Answered step by step

Verified Expert Solution

Question

1 Approved Answer

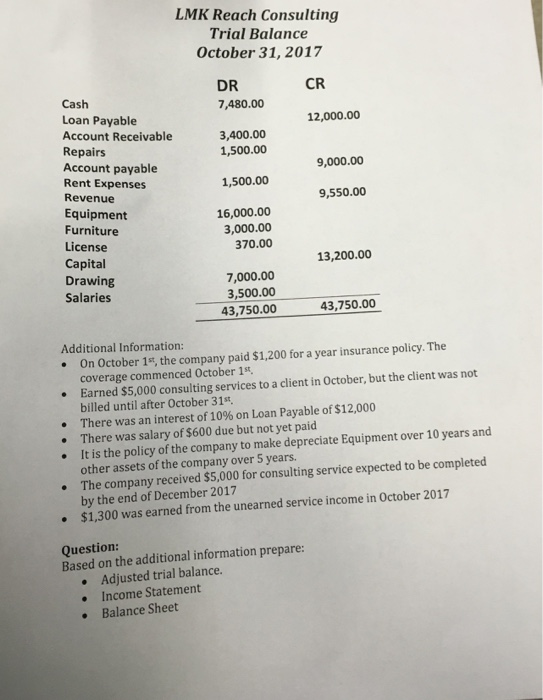

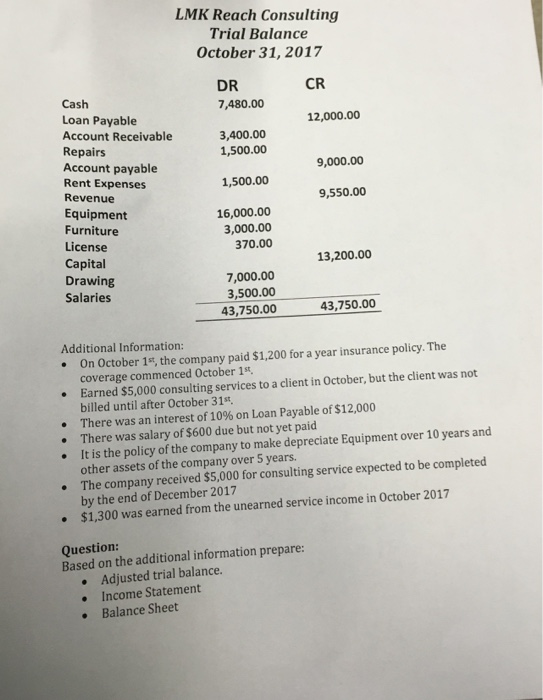

LMK Reach Consulting Trial Balance October 31, 2017 DR CR Cash 7,480.00 12,000.00 Loan Payable Account Receivable Repairs Account payable Rent Expenses Revenue 3,400.00 1,500.00

LMK Reach Consulting Trial Balance October 31, 2017 DR CR Cash 7,480.00 12,000.00 Loan Payable Account Receivable Repairs Account payable Rent Expenses Revenue 3,400.00 1,500.00 1,500.00 16,000.00 9,000.00 Equipment Furniture License 3,000.00 370.00 13,200.00 Capital Drawing Salaries 7,000.00 3,500.00 43,750.00 43,750.00 Additional Information: On October 1s, the company paid $1,200 for a year insurance policy. The .Earned $5,000 consulting services to a client in October, but the client was not coverage commenced October 1s billed until after October 31s There was an interest of 10% on Loan Payable of $12,000 There was salary of $600 due but not yet paid It is the policy of the company to make depreciate Equipment over 10 years and other assets of the company over 5 years. . . The company received $5,000 for consulting service expected to be completed by the end of December 2017 $1,300 was earned from the unearned service income in October 2017 Question: Based on the additional information prepare: Adjusted trial balance. Income Statement Balance Sheet . LMK Reach Consulting Trial Balance October 31, 2017 DR CR Cash 7,480.00 12,000.00 Loan Payable Account Receivable Repairs Account payable Rent Expenses Revenue 3,400.00 1,500.00 1,500.00 16,000.00 9,000.00 Equipment Furniture License 3,000.00 370.00 13,200.00 Capital Drawing Salaries 7,000.00 3,500.00 43,750.00 43,750.00 Additional Information: On October 1s, the company paid $1,200 for a year insurance policy. The .Earned $5,000 consulting services to a client in October, but the client was not coverage commenced October 1s billed until after October 31s There was an interest of 10% on Loan Payable of $12,000 There was salary of $600 due but not yet paid It is the policy of the company to make depreciate Equipment over 10 years and other assets of the company over 5 years. . . The company received $5,000 for consulting service expected to be completed by the end of December 2017 $1,300 was earned from the unearned service income in October 2017 Question: Based on the additional information prepare: Adjusted trial balance. Income Statement Balance Sheet

LMK Reach Consulting Trial Balance October 31, 2017 DR CR Cash 7,480.00 12,000.00 Loan Payable Account Receivable Repairs Account payable Rent Expenses Revenue 3,400.00 1,500.00 1,500.00 16,000.00 9,000.00 Equipment Furniture License 3,000.00 370.00 13,200.00 Capital Drawing Salaries 7,000.00 3,500.00 43,750.00 43,750.00 Additional Information: On October 1s, the company paid $1,200 for a year insurance policy. The .Earned $5,000 consulting services to a client in October, but the client was not coverage commenced October 1s billed until after October 31s There was an interest of 10% on Loan Payable of $12,000 There was salary of $600 due but not yet paid It is the policy of the company to make depreciate Equipment over 10 years and other assets of the company over 5 years. . . The company received $5,000 for consulting service expected to be completed by the end of December 2017 $1,300 was earned from the unearned service income in October 2017 Question: Based on the additional information prepare: Adjusted trial balance. Income Statement Balance Sheet . LMK Reach Consulting Trial Balance October 31, 2017 DR CR Cash 7,480.00 12,000.00 Loan Payable Account Receivable Repairs Account payable Rent Expenses Revenue 3,400.00 1,500.00 1,500.00 16,000.00 9,000.00 Equipment Furniture License 3,000.00 370.00 13,200.00 Capital Drawing Salaries 7,000.00 3,500.00 43,750.00 43,750.00 Additional Information: On October 1s, the company paid $1,200 for a year insurance policy. The .Earned $5,000 consulting services to a client in October, but the client was not coverage commenced October 1s billed until after October 31s There was an interest of 10% on Loan Payable of $12,000 There was salary of $600 due but not yet paid It is the policy of the company to make depreciate Equipment over 10 years and other assets of the company over 5 years. . . The company received $5,000 for consulting service expected to be completed by the end of December 2017 $1,300 was earned from the unearned service income in October 2017 Question: Based on the additional information prepare: Adjusted trial balance. Income Statement Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started