Question

A) XYZ Company is considering undertaking one of the four projects given below. The cost of each project is $2 million. Using the net present

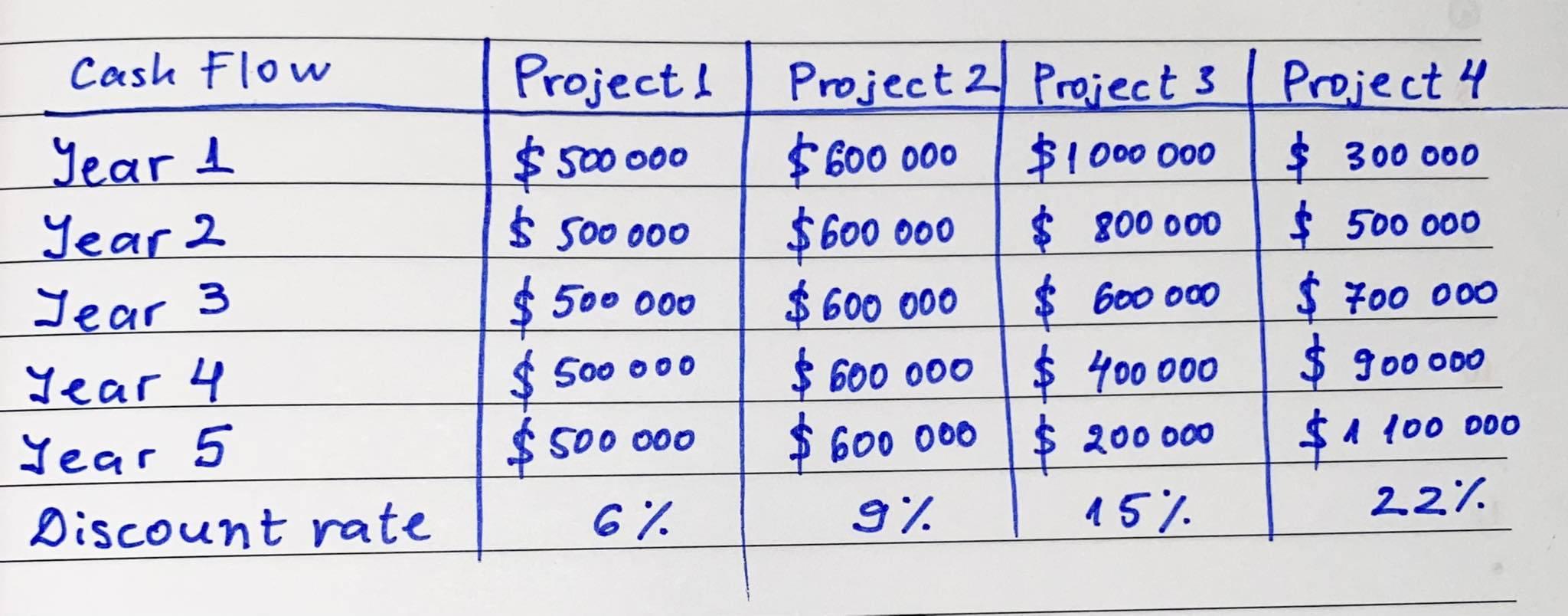

A) XYZ Company is considering undertaking one of the four projects given below. The cost of each project is $2 million. Using the net present value (NPV) decision rule, determine which project the company should accept. Show your calculations in full. B) There are various decision models that we use to perform capital budgeting. Provide a summary of their respective characteristics by addressing issues of the decision criterion, complexity of application, time value of money, risk, and economic basis and evaluation. Critically discuss which one is the best option for a finance manager.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started