Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is a list of independent transaction for Tinplex theatres during the year ended August 31, 20x8. For each independent transaction you will be require

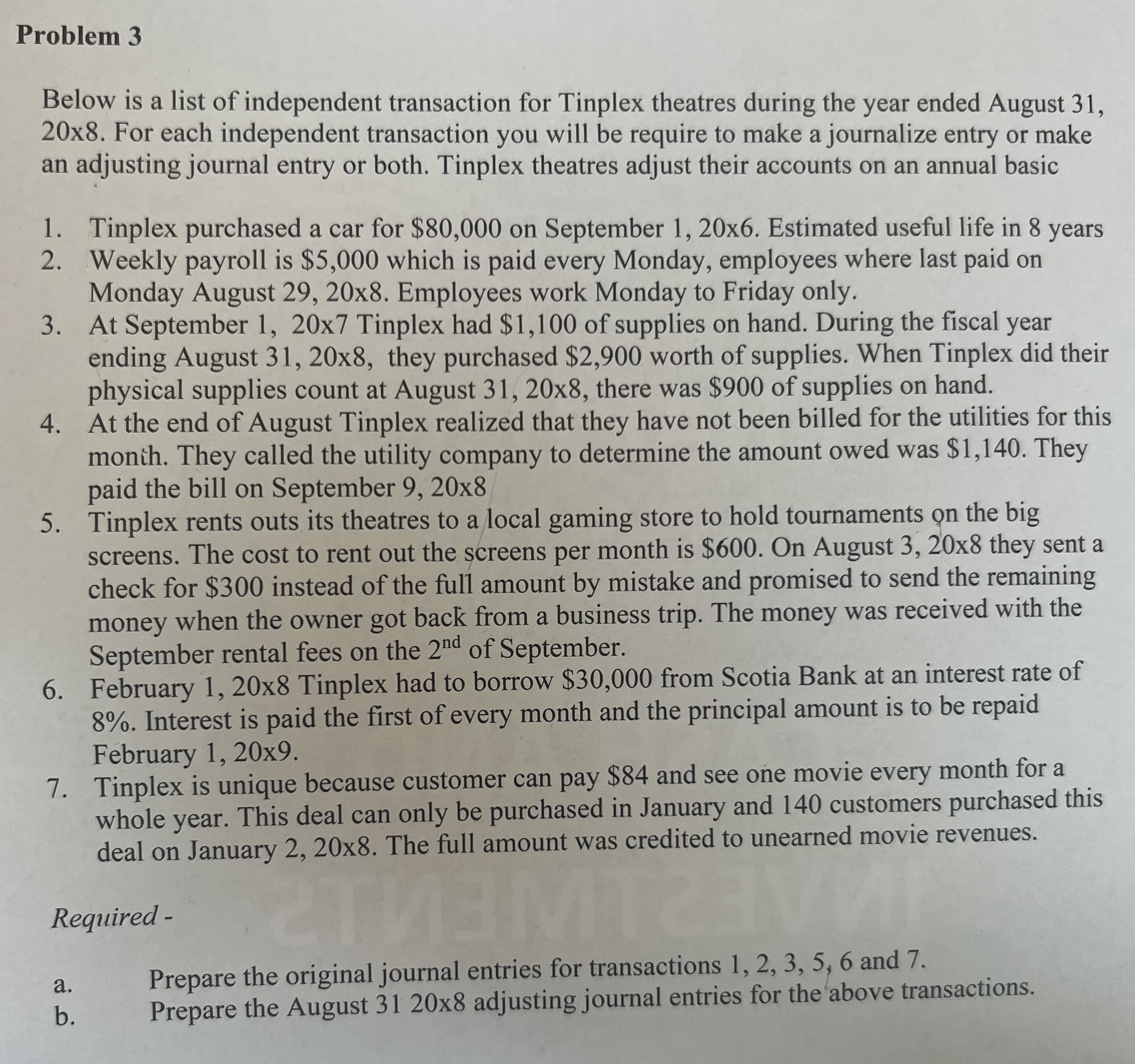

Below is a list of independent transaction for Tinplex theatres during the year ended August 31, 20x8. For each independent transaction you will be require to make a journalize entry or make an adjusting journal entry or both. Tinplex theatres adjust their accounts on an annual basic 1. Tinplex purchased a car for $80,000 on September 1,20x6. Estimated useful life in 8 years 2. Weekly payroll is $5,000 which is paid every Monday, employees where last paid on Monday August 29, 20x8. Employees work Monday to Friday only. 3. At September 1, 20x7 Tinplex had $1,100 of supplies on hand. During the fiscal year ending August 31, 20x8, they purchased $2,900 worth of supplies. When Tinplex did their physical supplies count at August 31,208, there was $900 of supplies on hand. 4. At the end of August Tinplex realized that they have not been billed for the utilities for this monih. They called the utility company to determine the amount owed was $1,140. They paid the bill on September 9, 20x8 5. Tinplex rents outs its theatres to a local gaming store to hold tournaments on the big screens. The cost to rent out the screens per month is $600. On August 3, 20x8 they sent a check for $300 instead of the full amount by mistake and promised to send the remaining money when the owner got back from a business trip. The money was received with the September rental fees on the 2nd of September. 6. February 1, 20x8 Tinplex had to borrow $30,000 from Scotia Bank at an interest rate of 8%. Interest is paid the first of every month and the principal amount is to be repaid February 1, 20x9. 7. Tinplex is unique because customer can pay $84 and see one movie every month for a whole year. This deal can only be purchased in January and 140 customers purchased this deal on January 2, 20x8. The full amount was credited to unearned movie revenues. Required- a. Prepare the original journal entries for transactions 1, 2, 3, 5, 6 and 7. b. Prepare the August 31208 adjusting journal entries for the above transactions. Below is a list of independent transaction for Tinplex theatres during the year ended August 31, 20x8. For each independent transaction you will be require to make a journalize entry or make an adjusting journal entry or both. Tinplex theatres adjust their accounts on an annual basic 1. Tinplex purchased a car for $80,000 on September 1,20x6. Estimated useful life in 8 years 2. Weekly payroll is $5,000 which is paid every Monday, employees where last paid on Monday August 29, 20x8. Employees work Monday to Friday only. 3. At September 1, 20x7 Tinplex had $1,100 of supplies on hand. During the fiscal year ending August 31, 20x8, they purchased $2,900 worth of supplies. When Tinplex did their physical supplies count at August 31,208, there was $900 of supplies on hand. 4. At the end of August Tinplex realized that they have not been billed for the utilities for this monih. They called the utility company to determine the amount owed was $1,140. They paid the bill on September 9, 20x8 5. Tinplex rents outs its theatres to a local gaming store to hold tournaments on the big screens. The cost to rent out the screens per month is $600. On August 3, 20x8 they sent a check for $300 instead of the full amount by mistake and promised to send the remaining money when the owner got back from a business trip. The money was received with the September rental fees on the 2nd of September. 6. February 1, 20x8 Tinplex had to borrow $30,000 from Scotia Bank at an interest rate of 8%. Interest is paid the first of every month and the principal amount is to be repaid February 1, 20x9. 7. Tinplex is unique because customer can pay $84 and see one movie every month for a whole year. This deal can only be purchased in January and 140 customers purchased this deal on January 2, 20x8. The full amount was credited to unearned movie revenues. Required- a. Prepare the original journal entries for transactions 1, 2, 3, 5, 6 and 7. b. Prepare the August 31208 adjusting journal entries for the above transactions

Below is a list of independent transaction for Tinplex theatres during the year ended August 31, 20x8. For each independent transaction you will be require to make a journalize entry or make an adjusting journal entry or both. Tinplex theatres adjust their accounts on an annual basic 1. Tinplex purchased a car for $80,000 on September 1,20x6. Estimated useful life in 8 years 2. Weekly payroll is $5,000 which is paid every Monday, employees where last paid on Monday August 29, 20x8. Employees work Monday to Friday only. 3. At September 1, 20x7 Tinplex had $1,100 of supplies on hand. During the fiscal year ending August 31, 20x8, they purchased $2,900 worth of supplies. When Tinplex did their physical supplies count at August 31,208, there was $900 of supplies on hand. 4. At the end of August Tinplex realized that they have not been billed for the utilities for this monih. They called the utility company to determine the amount owed was $1,140. They paid the bill on September 9, 20x8 5. Tinplex rents outs its theatres to a local gaming store to hold tournaments on the big screens. The cost to rent out the screens per month is $600. On August 3, 20x8 they sent a check for $300 instead of the full amount by mistake and promised to send the remaining money when the owner got back from a business trip. The money was received with the September rental fees on the 2nd of September. 6. February 1, 20x8 Tinplex had to borrow $30,000 from Scotia Bank at an interest rate of 8%. Interest is paid the first of every month and the principal amount is to be repaid February 1, 20x9. 7. Tinplex is unique because customer can pay $84 and see one movie every month for a whole year. This deal can only be purchased in January and 140 customers purchased this deal on January 2, 20x8. The full amount was credited to unearned movie revenues. Required- a. Prepare the original journal entries for transactions 1, 2, 3, 5, 6 and 7. b. Prepare the August 31208 adjusting journal entries for the above transactions. Below is a list of independent transaction for Tinplex theatres during the year ended August 31, 20x8. For each independent transaction you will be require to make a journalize entry or make an adjusting journal entry or both. Tinplex theatres adjust their accounts on an annual basic 1. Tinplex purchased a car for $80,000 on September 1,20x6. Estimated useful life in 8 years 2. Weekly payroll is $5,000 which is paid every Monday, employees where last paid on Monday August 29, 20x8. Employees work Monday to Friday only. 3. At September 1, 20x7 Tinplex had $1,100 of supplies on hand. During the fiscal year ending August 31, 20x8, they purchased $2,900 worth of supplies. When Tinplex did their physical supplies count at August 31,208, there was $900 of supplies on hand. 4. At the end of August Tinplex realized that they have not been billed for the utilities for this monih. They called the utility company to determine the amount owed was $1,140. They paid the bill on September 9, 20x8 5. Tinplex rents outs its theatres to a local gaming store to hold tournaments on the big screens. The cost to rent out the screens per month is $600. On August 3, 20x8 they sent a check for $300 instead of the full amount by mistake and promised to send the remaining money when the owner got back from a business trip. The money was received with the September rental fees on the 2nd of September. 6. February 1, 20x8 Tinplex had to borrow $30,000 from Scotia Bank at an interest rate of 8%. Interest is paid the first of every month and the principal amount is to be repaid February 1, 20x9. 7. Tinplex is unique because customer can pay $84 and see one movie every month for a whole year. This deal can only be purchased in January and 140 customers purchased this deal on January 2, 20x8. The full amount was credited to unearned movie revenues. Required- a. Prepare the original journal entries for transactions 1, 2, 3, 5, 6 and 7. b. Prepare the August 31208 adjusting journal entries for the above transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started