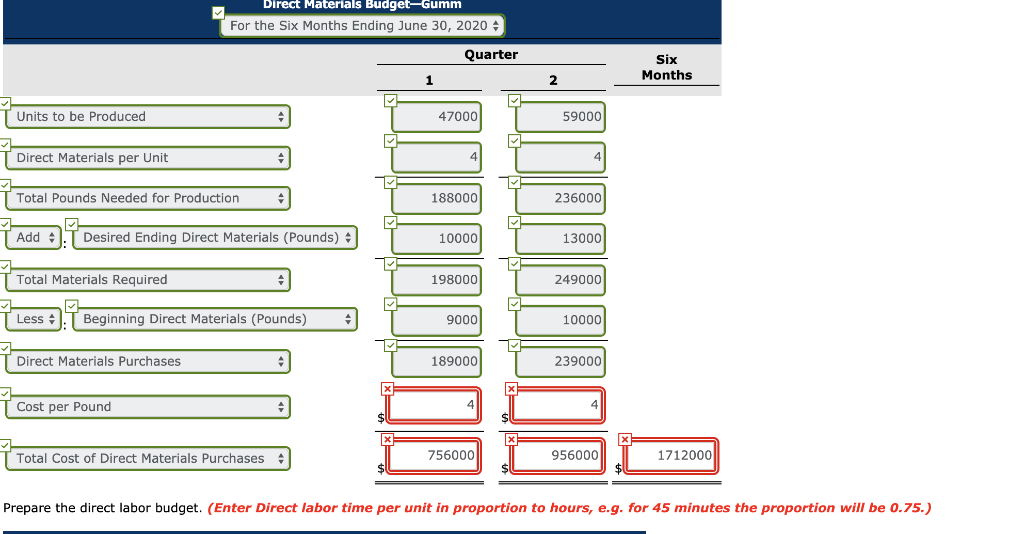

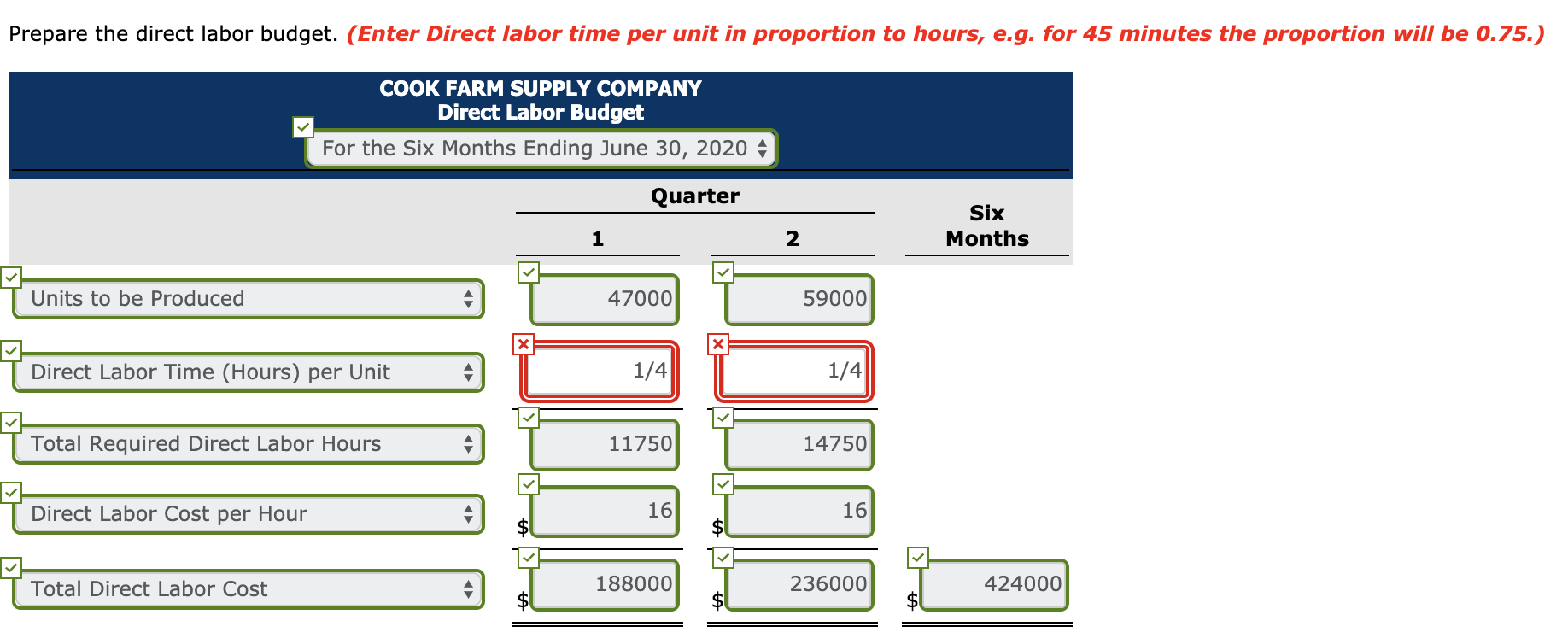

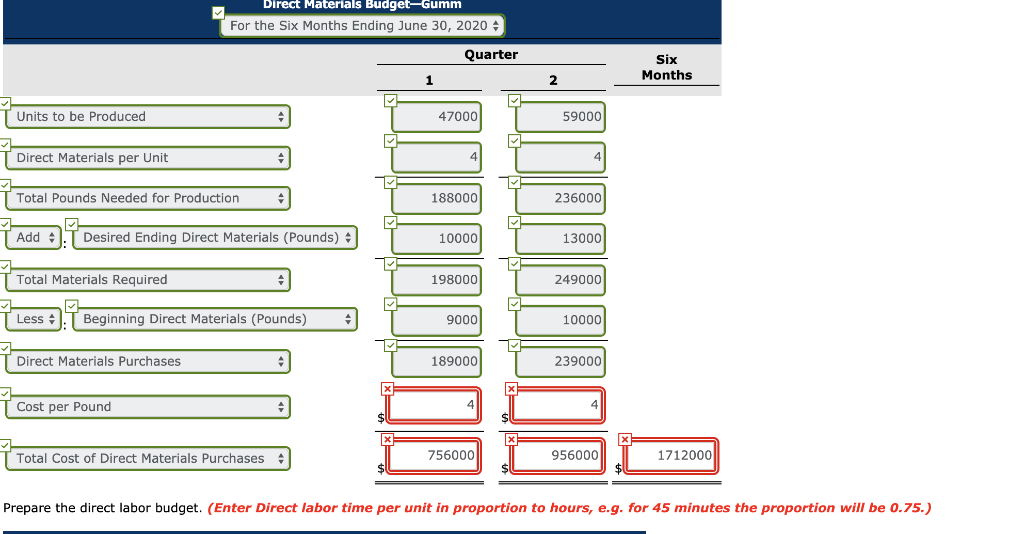

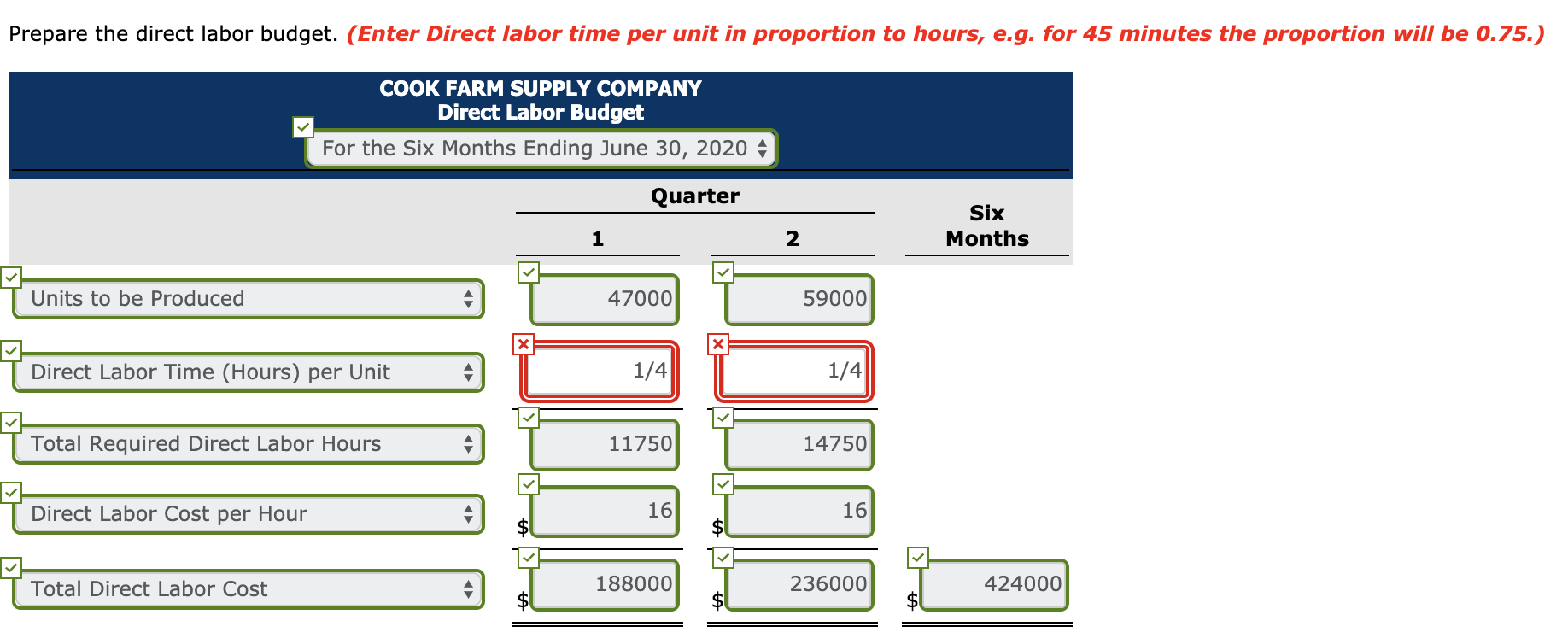

A Wiley PLUS user has reported a possible issue with this question. The Wiley PLUS Team is currently evaluating the reported issue, and we hope to resolve it shortly. You may wish to contact your instructor before submitting any work for this question and ask if you should attempt the question anyway. Problem 9-1A (Part Level Submission) (Video) Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 9,000 14,000 15,000 10,000 20,000 18,000 13,000 25,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $175,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.) Direct Materials Budget-Gumm For the Six Months Ending June 30, 2020 Quarter Six Months T Units to be produced 47000 59000 T Direct Materials per Unit T Total Pounds Needed for Production 188000 236000 Desired Ending Direct Materials (Pounds) 10000 13000 1 Total Materials Required 198000 249000 Beginning Direct Materials (Pounds) - 9000 10000 | Direct Materials Purchases 189000 239000 TCost per Pound Total Cost of Direct Materials Purchases 756000 956000 1712000 Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, e.g. for 45 minutes the proportion will be 0.75.) Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, e.g. for 45 minutes the proportion will be 0.75.) COOK FARM SUPPLY COMPANY Direct Labor Budget For the Six Months Ending June 30, 2020 - Quarter Six Months 1 T Units to be Produced 47000 59000 T Direct Labor Time (Hours) per Unit 1/4 1/4 Total Required Direct Labor Hours 11750 14750 Direct Labor Cost per Hour Total Direct Labor Cost 188000 236000 424000 A Wiley PLUS user has reported a possible issue with this question. The Wiley PLUS Team is currently evaluating the reported issue, and we hope to resolve it shortly. You may wish to contact your instructor before submitting any work for this question and ask if you should attempt the question anyway. Problem 9-1A (Part Level Submission) (Video) Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 9,000 14,000 15,000 10,000 20,000 18,000 13,000 25,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $175,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.) Direct Materials Budget-Gumm For the Six Months Ending June 30, 2020 Quarter Six Months T Units to be produced 47000 59000 T Direct Materials per Unit T Total Pounds Needed for Production 188000 236000 Desired Ending Direct Materials (Pounds) 10000 13000 1 Total Materials Required 198000 249000 Beginning Direct Materials (Pounds) - 9000 10000 | Direct Materials Purchases 189000 239000 TCost per Pound Total Cost of Direct Materials Purchases 756000 956000 1712000 Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, e.g. for 45 minutes the proportion will be 0.75.) Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, e.g. for 45 minutes the proportion will be 0.75.) COOK FARM SUPPLY COMPANY Direct Labor Budget For the Six Months Ending June 30, 2020 - Quarter Six Months 1 T Units to be Produced 47000 59000 T Direct Labor Time (Hours) per Unit 1/4 1/4 Total Required Direct Labor Hours 11750 14750 Direct Labor Cost per Hour Total Direct Labor Cost 188000 236000 424000