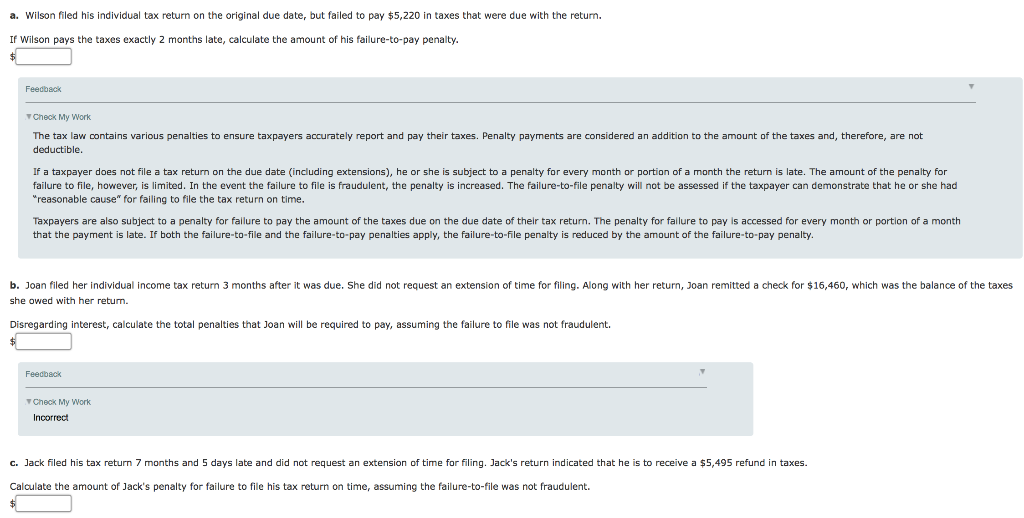

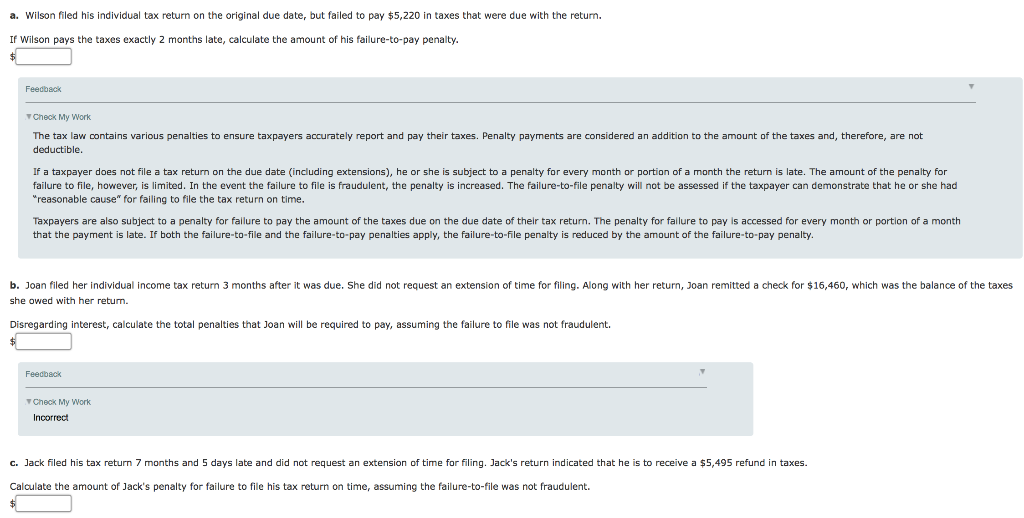

a. Wilson filed his individual tax return on the original due date, but failed to pay $5,220 in taxes that were due with the retun. If Wilson pays the taxes exactly 2 months late, calculate the amount of his failure-to-pay penalty. Feedback Check My Work The tax law contains various penalties to ensure taxpayers accurately report and pay their taxes. Penalty payments are considered an addition to the amount of the taxes and, therefore, are not deductible If a taxpayer does not file a tax return on the due date (including extensions), he or she is subject to a penalty for every month or portion of a month the return is late. The amount of the penalty for failure to file, however, is limited. In the event the failure to file is fraudulent, the penalty is increased. The failure-to-file penalty will not be assessed if the taxpayer can demonstrate that he or she had reasonable cause" for failing to file the tax return on time. Taxpayers are also subject to a penalty for fallure to pay the amount of the taxes due on the due date of their tax return. The penalty for failure to pay is accessed for every month or portion of a month that the payment is late. If both the failure-to-file and the failure-to-pay penalties apply, the failure-to-file penalty is reduced by the amount of the failure-to-pay penalty. b. Joan filed her individual income tax return 3 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $16,460, which was the balance of the taxes she owed with her retum. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent. Feedback Check My Work Incorrect c Jack filed his tax return 7 months and 5 days late and did not request an extension of time for filing. Jack's return indicated that he is to receive a $5,495 refund in taxes. Calculate the amount of Jack's penalty for failure to file his tax return on time, assuming the failure-to-file was not fraudulent. a. Wilson filed his individual tax return on the original due date, but failed to pay $5,220 in taxes that were due with the retun. If Wilson pays the taxes exactly 2 months late, calculate the amount of his failure-to-pay penalty. Feedback Check My Work The tax law contains various penalties to ensure taxpayers accurately report and pay their taxes. Penalty payments are considered an addition to the amount of the taxes and, therefore, are not deductible If a taxpayer does not file a tax return on the due date (including extensions), he or she is subject to a penalty for every month or portion of a month the return is late. The amount of the penalty for failure to file, however, is limited. In the event the failure to file is fraudulent, the penalty is increased. The failure-to-file penalty will not be assessed if the taxpayer can demonstrate that he or she had reasonable cause" for failing to file the tax return on time. Taxpayers are also subject to a penalty for fallure to pay the amount of the taxes due on the due date of their tax return. The penalty for failure to pay is accessed for every month or portion of a month that the payment is late. If both the failure-to-file and the failure-to-pay penalties apply, the failure-to-file penalty is reduced by the amount of the failure-to-pay penalty. b. Joan filed her individual income tax return 3 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $16,460, which was the balance of the taxes she owed with her retum. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent. Feedback Check My Work Incorrect c Jack filed his tax return 7 months and 5 days late and did not request an extension of time for filing. Jack's return indicated that he is to receive a $5,495 refund in taxes. Calculate the amount of Jack's penalty for failure to file his tax return on time, assuming the failure-to-file was not fraudulent