred thousand yuan, which included personnel and marketing costs, among others R Opening Direct-sale Stores to Enhance Brand Image ducttor Supor had opened its own direct-sale stores in Zhejiang, Liaoning, and other provinces. Sales of its kitchen utensils and sanitary ware stores in Yuhuan County, Zhejiang province were around $20 million per year. "The costs are much higher," Hu explained. "The main purpose of direct-sale stores is to enhance the enterprise image and oversee market prices. Its cost was not our main concern." Inventing a New Way to Sell in 3C, KA Stores The China Compulsory Certification (3C) and Key Account (KA)'7 store channels were based on Supor's electric appliance channels. 30 channels referred to electric appliance chain stores, such as Gome and Suning. Supor was the first sanitary ware brand to build these channels. For supplier enterprises, KA stores were direct-sales terminal platforms that had an advantage in location, traffic, and development potential, like Wal-Mart, Carrefour, and Tesco. As for their strengths and weaknesses, Hu said, "Products sold in these places have high exposure. However, the working cash we needed was great, since these stores usually pay us three months later."Page 6 9B16M161 Opportunities to Enter the Home Decor Market The construction of extensive housing infrastructure and the transformation of city commercial housing from low-quality to tasteful decor in China had brought about new opportunities for sanitary ware enterprises. Besides bringing considerable sales, it was also an excellent opportunity to expand brand awareness. But these channels also had certain shortcomings. Their payment cycle was long, and real estate developers always wanted to cooperate with international brands that they thought were more appealing to customers. With the ongoing development of e-commerce, Supor also established online business channels, which included two stages. The First Stage Supor began building an e-commerce channel before 2013. It opened an online flagship store on the third- party business-to-consumer (B2C) e-commerce platform Tmall. The company's logistics were all entrusted to the Express Mail Service (EMS). Consumers' online orders would be sent directly to EMS's warehouse, and EMS would then deliver the products. In the beginning, the overall sales of the e-commerce channel were very low, and the annual sales revenue was between V200,000 and V300,000. The e-commerce team was unprofessional and inexperienced, so the company hired a new team leader. This leader had strong operational capability, but sales were still poor due to Supor's incomplete product lines. Besides that, compared with other e-commerce products that were sold at very low prices, Supor's products appeared less attractive. Next, the company realized that it may not be able to support the coexistence of online and offline channels. Also, the cost of maintaining a professional e-commerce team was high. An e-commerce department should have a manager, at least three or four designers to continually update web pages to grab customers attention, and 24-hour online customer service personnel. Even if staff worked in three shifts, there should have been at least six to eight people per shift. In addition, they needed a product manager to work with the factory, a sales manager to communicate with Tmall, a logistics manager to work with third-party logistics companies, and so on. "We think e-commerce must be done by a group of passionate young people. Supor, a traditional manufacturing enterprise, can't do it very well," a member of the management team said. Thus, at the end of 2014, Supor outsourced its e-commerce business to a professional e-commerce agent (Company X), which was located in Shenzhen. The Second Stage Company X would order products from Supor, and after Company X had paid for them, Supor would ship the products. Some of the product types were required by Company X, and some were imposed by Supor. After receiving the products, Company X would sell them on the third-party e-commerce platform. Supor would set a minimum price for each product for Company X. If Company X set a price below the minimum, it needed Supor's approval. But if the selling price was higher than the minimum, Company X did not need its approval.Page 7 9816M161 Company X was also responsible for marketing on the online business platform. The marketing tools they used were subject to the policies of online business platforms. In order to rank in the list of top sales, some enterprises would cut their prices. In addition, the quantity and quality of the advertisements provided by the e-commerce platform depended on the marketing expenses incurred by Company X. Because only those products whose sales ranked at the top were included in the promotion activities held on the e-commerce platform, Company X hoped to attract consumers and increase sales by setting low prices and achieving better performance in the sales ranking of the product category or product. Company X would not even consider profit before this goal was achieved. To realize this goal, it would request that Supor provide low-cost products without considering product quality. This strategy would affect Supor's reputation. Supor compromised and worked on some low-cost products, but as it still considered product quality first, it needed to maintain high-cost research, development, and production. It therefore sold high- quality products at low prices for nearly no profit. Company X looked after its own interests first in order to maximize profit. Thus, this e-commerce proxy mode had some problems. Hu aptly described this relationship by saying that working with the e- commerce agency was like we were not an original couple. Instead, we were more like a divorced couple with children who were compelled to live together." FACING THE CHALLENGE OF CHANNEL CONFLICT Although the introduction of e-commerce channels helped Supor gain popularity and increased brand visibility and sales, it also brought problems. When the company paid more attention to online channels, it caused dissatisfaction in the offline channels, and vice versa. For example, in order to attract more online customers, Supor had implemented the price strategy of lower online prices, leading to the discontent of the offline sales agents. One of the sales agents complained, "I sold the product at $1,000, while the online store sold the same product at 1800. It attracted so many customers from our stores. But I have to support a big sales team!" Once an offline sales agent even purchased some products from the online platform, meaning the company could not obtain the real sales status. Hu's reaction to this was not positive: The problem was the online prices. For example, we had one product priced at V329. Juhuasuan, a group buying website belonging to the Alibaba Group, asked us to reduce the price. We reduced it to V169. As a result, some of the offline sales agents bought the products from the website to sell in their stores. We didn't know whether the offline sales agents had sold the products to the customer or not and we didn't know the exact sales volume. It was very troublesome. How could we coordinate this? We felt very upset Although what Hu said confirmed that the rapid development of the online sales channel was very important for Supor, offline channels still had great significance considering Supor had many years of experience building these channels and considering the particularity of sanitary ware products. Hu said: Sanitary ware products focused heavily on user experience. Customers wanted to experience them before they bought them. They might want to turn on the tap and see the water flow and listen to the sound of the water. So it was difficult to sell them online only. Many customers are used to going into brick-and-mortar stores to choose products. We also wanted to get sales data andPage 8 9B16M161 consumer information from these stores. We hoped to finally realize the online to offline (020) marketing mode, but the channel conflict was still there. Ah! To achieve the channel synergies that Supor wanted, they had to eliminate the channel conflict. With the conflict eliminated, it could achieve synergies from online to offline and from offline to online channels. How to eliminate channel conflict and integrate the two channels was a question that continued to linger in Su's mind. A proposal was put forward at a meeting to develop new brands and products for the Internet to ensure that online and offline channels would sell different products to avoid competition. Some said it would not completely solve the problem and that Supor should build its own online mall to integrate the online and offline channels. The profit allocation of different channels would be based on the overall performance of channels. However, there were also some objections to this proposal since the cost was high and it was more risky. Su fell into deep thinking, wondering how to resolve the channel conflict.Page 9 9816M161 EXHIBIT 1: TOTAL INDUSTRIAL OUTPUT VALUE AND ANNUAL GROWTH RATE IN CHINA'S SANITARY WARE INDUSTRY (2005-2013) 600 41.55%% 520.51 500 32.039 40 24.84%% 426.83 21 47% 422.55 23.1836 30 400 17.30% 20 301 54 300 228 38 10 223.09) 239.53 -1.0 096 197.20 -4. 65%% 200 168.11 -10 -24.6496 -20 2005 2006 2007 2008 2009 2010 2011 2012 2013 #Growth rate (%) Gross value of industrial output (80 1 billion Source: China Industry Information, "Analysis of the Development and Favorable Factors of Chinese Sanitary Ware Industry in 2015," December 4, 2015, accessed February 15, 2016, www.chyxx.com/industry/201512/365317.html. EXHIBIT 2: PRODUCTION AND SALES VOLUME OF SIX CATEGORIES OF SANITARY WARE PRODUCTS IN 2014 The proportion of production and marketing 60 50 40 SPE Not For Reproduction 214 22%% 15% 15%% 1495 1% Ceramic Faucet Bathroom Shower Bathtub Sanitary Cabinet Room Ware Source: Jianyu Che, "The Data of Sanitary Products in 2014," January 18, 2015, accessed February 15, 2016, www.jieju.cn/News/20150118/Detail384040.shtml