Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) When an acquisition takes place, the purchase consideration may be in the form of share capital. Where no suitable market price exist (for

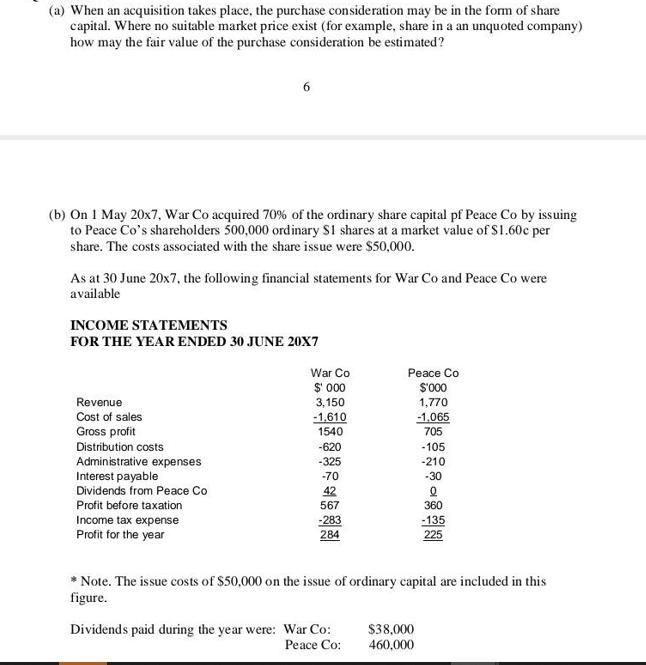

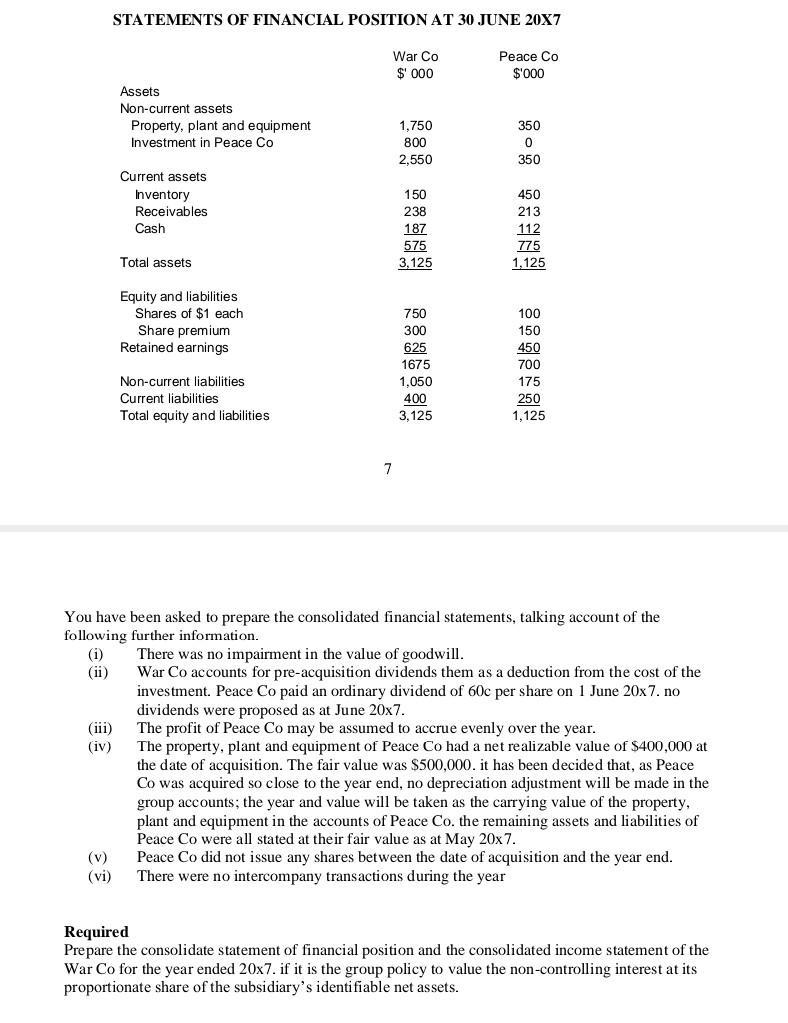

(a) When an acquisition takes place, the purchase consideration may be in the form of share capital. Where no suitable market price exist (for example, share in a an unquoted company) how may the fair value of the purchase consideration be estimated? (b) On 1 May 20x7, War Co acquired 70% of the ordinary share capital pf Peace Co by issuing to Peace Co's shareholders 500,000 ordinary S1 shares at a market value of $1.60c per share. The costs associated with the share issue were $50,000. As at 30 June 20x7, the following financial statements for War Co and Peace Co were available INCOME STATEMENTS FOR THE YEAR ENDED 30 JUNE 20X7 Revenue Cost of sales Gross profit 6 Distribution costs Administrative expenses Interest payable Dividends from Peace Co Profit before taxation Income tax expense Profit for the year War Co $' 000 3,150 -1.610 1540 -620 -325 -70 42 567 -283 284 Peace Co $'000 1,770 Dividends paid during the year were: War Co: Peace Co: -1,065 705 -105 -210 $38,000 460,000 -30 Q 360 *Note. The issue costs of $50,000 on the issue of ordinary capital are included in this figure. -135 225 (iii) (iv) STATEMENTS OF FINANCIAL POSITION AT 30 JUNE 20X7 (v) (vi) Assets Non-current assets Property, plant and equipment Investment in Peace Co Current assets Inventory Receivables O Cash Total assets Equity and liabilities Shares of $1 each Share premium Retained earnings Non-current liabilities Current liabilities Total equity and liabilities. War Co $000 7 1,750 800 2,550 150 238 187 575 3,125 750 300 625 1675 1,050 400 3,125 Peace Co $'000 350 0 350 450 213 112 775 1,125 100 150 450 700 175 You have been asked to prepare the consolidated financial statements, talking account of the following further information. (i) There was no impairment in the value of goodwill. War Co accounts for pre-acquisition dividends them as a deduction from the cost of the investment. Peace Co paid an ordinary dividend of 60c per share on 1 June 20x7. no dividends were proposed as at June 20x7. 250 1,125 The profit of Peace Co may be assumed to accrue evenly over the year. The property, plant and equipment of Peace Co had a net realizable value of $400,000 at the date of acquisition. The fair value was $500,000. it has been decided that, as Peace Co was acquired so close to the year end, no depreciation adjustment will be made in the group accounts; the year and value will be taken as the carrying value of the property, plant and equipment in the accounts of Peace Co. the remaining assets and liabilities of Peace Co were all stated at their fair value as at May 20x7. Peace Co did not issue any shares between the date of acquisition and the year end. There were no intercompany transactions during the year Required Prepare the consolidate statement of financial position and the consolidated income statement of the War Co for the year ended 20x7. if it is the group policy to value the non-controlling interest at its proportionate share of the subsidiary's identifiable net assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a When no suitable market price exists for a share capital acquisition the fair value of the purchase consideration can be estimated through various v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started