Answered step by step

Verified Expert Solution

Question

1 Approved Answer

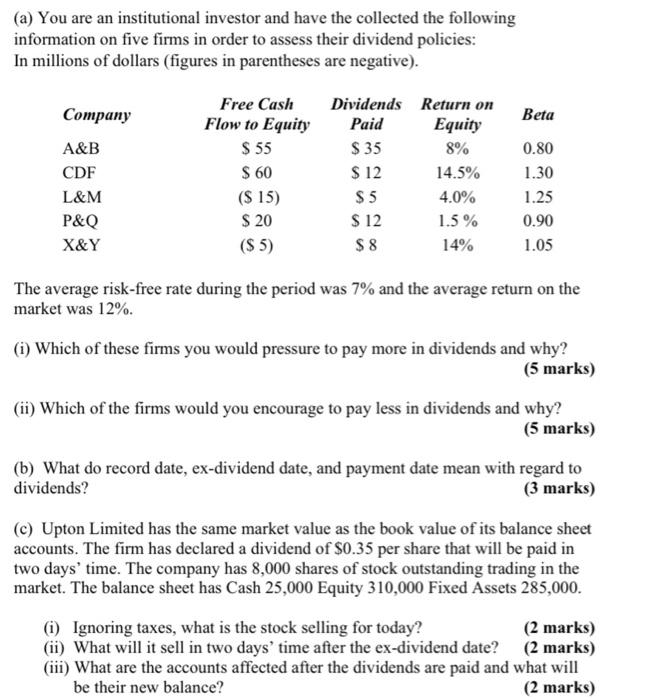

(a) You are an institutional investor and have the collected the following information on five firms in order to assess their dividend policies: In

(a) You are an institutional investor and have the collected the following information on five firms in order to assess their dividend policies: In millions of dollars (figures in parentheses are negative). Company A&B CDF L&M P&Q X&Y Free Cash Flow to Equity $ 55 $ 60 ($ 15) $ 20 ($ 5) Dividends Return on Paid $35 $ 12 $5 $12 $8 Equity 8% 14.5% 4.0% 1.5% 14% Beta 0.80 1.30 1.25 0.90 1.05 The average risk-free rate during the period was 7% and the average return on the market was 12%. (i) Which of these firms you would pressure to pay more in dividends and why? (5 marks) (ii) Which of the firms would you encourage to pay less in dividends and why? (5 marks) (b) What do record date, ex-dividend date, and payment date mean with regard to dividends? (3 marks) (c) Upton Limited has the same market value as the book value of its balance sheet accounts. The firm has declared a dividend of $0.35 per share that will be paid in two days' time. The company has 8,000 shares of stock outstanding trading in the market. The balance sheet has Cash 25,000 Equity 310,000 Fixed Assets 285,000. (i) Ignoring taxes, what is the stock selling for today? (2 marks) (2 marks) (ii) What will it sell in two days' time after the ex-dividend date? (iii) What are the accounts affected after the dividends are paid and what will be their new balance? (2 marks)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Required Company Free Cash Dividend Returen Beta reruin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started