Answered step by step

Verified Expert Solution

Question

1 Approved Answer

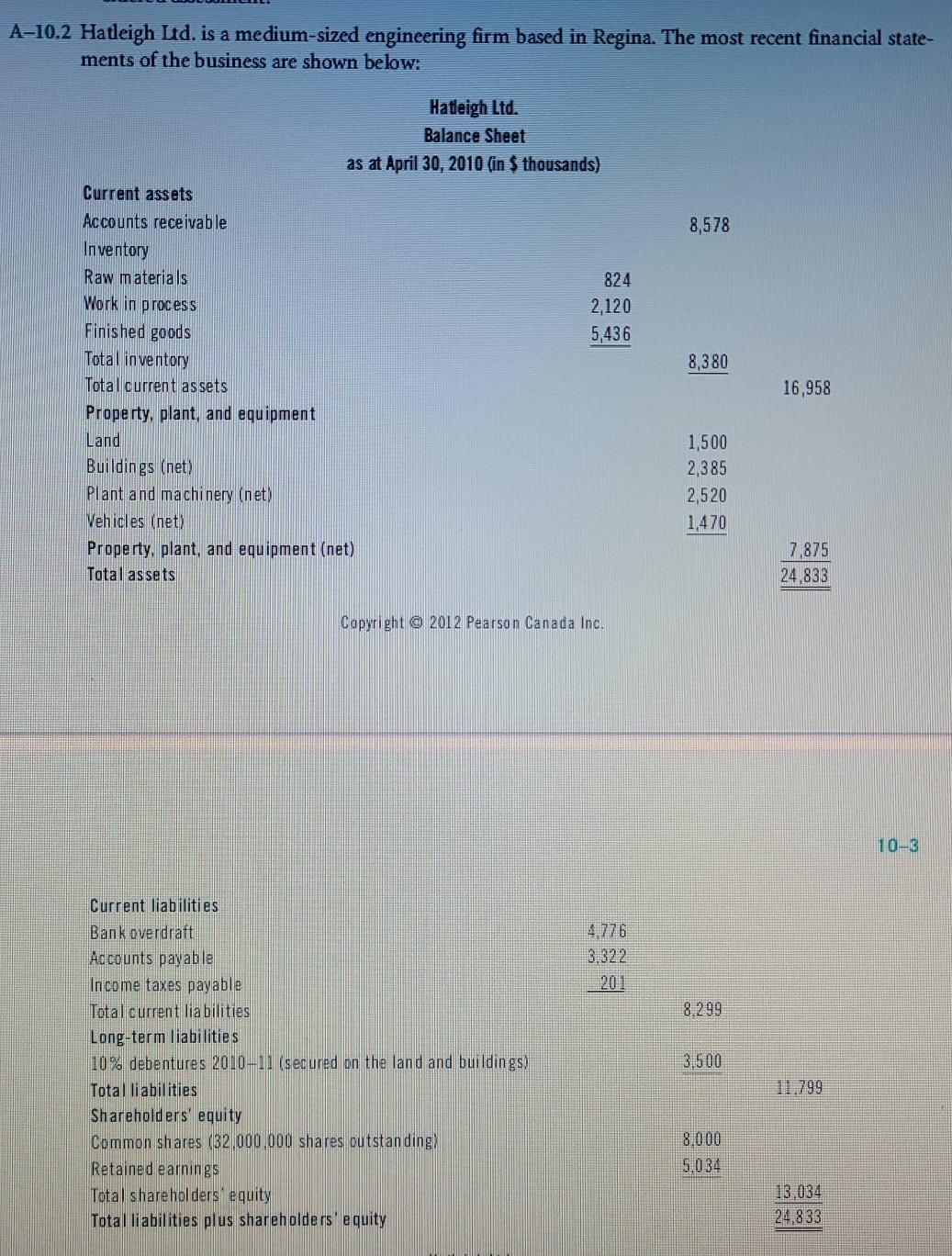

A-10.2 Hatleigh Ltd. is a medium-sized engineering firm based in Regina. The most recent financial state- ments of the business are shown below: 8,578 Hatleigh

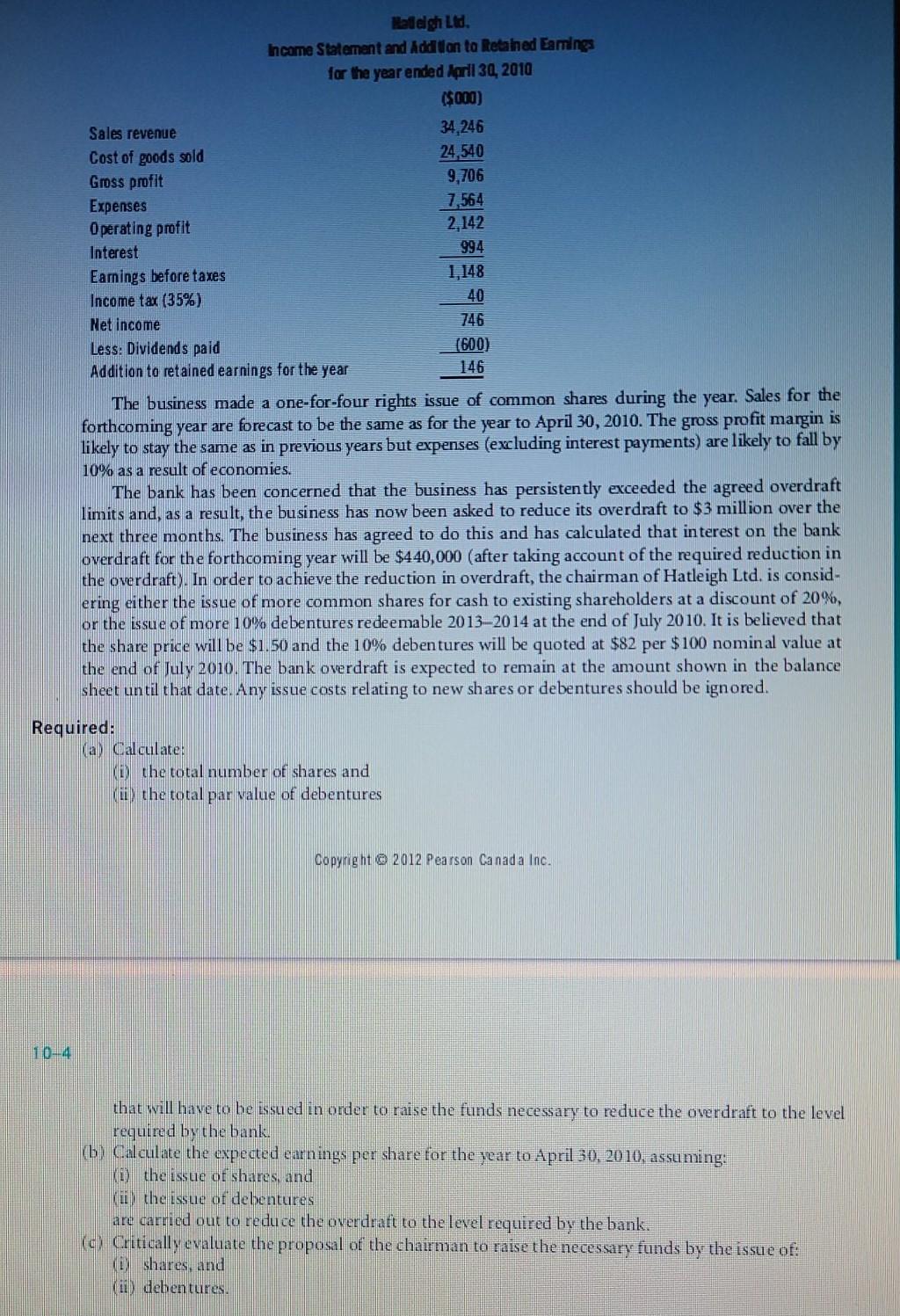

A-10.2 Hatleigh Ltd. is a medium-sized engineering firm based in Regina. The most recent financial state- ments of the business are shown below: 8,578 Hatleigh Ltd. Balance Sheet as at April 30, 2010 (in $ thousands) Current assets Accounts receivable Inventory Raw materials 824 Work in process 2,120 Finished goods 5,436 Total inventory Total current assets Property, plant, and equipment Land Buildings (net) Plant and machinery (net) Vehicles (net) Property, plant, and equipment (net) Total assets 8,380 16,958 1,500 2,385 2,520 1.470 7,875 24,838 Copyright 2012 Pearson Canada Inc. 10-3 4.776 3.322 201 8.299 Current liabilities Bank overdraft Accounts payable Income taxes payable Total current liabilities Long-term liabilities 10% debentures 2010-11 (secured on the land and buildings) Total liabilities Shareholders' equity Common shares (32.000.000 shares outstanding) Retained earnings Total shareholders equity Total liabilities plus shareholders' equity 3.500 11.799 8.000 5,034 13,034 24,833 Hellelgh Ltd. Income Statement and addition to Retained Eamings for the year ended daril 30, 2010 (5000) Sales revenue 34,246 Cost of goods sold 24.540 Gross profit 9,706 Expenses 7,564 Operating profit 2.142 Interest 994 Earnings before taxes 1,148 Income tax (35%) 40 Net income 746 Less: Dividends paid (600) Addition to retained earnings for the year 146 The business made a one-for-four rights issue of common shares during the year. Sales for the forthcoming year are forecast to be the same as for the year to April 30, 2010. The gross profit margin is likely to stay the same as in previous years but expenses (excluding interest payments) are likely to fall by 10% as a result of economies. The bank has been concerned that the business has persistently exceeded the agreed overdraft limits and, as a result, the business has now been asked to reduce its overdraft to $3 million over the next three months. The business has agreed to do this and has calculated that interest on the bank overdraft for the forthcoming year will be $440,000 (after taking account of the required reduction in the overdraft). In order to achieve the reduction in overdraft, the chairman of Hatleigh Ltd. is consid- ering either the issue of more common shares for cash to existing shareholders at a discount of 20%, or the issue of more 10% debentures redeemable 2013-2014 at the end of July 2010. It is believed that the share price will be $1.50 and the 10% debentures will be quoted at $82 per $100 nominal value at the end of July 2010. The bank overdraft is expected to remain at the amount shown in the balance sheet until that date. Any issue costs relating to new shares or debentures should be ignored. Required: (a) Calculate: the total number of shares and ii) the total par value of debentures Copyright 2012 Pearson Canada Inc. 10-4 that will have to be issued in order to raise the funds necessary to reduce the overdraft to the level required by the bank. (b) Calculate the expected earnings per share for the year to April 30, 2010, assuming: Ke the issue of shares, and (ii) the issue of debentures are carried out to reduce the overdraft to the level required by the bank. (c) Critically evaluate the proposal of the chairman to raise the necessary funds by the issue of: (EX shares, and (debentures. A-10.2 Hatleigh Ltd. is a medium-sized engineering firm based in Regina. The most recent financial state- ments of the business are shown below: 8,578 Hatleigh Ltd. Balance Sheet as at April 30, 2010 (in $ thousands) Current assets Accounts receivable Inventory Raw materials 824 Work in process 2,120 Finished goods 5,436 Total inventory Total current assets Property, plant, and equipment Land Buildings (net) Plant and machinery (net) Vehicles (net) Property, plant, and equipment (net) Total assets 8,380 16,958 1,500 2,385 2,520 1.470 7,875 24,838 Copyright 2012 Pearson Canada Inc. 10-3 4.776 3.322 201 8.299 Current liabilities Bank overdraft Accounts payable Income taxes payable Total current liabilities Long-term liabilities 10% debentures 2010-11 (secured on the land and buildings) Total liabilities Shareholders' equity Common shares (32.000.000 shares outstanding) Retained earnings Total shareholders equity Total liabilities plus shareholders' equity 3.500 11.799 8.000 5,034 13,034 24,833 Hellelgh Ltd. Income Statement and addition to Retained Eamings for the year ended daril 30, 2010 (5000) Sales revenue 34,246 Cost of goods sold 24.540 Gross profit 9,706 Expenses 7,564 Operating profit 2.142 Interest 994 Earnings before taxes 1,148 Income tax (35%) 40 Net income 746 Less: Dividends paid (600) Addition to retained earnings for the year 146 The business made a one-for-four rights issue of common shares during the year. Sales for the forthcoming year are forecast to be the same as for the year to April 30, 2010. The gross profit margin is likely to stay the same as in previous years but expenses (excluding interest payments) are likely to fall by 10% as a result of economies. The bank has been concerned that the business has persistently exceeded the agreed overdraft limits and, as a result, the business has now been asked to reduce its overdraft to $3 million over the next three months. The business has agreed to do this and has calculated that interest on the bank overdraft for the forthcoming year will be $440,000 (after taking account of the required reduction in the overdraft). In order to achieve the reduction in overdraft, the chairman of Hatleigh Ltd. is consid- ering either the issue of more common shares for cash to existing shareholders at a discount of 20%, or the issue of more 10% debentures redeemable 2013-2014 at the end of July 2010. It is believed that the share price will be $1.50 and the 10% debentures will be quoted at $82 per $100 nominal value at the end of July 2010. The bank overdraft is expected to remain at the amount shown in the balance sheet until that date. Any issue costs relating to new shares or debentures should be ignored. Required: (a) Calculate: the total number of shares and ii) the total par value of debentures Copyright 2012 Pearson Canada Inc. 10-4 that will have to be issued in order to raise the funds necessary to reduce the overdraft to the level required by the bank. (b) Calculate the expected earnings per share for the year to April 30, 2010, assuming: Ke the issue of shares, and (ii) the issue of debentures are carried out to reduce the overdraft to the level required by the bank. (c) Critically evaluate the proposal of the chairman to raise the necessary funds by the issue of: (EX shares, and (debentures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started