Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A1 fs Accessibility tab summary: Information about Lucia Company is provided in rows 2 to 14. 8 C D E F G Lucia Company has

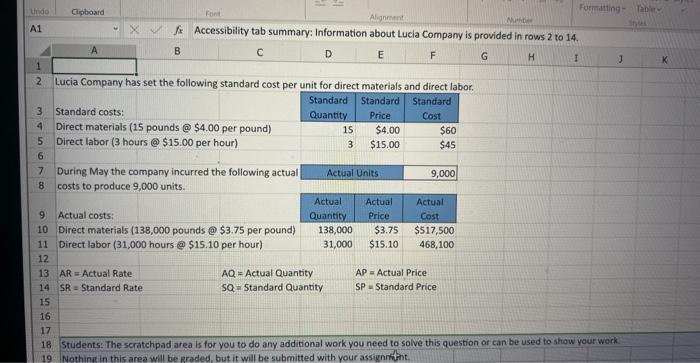

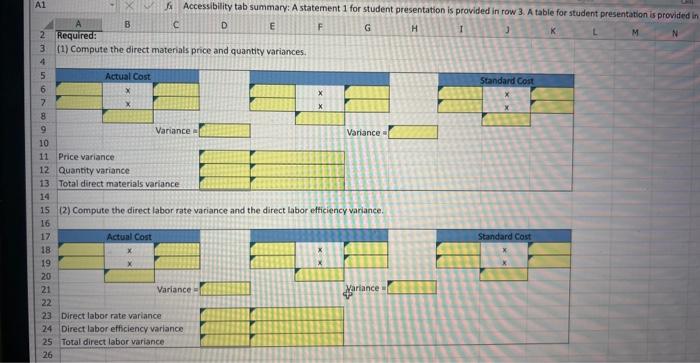

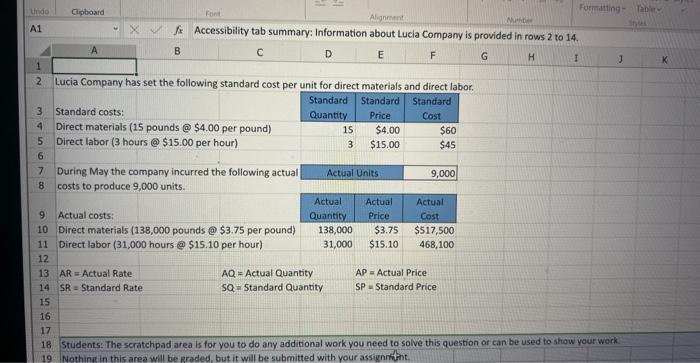

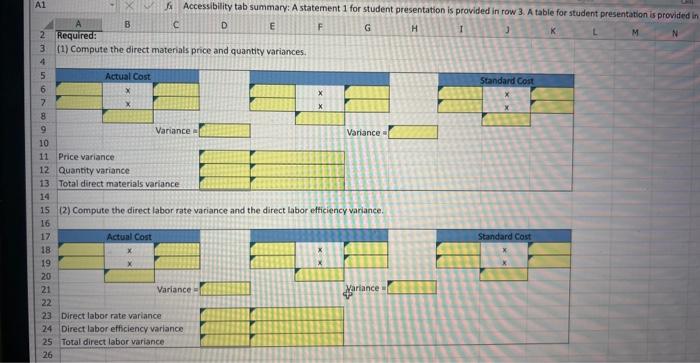

A1 fs Accessibility tab summary: Information about Lucia Company is provided in rows 2 to 14. 8 C D E F G Lucia Company has set the following standard cost per unit for direct materials and direct labor. 3 Standard costs: 4 Direct materials (15 pounds @ $4.00 per pound) Direct labor ( 3 hours @ $15.00 per hour) \begin{tabular}{|r|r|r|} \hline StandardQuantity & StandardPrice & StandardCost \\ \hline 15 & $4.00 & $60 \\ \hline 3 & $15.00 & $45 \\ \hline \end{tabular} During May the company incurred the following actual \begin{tabular}{|c|r|} \hline Actual Units & 9,000 \\ \hline \end{tabular} 8 costs to produce 9,000 units. 9 Actual costs: 10 Direct materials (138,000 pounds @ $3.75 per pound) 138,000$3.75$517,500 11 Direct labor (31,000 hours $15.10 per hour) 31,000$15.10468,100 12 13AR= Actual Rate AQ= Actual Quantity AP= Actual Price 145R= Standard Rate SQ = Standard Quantity SP= Standard Price 15 16 17 18 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 19 Nothine in this area will be eraded, but it will be submitted with your assignnthit. (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance

A1 fs Accessibility tab summary: Information about Lucia Company is provided in rows 2 to 14. 8 C D E F G Lucia Company has set the following standard cost per unit for direct materials and direct labor. 3 Standard costs: 4 Direct materials (15 pounds @ $4.00 per pound) Direct labor ( 3 hours @ $15.00 per hour) \begin{tabular}{|r|r|r|} \hline StandardQuantity & StandardPrice & StandardCost \\ \hline 15 & $4.00 & $60 \\ \hline 3 & $15.00 & $45 \\ \hline \end{tabular} During May the company incurred the following actual \begin{tabular}{|c|r|} \hline Actual Units & 9,000 \\ \hline \end{tabular} 8 costs to produce 9,000 units. 9 Actual costs: 10 Direct materials (138,000 pounds @ $3.75 per pound) 138,000$3.75$517,500 11 Direct labor (31,000 hours $15.10 per hour) 31,000$15.10468,100 12 13AR= Actual Rate AQ= Actual Quantity AP= Actual Price 145R= Standard Rate SQ = Standard Quantity SP= Standard Price 15 16 17 18 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 19 Nothine in this area will be eraded, but it will be submitted with your assignnthit. (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started