Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A18-9 Lessee Accounting; Amortization Table and Entries (LO 18-2, 18-3) Watson Co. entered into a lease arrangement for a truck on 1 April 20X2 that

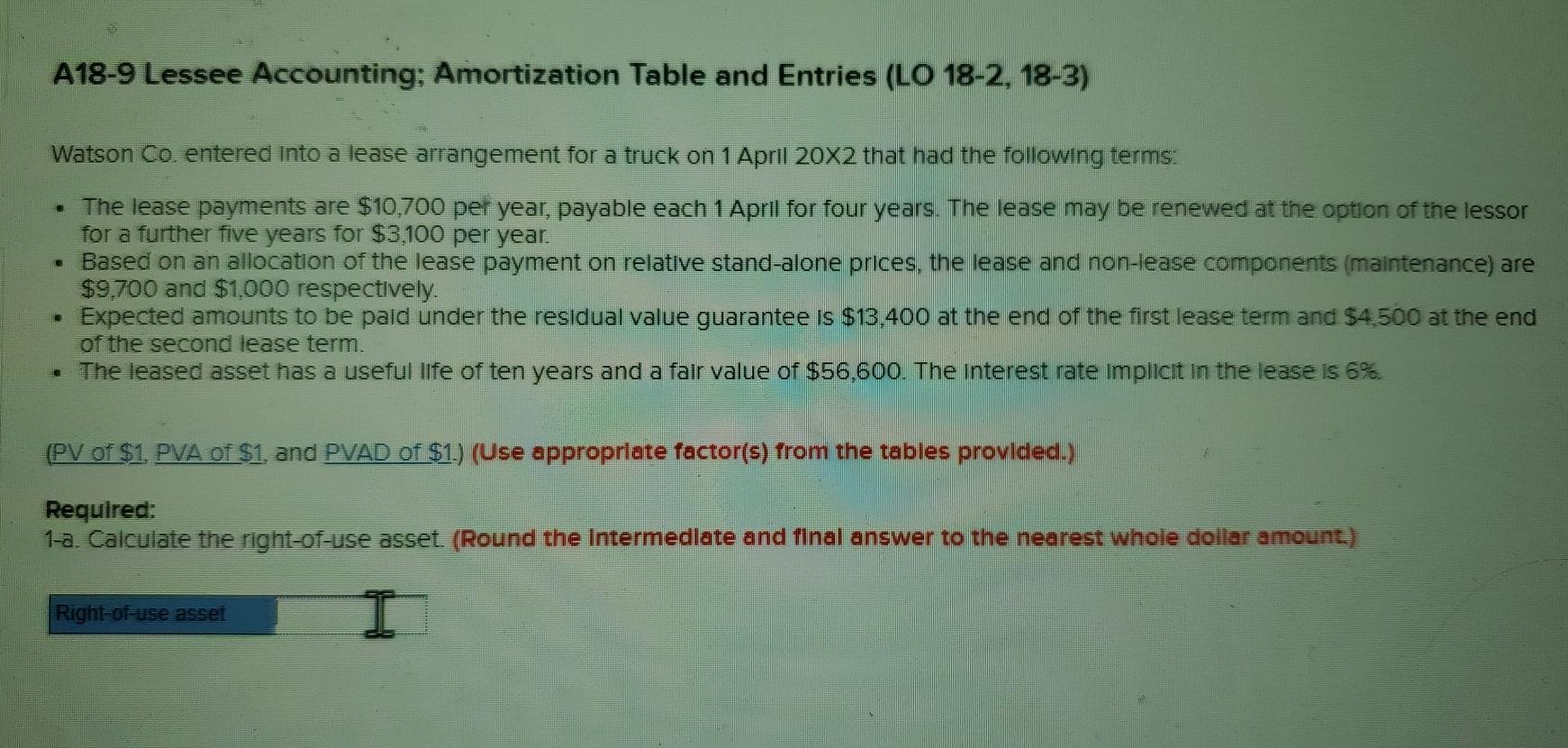

A18-9 Lessee Accounting; Amortization Table and Entries (LO 18-2, 18-3) Watson Co. entered into a lease arrangement for a truck on 1 April 20X2 that had the following terms: The lease payments are $10,700 per year, payable each 1 April for four years. The lease may be renewed at the option of the lessor for a further five years for $3,100 per year. Based on an allocation of the lease payment on relative stand-alone prices, the lease and non-lease components (maintenance) are $9.700 and $1,000 respectively. Expected amounts to be paid under the residual value guarantee is $13,400 at the end of the first lease term and $4,500 at the end of the second lease term. The leased asset has a useful life of ten years and a fair value of $56.600. The interest rate implicit in the lease is 6% (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Calculate the right-of-use asset. (Round the Intermediate and final answer to the nearest whole dollar amount.) Right-of-use asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started