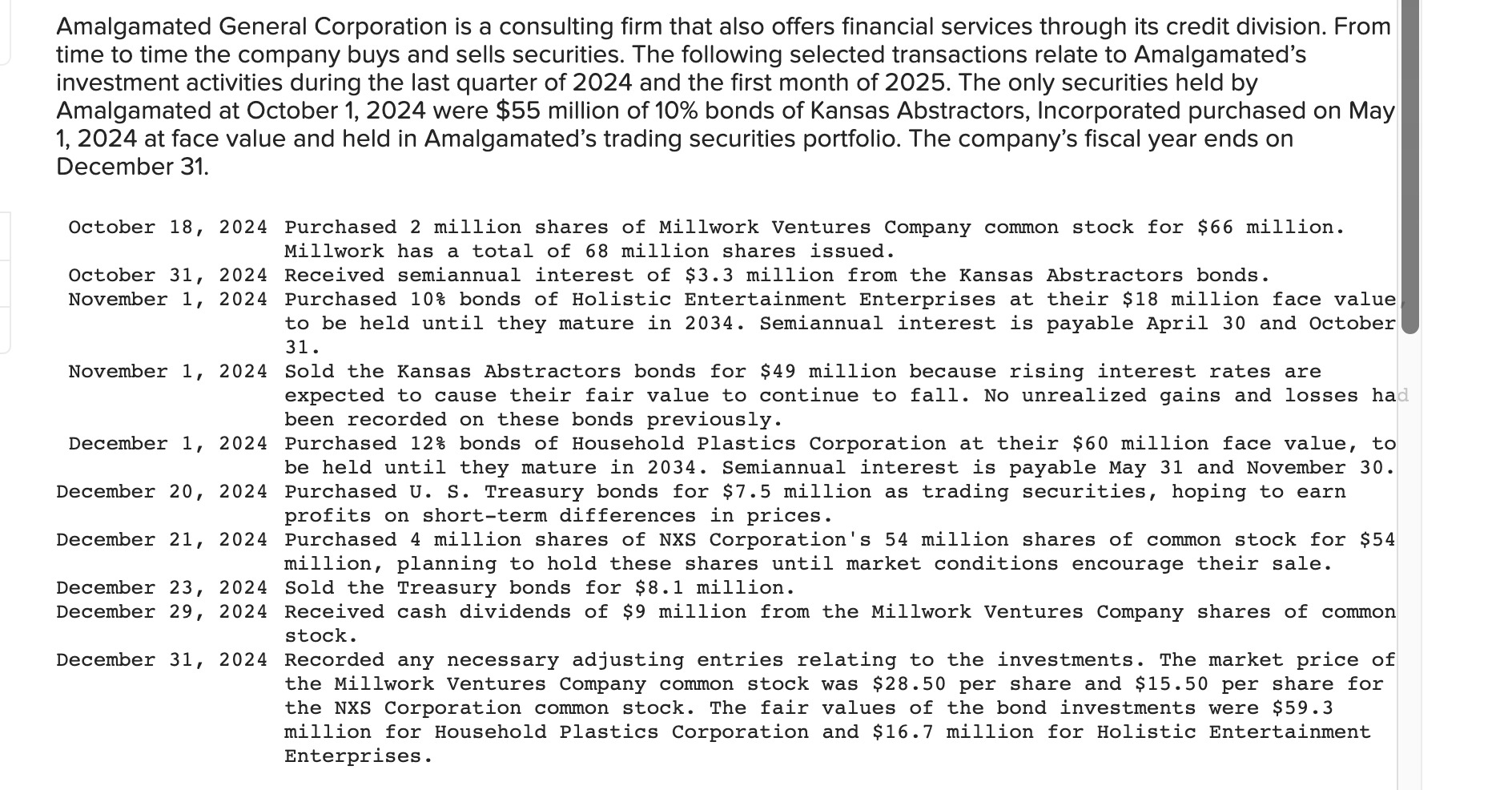

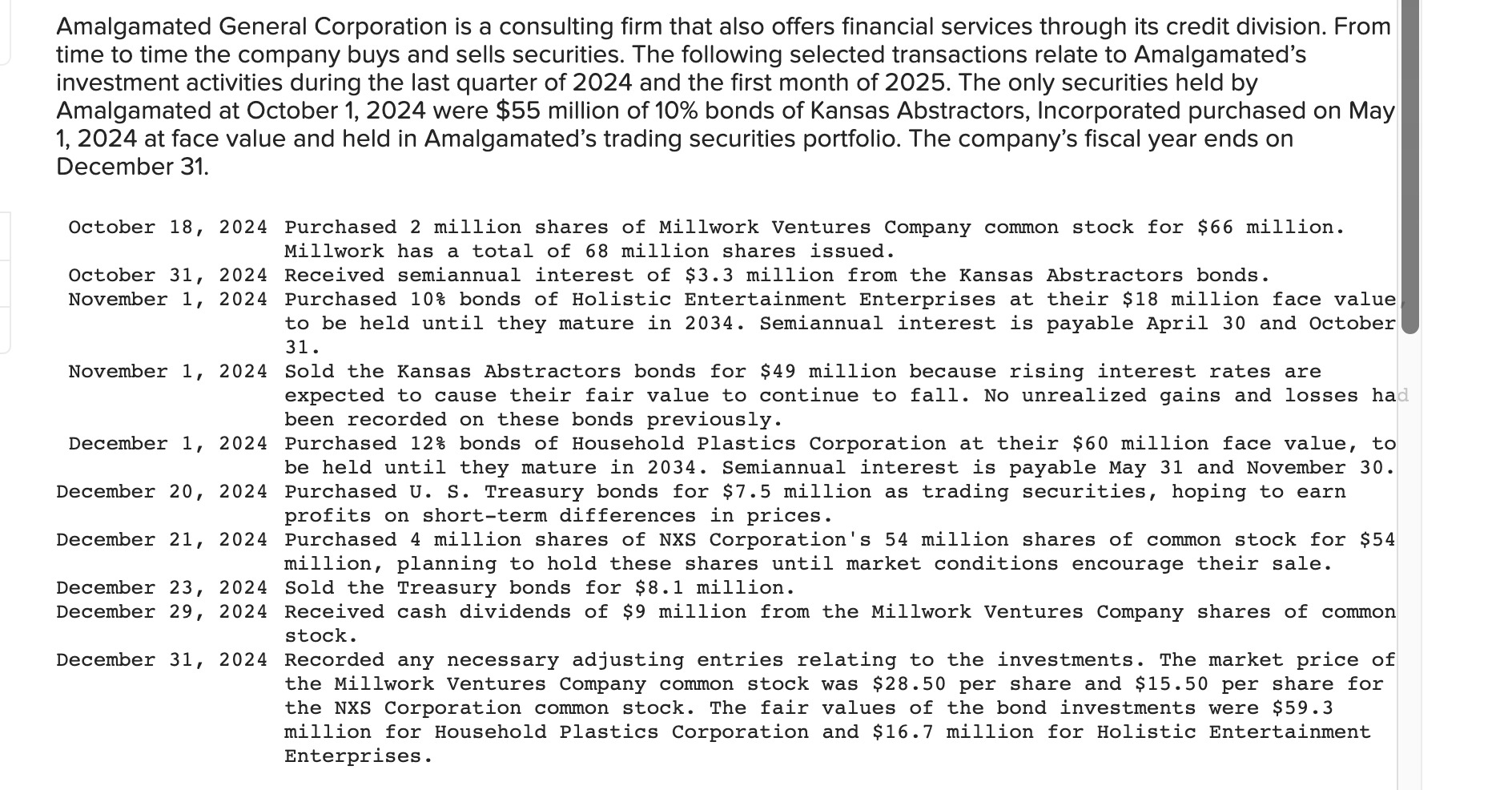

Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated's investment activities during the last quarter of 2024 and the first month of 2025 . The only securities held by Amalgamated at October 1,2024 were $55 million of 10% bonds of Kansas Abstractors, Incorporated purchased on May 1, 2024 at face value and held in Amalgamated's trading securities portfolio. The company's fiscal year ends on December 31. January 7, 2025 Sold the NXS Corporation common stock shares for \$52 million. Required: Prepare the appropriate journal entry for each transaction or event. Use one summary entry on December 31 to adjust th portfolio of equity investments to fair value. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do n round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should entered as 5.5). Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated's investment activities during the last quarter of 2024 and the first month of 2025 . The only securities held by Amalgamated at October 1,2024 were $55 million of 10% bonds of Kansas Abstractors, Incorporated purchased on May 1, 2024 at face value and held in Amalgamated's trading securities portfolio. The company's fiscal year ends on December 31. January 7, 2025 Sold the NXS Corporation common stock shares for \$52 million. Required: Prepare the appropriate journal entry for each transaction or event. Use one summary entry on December 31 to adjust th portfolio of equity investments to fair value. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do n round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should entered as 5.5)