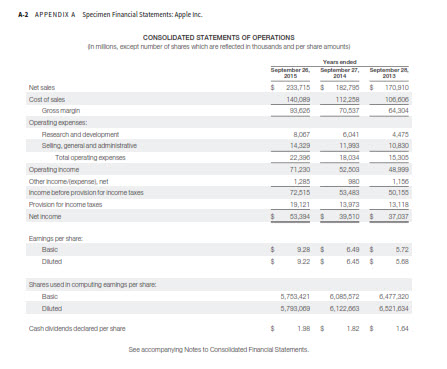

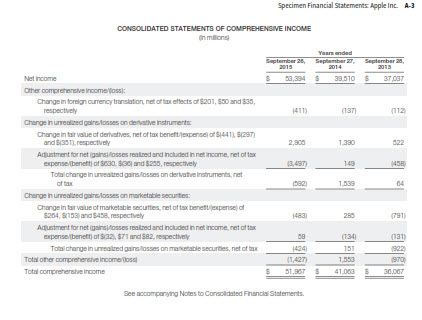

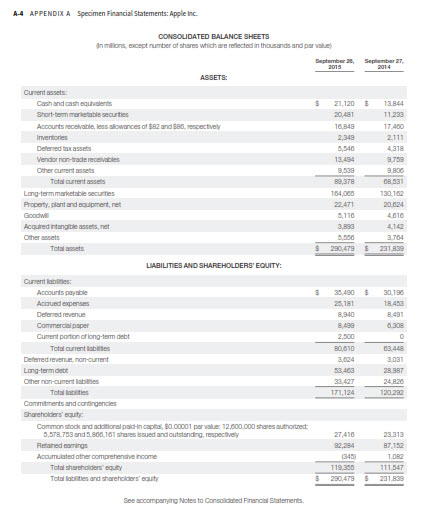

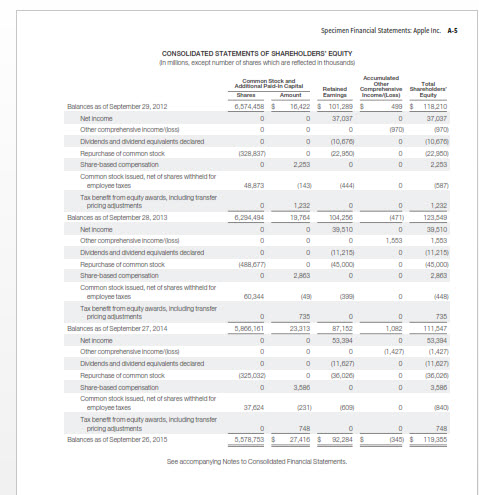

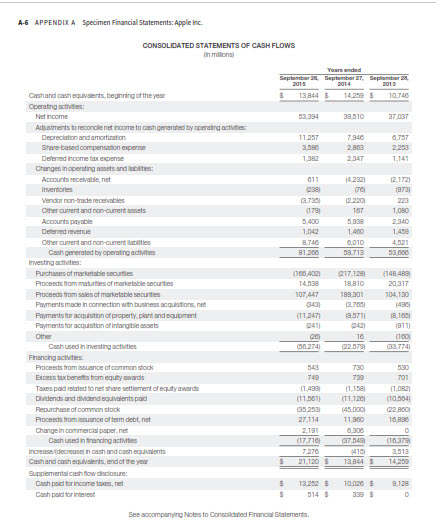

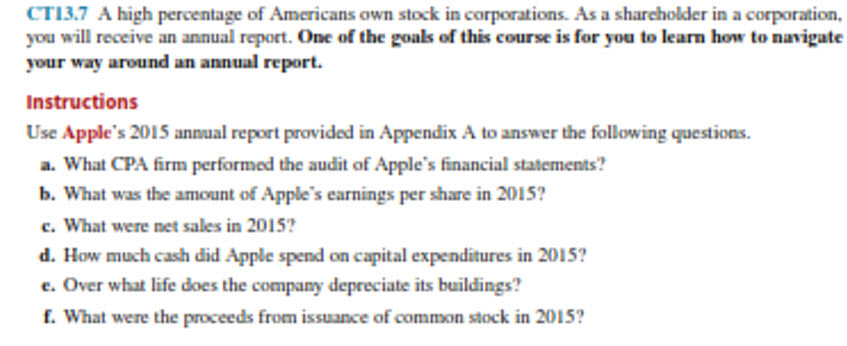

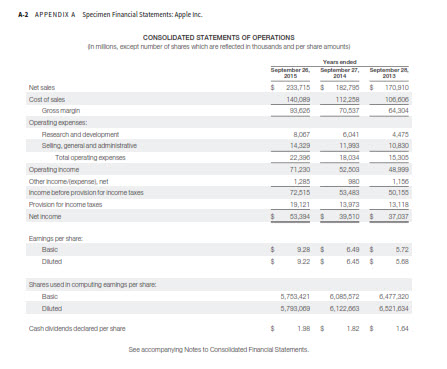

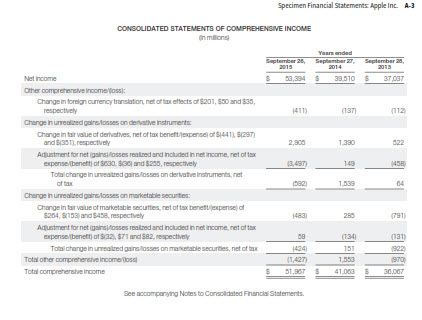

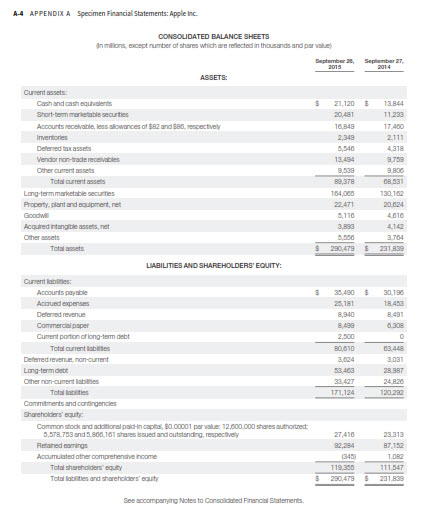

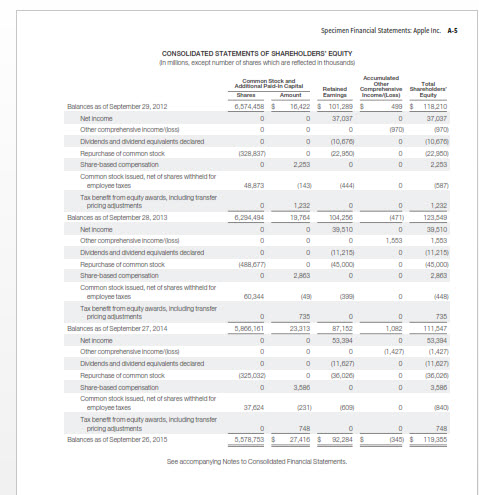

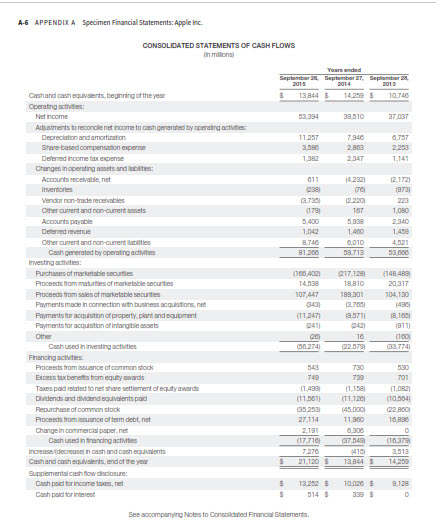

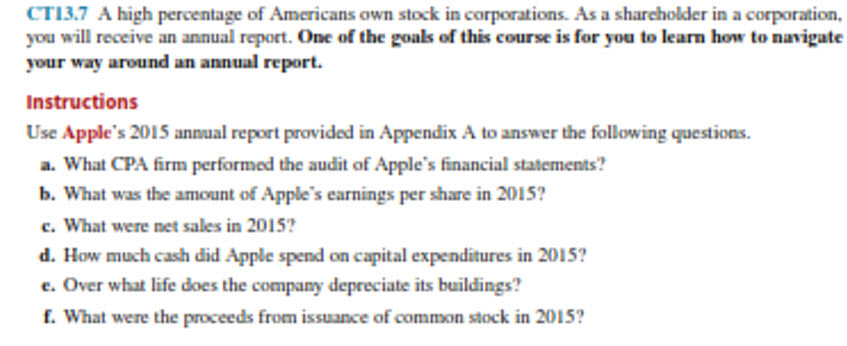

A-2 APPENDIX A Specimen Financial Statements: Apple Inc CONSOLIDATED STATEMENTS OF OPERATIONS In millions, except number of shares which are relected In thousands and per share amounts 233,715 182,780 170.910 Cost of sales 1 Gross magn 93,020 Operating expenses Resesroh and development Selling, general and actministrative ,007 041 11,383 4.476 10 830 Total operating expenses Operating ncome Other Incomeexperse net Income betore provislon for income txes 1 230 2,303 3,483 3,973 3,394 39,510 37 037 72515 Net income Eamings per share Basc ,783.421 ,083,572477 320 5,783,009 6,122.00 0.52 1.034 Cash dlvidends declared per share 1.98 S 1.82 154 See accompanylin Notes to Consoildated Financial Statements Specimen Financial Statements Apple lnc A3 CONSOLIDATED S 3,39438510 37 03 Change in toreign currency translation net aff tax etects o $201 1,550 and $35, (137 Change in urealzed gairelosses on denative Instruments Change in tair value of dervatives, net of tax beneftlexpense of $1441 8(297) Adjustment for net (gainslosses reakzed and Included in net income, net of tax otal charge in unvealtred gairs/losses on dervatve Instruments net and $/35T1 respectvely 330 expense/benett) of Se30.3 and $25, respectively Change in urealized gains losses on marketable securties: Change In tair value cf marketsble securttes, net oftax benettilexpense) o S264, $0.53rd S458, respect ely Adjustment for net (gsinsMosses reakzed and Inctuded In net income, net of tax expenseltbeneft) of S32, $71 and 582, nespectvely ota change in unealtred gainslasses on matable securties, net of t 1,427) 51,90741.0330,007 Total comprehensve income A-4 APPENDIX A Specimen Financial Statements: Apple Inc. CONSOLIDATED BALANCE SHEETS pember, Sepr E Current assets Cash and cash equalents Short-term marketable securties Accounts necelvable, less allowances of $82 and $80, respectively 21,12013844 20,481 11.23 6,849 2,349 ,540 13,494 17 400 endor non-trade receivables RN Lang-term marketable securites Property, plant and equipment, net 83,378 164,065 22,471 20024 30,102 ,110 cquired intangible assets, net 4,142 290,479 $ 231 839 Curnent Rablinies: 35,40 30138 2,181 18433 8.49 Accounts payable Defered revenue 8,340 8,499 Cument partion of long-term debt Defemed revenue non-curent Lang-termdlett Other non-cument labilibes 0,810 3,024 3,403 3.031 Total labities Commitments and cantingencles Shareholders' equity Common stock and adalitional paid-in capital$0.00001 parvalue 12.000,000 shares authortzedt ,578 753 and 5.80,161 shares isued and outstanding, respectvely Retaned eamings Accumulated other 27410 87,152 345 Total shareholders equity Total labities and shareholders' equity 11.547 230,479231839 See acoompanylng Notes to Consoidated Financial Statements pecimen Financial Statements Apple Inc. A-5 SHAREHOLDERS EQUITY n millions except number of shares which are reflected in thousands TED STATEMENTS OF Balances as of September 29, 2012 .574458 16422 101.28949 118210 37 037 970 Net Income Other comprehenave Incomeloss Dvidends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock Issued, net of shares whheld for 37,037 970 (22.950 2253 employee taxes 48,873 143 (444 087 Tax benet trom equity award Including transter pricing adustments Balances as of September 28, 2013 .284494 18704 104.25 39,510 Net income 38 010 Dvdends and dividend equivaients declared (1121 045,000 Common stock Issued, net of shares wthheld for employee taxes 448 501 111 347 Tax benett trom equity awards, Including transter pricing adustments Balances as of September 27,2014 5,800,101 23,313 Net Income 0 3,334 1427 0 (1,27 Dvdends and dividend equivalents declared of common stock 325,032 Comman stock Issued, net of shares whheld for employee taxes 37 024 840 Tax benet trom equty awards, Including transter pricing adjustments Balances s of September 20, 2015 ,578,75327416 92,284 345)119.355 See accompanying Notes to Consolldsted Financal Statements A-6 APPENDIX A Specimen Financial Statements: Apple Inc CONSOLIDATED STATEMENTS OF CASH In milions Cash and cash equivalents, beginning of the year Operating actvtes s 13.844s 1425es 10.746 9.510 Adustments to reconcile net income to cash generated by operating actvides 1.257 Defened Income ta Accounts necelvable, net endor non-trade receivables Accounts payable ,382 .141 Changes inaperating aasets and bltes 2.172 cument and 1671.080 Deferned revenue 400 1439 cument and a non-oument lablilities Cash generated by operating actvities vesting sctvties Purchases of marketsble securtiles Proceeds from maturities of marketable securties Proceeds trom sales of marketable securities Payments made in connection with business acquistions net 00402) 217,128 148.488 4538 07,447 83.301 430 11,247) Cash used in investing actuities Proceeds from lssuance of common stock Excess taxbenets trom equty awards axes paid nelated to net share settlement of equity awards Didends and dividend equvaients paid Repurchase of common stock Proceeds from suance of term debt, net Change In commercial paper, net 739 70 1,082 10.504 35.253 (45000(22.800 27.11400 16 B30 1,138 Cach used in francing actite nareaseNdeceaselncash and cash equivalents Cash and cash equivelents endi of the year S 21.120 S 13B44 14,259 cash fow disclosure Cash paid for income taxes, net Cash pald for Interest 13.252 514 339 companying Notes to Consolidted Financial Statements CT13.7 Ahigh percentage of Americans own stock in corporations. As a sharcholder in a corporation., you will receive an annual report.One of the goals of this course is for you to learn how to navigate your way around an annual report. Instructions Use Apple's 2015 annual report provided in Appendix A to answer the following questions a. What CPA firm performed the audit of Apple's financial statements? b. What was the amount of Apple's earnings per share in 2015? e. What were net sales in 2015? d. How much cash did Apple spend on capital expenditures in 2015? e. Over what life does the company depreciate its buildings? . What were the proceeds from issuance of common stock in 2015