Question

a) You intend to construct a 2-asset portfolio. Three stock candidates are available with the following probability distribution of their returns: Return on Return

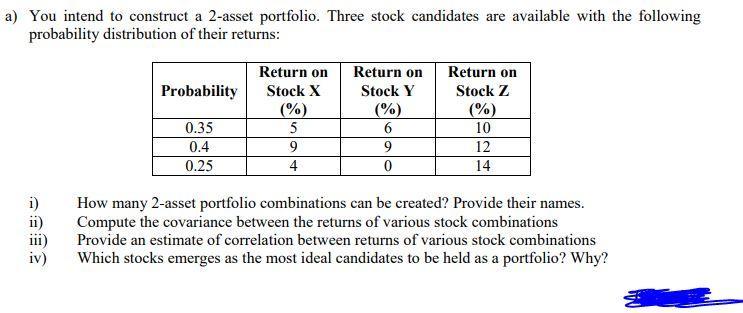

a) You intend to construct a 2-asset portfolio. Three stock candidates are available with the following probability distribution of their returns: Return on Return on Return on Probability Stock X Stock Y Stock Z (%) (%) (%) 0.35 5 6 10 0.4 9 9 12 0.25 4 0 14 How many 2-asset portfolio combinations can be created? Provide their names. Compute the covariance between the returns of various stock combinations Provide an estimate of correlation between returns of various stock combinations iv) Which stocks emerges as the most ideal candidates to be held as a portfolio? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the number of 2asset portfolio combinations we need to consider the available stocks X ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Methods For Business

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

12th Edition

840062338, 840062346, 9780840062338, 978-0840062345

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App