Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A young couple is planning for the education of their two children. They plan to invest the same amount of money at the end of

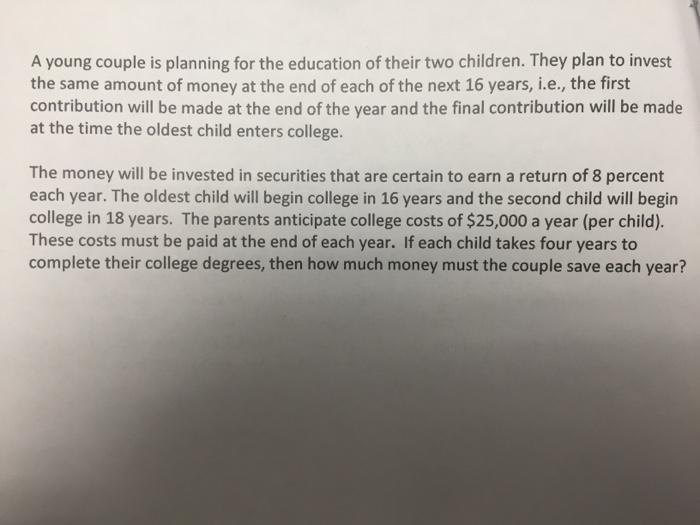

A young couple is planning for the education of their two children. They plan to invest the same amount of money at the end of each of the next 16 years,i.e., the first contribution will be made at the end of the year and the final contribution will be made at the time the oldest child enters college.

The money will be invested in securities that are certain to earn a return of 8percent each year. The oldest child will begin college in 16years and the second child will begin college in 18 years. The parents anticipate college cost of $25000 a year (Per child). These costs must be paid at the end of each year. If each child takes four years to complete their college degrees, then how much money must the parents save each year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started