Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Which swap should Daiwa Bank choose to hedge their position? (b) What precisely is the risk that Daiwa Bank faces if it does not

(a) Which swap should Daiwa Bank choose to hedge their position?

(b) What precisely is the risk that Daiwa Bank faces if it does not enter into the interest rate swap?

- LIBOR increasing

- LIBOR decreasing

(c) What is the interest rate spread that Daiwa Bank would realize as a result of all the transactions (i.e., what is the spread between their effective borrowing and lending rates)? Write your answer in unit of percentage points.

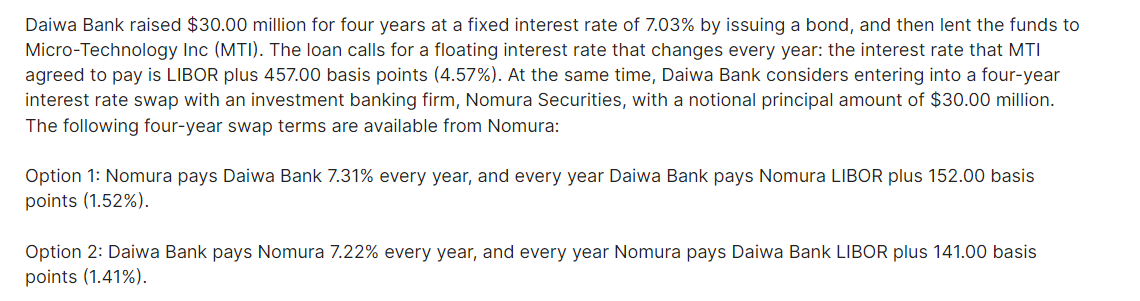

Daiwa Bank raised $30.00 million for four years at a fixed interest rate of 7.03% by issuing a bond, and then lent the funds to Micro-Technology Inc (MTI). The loan calls for a floating interest rate that changes every year: the interest rate that MTI agreed to pay is LIBOR plus 457.00 basis points (4.57\%). At the same time, Daiwa Bank considers entering into a four-year interest rate swap with an investment banking firm, Nomura Securities, with a notional principal amount of $30.00 million. The following four-year swap terms are available from Nomura: Option 1: Nomura pays Daiwa Bank 7.31\% every year, and every year Daiwa Bank pays Nomura LIBOR plus 152.00 basis points (1.52%). Option 2: Daiwa Bank pays Nomura 7.22\% every year, and every year Nomura pays Daiwa Bank LIBOR plus 141.00 basis points (1.41%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started