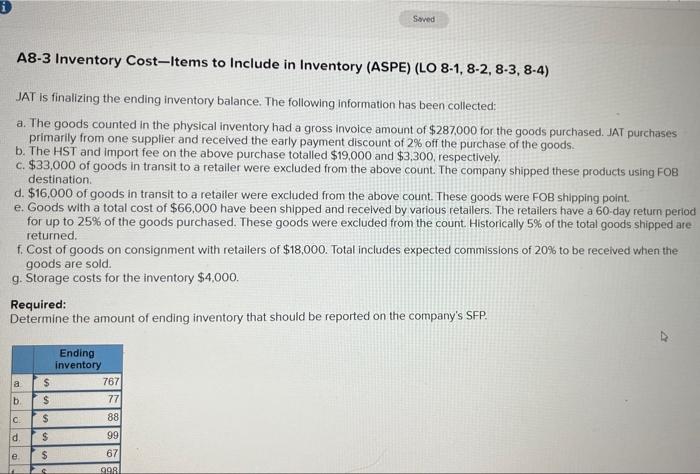

A8-3 Inventory Cost-Items to Include in Inventory (ASPE) (LO 8-1, 8-2, 8-3, 8-4) JAT is finalizing the ending inventory balance. The following information has been collected: a. The goods counted in the physical inventory had a gross invoice amount of $287,000 for the goods purchased. JAT purchases primarily from one supplier and recelved the early payment discount of 2% off the purchase of the goods. b. The HST and import fee on the above purchase totalled $19,000 and $3,300, respectively. c. $33,000 of goods in transit to a retaller were excluded from the above count. The company shipped these products using FO8 destination. d. $16,000 of goods in transit to a retailer were excluded from the above count. These goods were FOB shipping point. e. Goods with a total cost of $66,000 have been shipped and recelved by various retallers. The retailers have a 60 -day return period for up to 25% of the goods purchased. These goods were excluded from the count. Historically 5% of the total goods shipped are returned. f. Cost of goods on consignment with retailers of $18,000. Total includes expected commissions of 20% to be received when the goods are sold. g. Storage costs for the inventory $4,000. Required: Determine the amount of ending inventory that should be reported on the company's SFP. A8-3 Inventory Cost-Items to Include in Inventory (ASPE) (LO 8-1, 8-2, 8-3, 8-4) JAT is finalizing the ending inventory balance. The following information has been collected: a. The goods counted in the physical inventory had a gross invoice amount of $287,000 for the goods purchased. JAT purchases primarily from one supplier and recelved the early payment discount of 2% off the purchase of the goods. b. The HST and import fee on the above purchase totalled $19,000 and $3,300, respectively. c. $33,000 of goods in transit to a retaller were excluded from the above count. The company shipped these products using FO8 destination. d. $16,000 of goods in transit to a retailer were excluded from the above count. These goods were FOB shipping point. e. Goods with a total cost of $66,000 have been shipped and recelved by various retallers. The retailers have a 60 -day return period for up to 25% of the goods purchased. These goods were excluded from the count. Historically 5% of the total goods shipped are returned. f. Cost of goods on consignment with retailers of $18,000. Total includes expected commissions of 20% to be received when the goods are sold. g. Storage costs for the inventory $4,000. Required: Determine the amount of ending inventory that should be reported on the company's SFP