Question

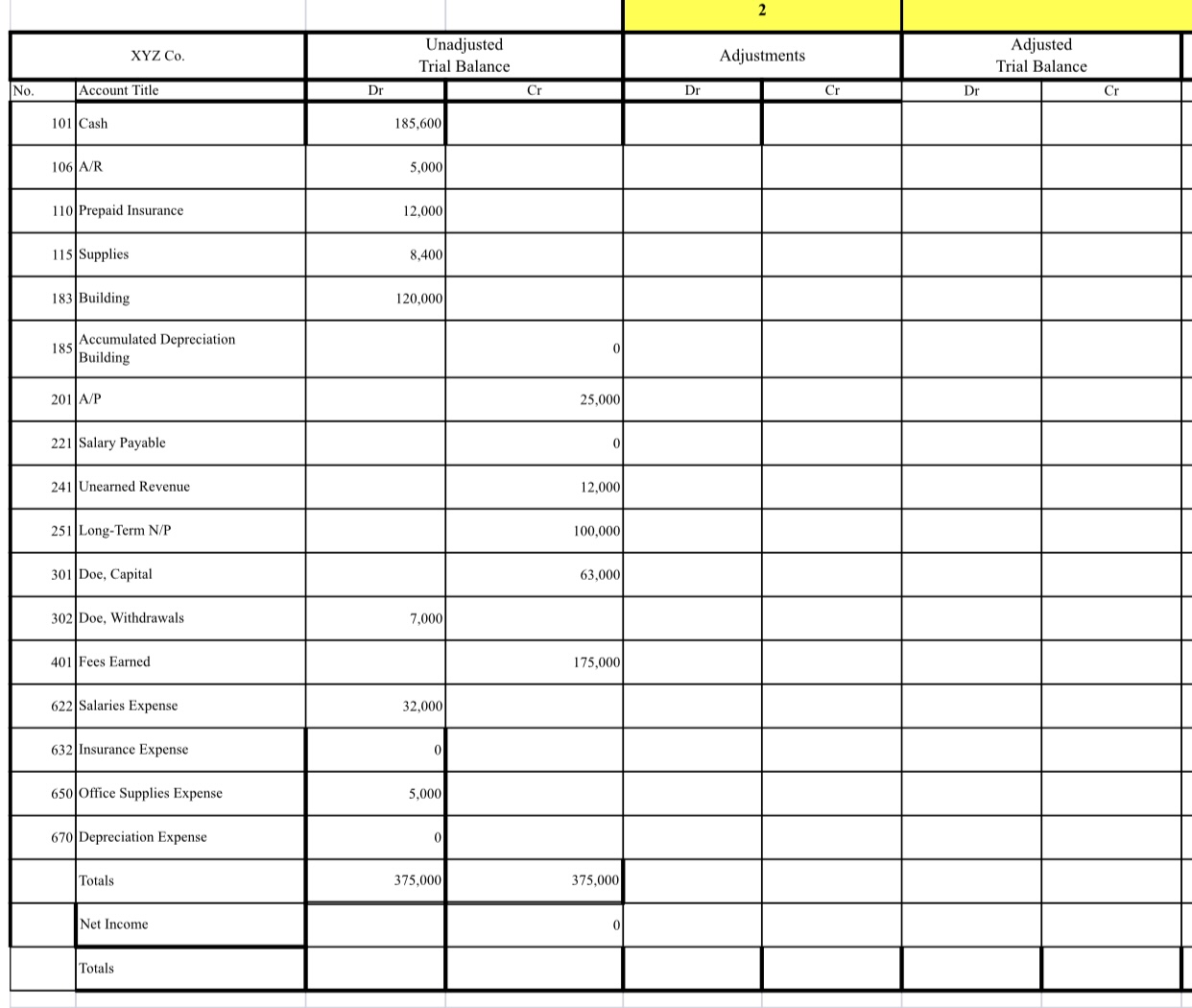

a. XYZ Co. has earned $40,000 in additional fees for services they provided but not yet invoiced for year by end. b. XYZ Co. pays

a. XYZ Co. has earned $40,000 in additional fees for services they provided but not yet invoiced for year by end.

b. XYZ Co. pays its employees each Friday for the CURRENT Monday through Friday.

Assuming 12/31 is a Monday, and there are 5 employees who are paid $1000 in total daily, record the adjustment required for the days in December not yet recorded as an expense on the books

c. XYZ Co. Prepaid Insurance for $12,000 on May 1. It was a 12 month policy. Record the adjustment required as of 12/31 for the usage of the insurance.

d. XYZ Co. purchased a building on January 1 for $120,000 with a salvage value of $10,000. The useful life of the building is 20 years. Record the required adjustment as of 12/31.

e. A count of supplies at year end found that $2,000 of supplies were expired. Record the adjustment d.required as of 12/31 to recognize supplies used.

f. On 7/1 a client paid XYZ Co. $12,000 in advance for 12 months of services to start immediately upon payment e.Record the adjustment required as of 12/31 to recognize the revenue earned. f.INSTRUCTIONS: 1) Record the adjusting entries in a-f.

2) Post adjustments to chart

3)Complete the Adjusted Trial Balance/Income Statement/Balance Sheet in Chart 4) Prepare closing entries (4 of them) 5) Complete Post Closing Trial Balance in Chart 6) prepare the correctly formatted Income Statement, Statement of Owners Equity, and Balance Sheet for XYZ Co. NOTES: c.1) Assume the owners beginning capital was $0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started