Question

a) You are planning the audit of the 2019 financial statements for Queen Consolidated. You have a brief conversation with your audit manager about materiality.

a) You are planning the audit of the 2019 financial statements for Queen Consolidated. You have a brief conversation with your audit manager about materiality. During that conversation he says, When we quantify overall planning materiality remember that for net revenue any amount less than 0.6 percent is immaterial while amounts over 1.75 percent are material. Similarly, for income before taxes any amount less than 1.25 percent is immaterial while amounts over 9 percent are material. Also remember that for total assets any amount less than 0.55 percent is immaterial while amounts over 1.8 percent are material. Do not forget that Queen Consolidated is a relatively young and growing company, they have incurred a lot of operating losses so far, so not all of these possible bases will be appropriate. The performance materiality established for a particular financial statement account/class of transactions should not exceed 65 percent of overall planning materiality. The percentage threshold should be lower as the expectation for management fraud increases. The performance materiality percentage threshold should not exceed 65 percent of overall planning materiality when there is a low likelihood of management fraud, 55 percent when there is a moderate likelihood of management fraud, and 45 when there is a high likelihood of management fraud.

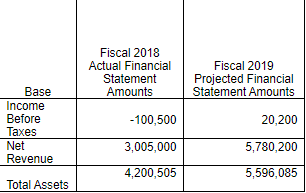

You manager then provides you with the following selected financial information:

Given your conversation and the above financial statement information, compute possible overall planning materiality thresholds for the 2019 audit and select the most appropriate one. Be sure to show your work.

b) What should performance materiality be if the likelihood of management fraud is set to moderate?

c) What should performance materiality be if the likelihood of management fraud is set to low?

I AM NOT JUST LOOKING FOR THE ANSWER, I WOULD LIKE SOMEBODY TO PLEASE EXPLAIN THE PROCESS OF HOW THE ANSWER IS DERIVED AS WELL AS ALL NUMBERS AND COMPUTATIONS PLEASE

Fiscal 2018 Actual Financial Statement Amounts Fiscal 2019 Projected Financial Statement Amounts Base Income Before Taxes Net Revenue -100,500 20,200 5,780,200 3,005,000 4,200,505 5,596,085 Total AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started