Answered step by step

Verified Expert Solution

Question

1 Approved Answer

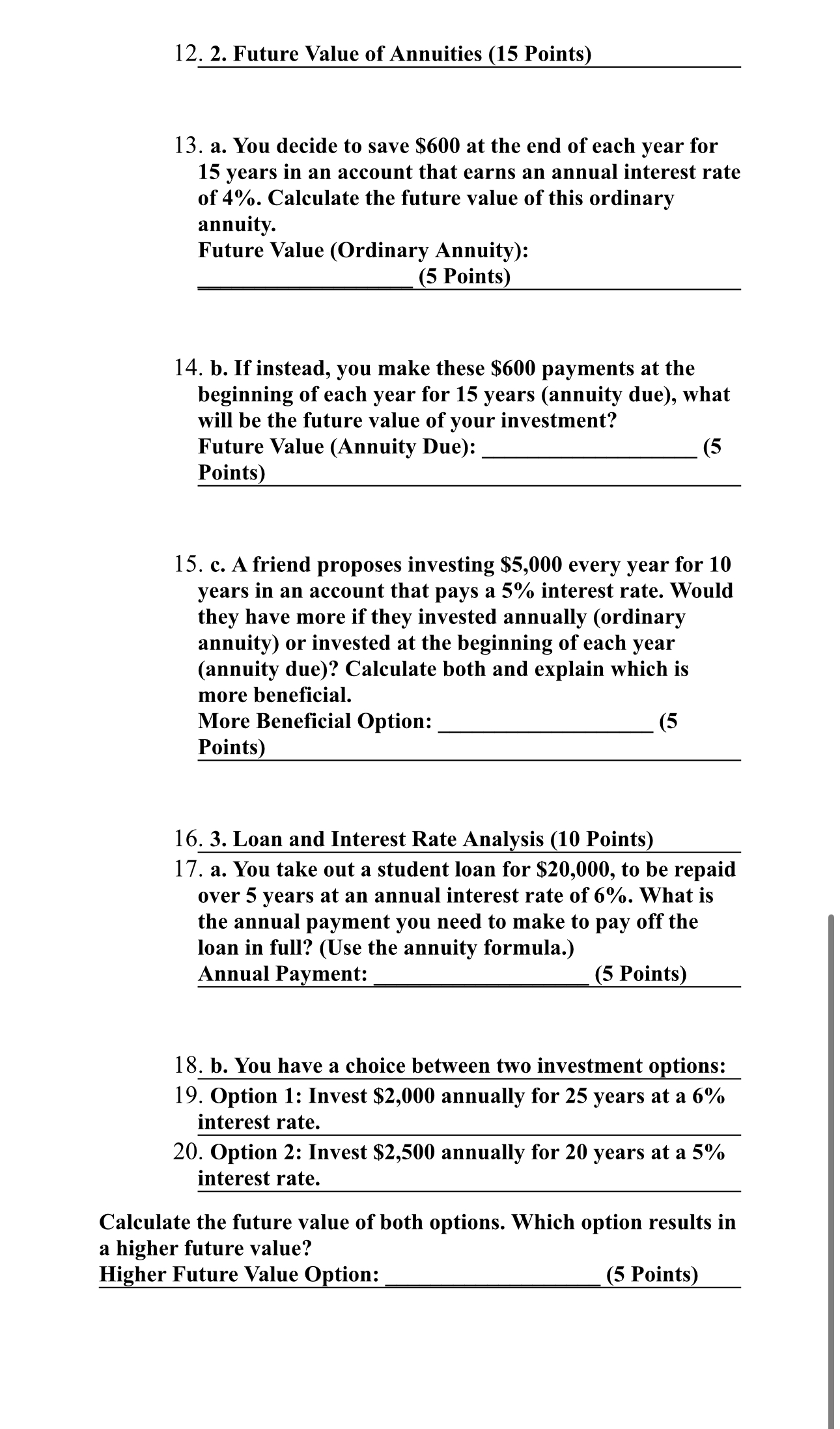

a . You decide to save $ 6 0 0 at the end of each year for 1 5 years in an account that earns

a You decide to save $ at the end of each year for

years in an account that earns an annual interest rate

of Calculate the future value of this ordinary

annuity.

Future Value Ordinary Annuity:

Points

b If instead, you make these $ payments at the

beginning of each year for years annuity due what

will be the future value of your investment?

Future Value Annuity Due:

Points

c A friend proposes investing $ every year for

years in an account that pays a interest rate. Would

they have more if they invested annually ordinary

annuity or invested at the beginning of each year

annuity due Calculate both and explain which is

more beneficial.

More Beneficial Option:

Points

Loan and Interest Rate Analysis Points

a You take out a student loan for $ to be repaid

over years at an annual interest rate of What is

the annual payment you need to make to pay off the

loan in full? Use the annuity formula.

Annual Payment:

Points

b You have a choice between two investment options:

Option : Invest $ annually for years at a

interest rate.

Option : Invest $ annually for years at a

interest rate.

Calculate the future value of both options. Which option results in

a higher future value?

Higher Future Value Option:

Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started