Answered step by step

Verified Expert Solution

Question

1 Approved Answer

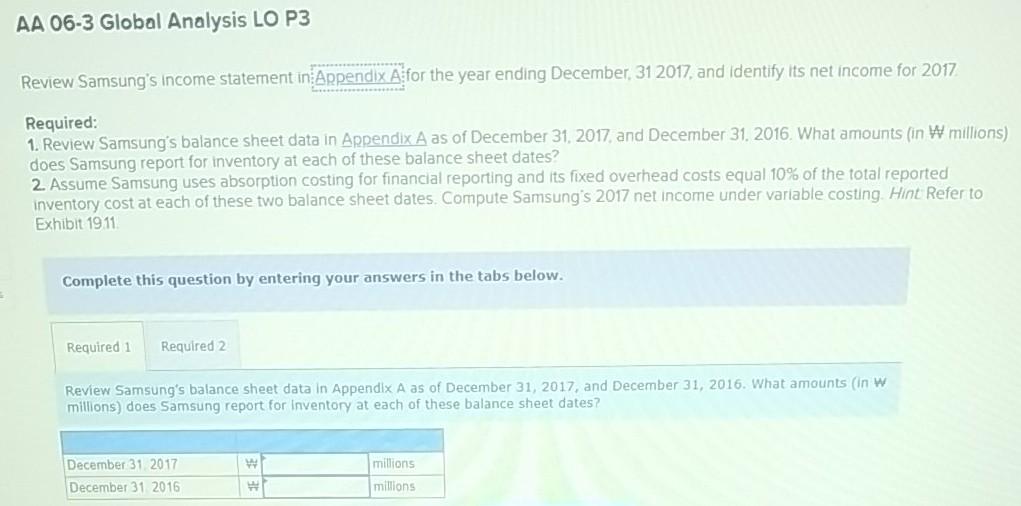

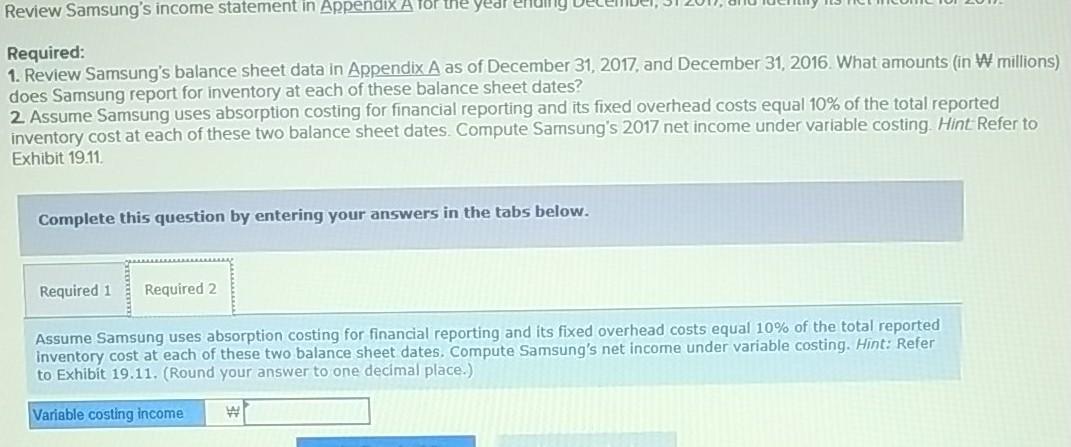

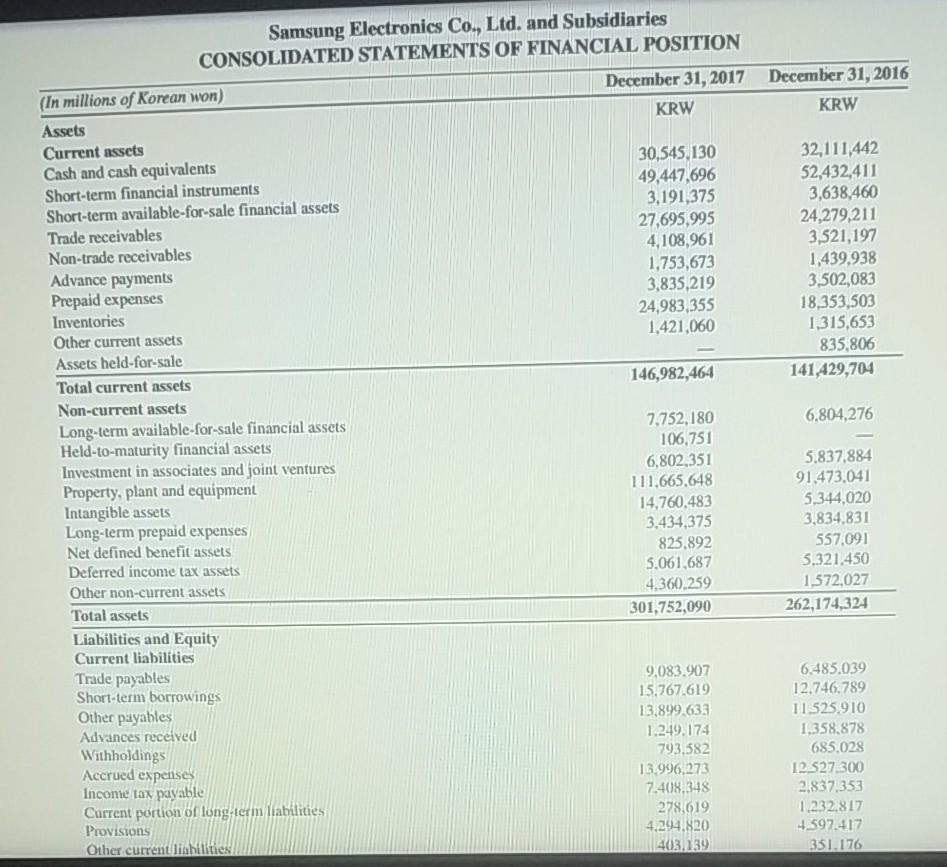

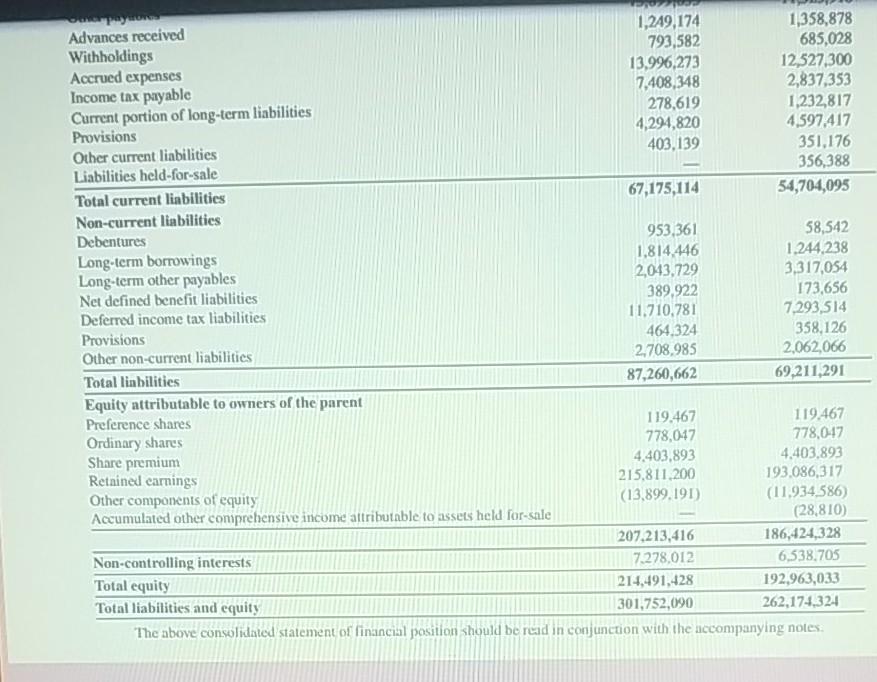

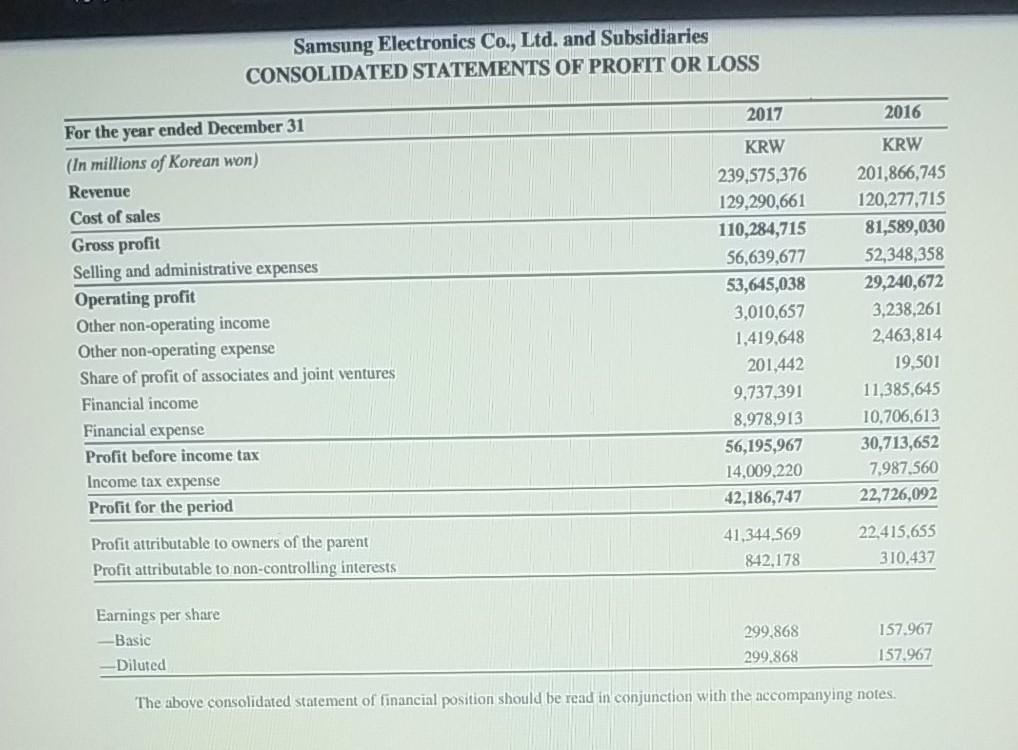

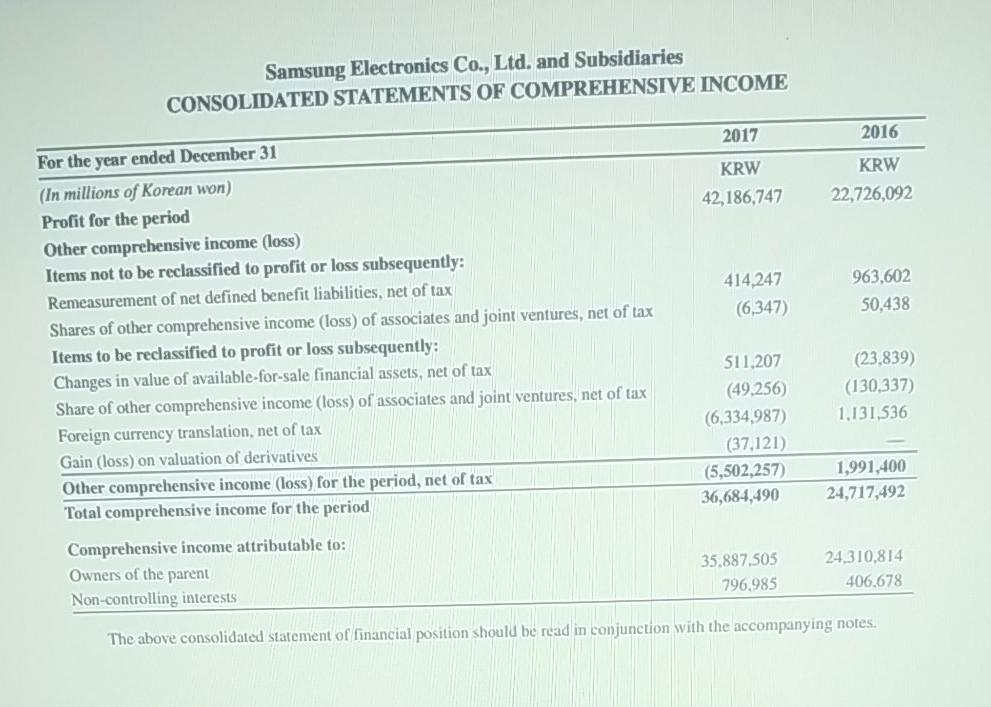

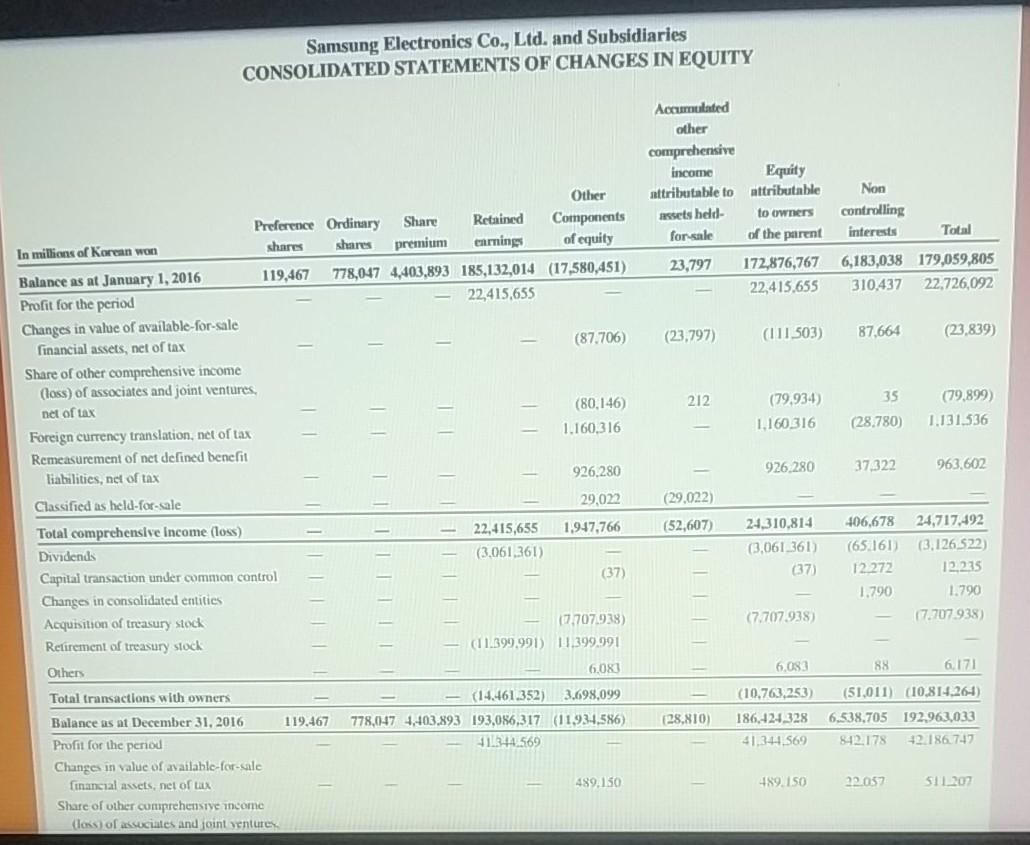

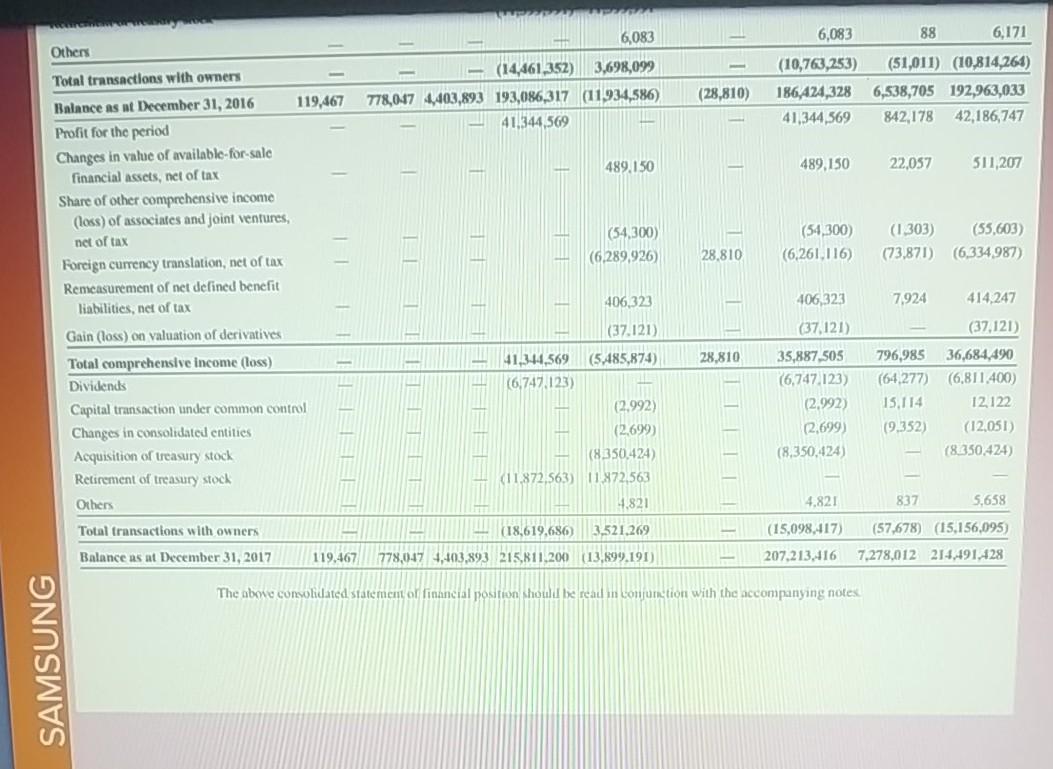

AA 06-3 Global Analysis LO P3 Review Samsung's income statement in Appendix A for the year ending December 31 2017, and Identify its net income

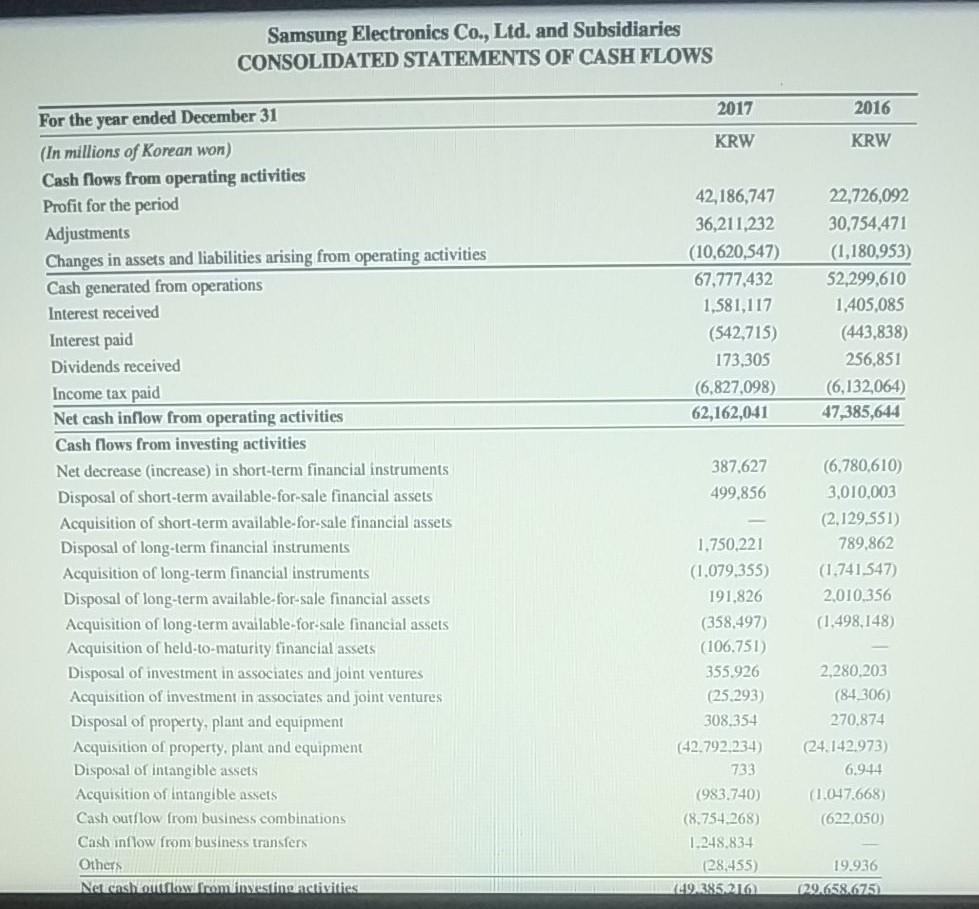

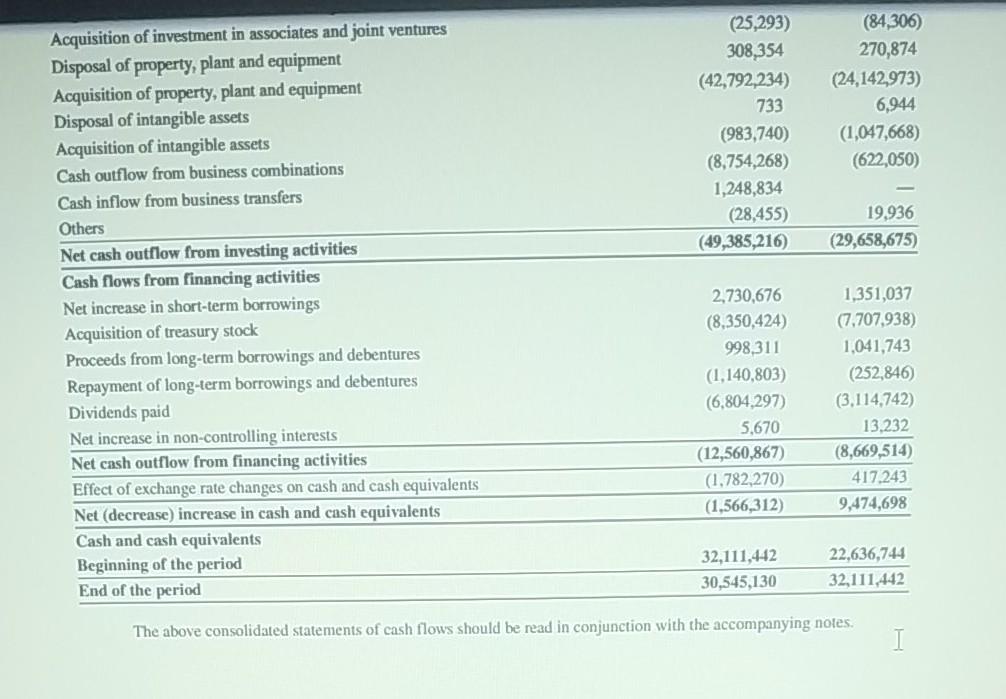

AA 06-3 Global Analysis LO P3 Review Samsung's income statement in Appendix A for the year ending December 31 2017, and Identify its net income for 2017 Required: 1. Review Samsung's balance sheet data in Appendix A as of December 31, 2017 and December 31, 2016. What amounts (in W millions) does Samsung report for inventory at each of these balance sheet dates? 2. Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported inventory cost at each of these two balance sheet dates Compute Samsung's 2017 net income under variable costing Hint Refer to Exhibit 1911 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Review Samsung's balance sheet data in Appendix A as of December 31, 2017, and December 31, 2016. What amounts (in W millions) does Samsung report for Inventory at each of these balance sheet dates? millions December 31 2017 December 31 2016 millions Review Samsung's income statement in Appendix A for the yed! Required: 1. Review Samsung's balance sheet data in Appendix A as of December 31, 2017, and December 31, 2016. What amounts (in W millions) does Samsung report for inventory at each of these balance sheet dates? 2 Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported inventory cost at each of these two balance sheet dates. Compute Samsung's 2017 net income under variable costing. Hint Refer to Exhibit 19.11 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported Inventory cost at each of these two balance sheet dates. Compute Samsung's net income under variable costing. Hint: Refer to Exhibit 19.11. (Round your answer to one decimal place.) Variable costing income Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) KRW KRW Assets Current assets 30,545,130 32,111,442 Cash and cash equivalents 49,447,696 52,432,411 Short-term financial instruments 3,191,375 3,638,460 Short-term available-for-sale financial assets 27,695,995 24,279,211 Trade receivables 4,108,961 3,521,197 Non-trade receivables Advance payments 1,753,673 1,439.938 3,835,219 3,502,083 Prepaid expenses Inventories 24,983,355 18,353,503 1,421,060 1,315,653 Other current assets Assets held-for-sale 835,806 Total current assets 146,982,464 141,429,704 Non-current assets Long-term available-for-sale financial assets 7,752,180 6,804,276 Held-to-maturity financial assets 106,751 Investment in associates and joint ventures 6,802.351 5.837,884 Property, plant and equipment 111,665,648 91.473,041 Intangible assets 14,760,483 5,344,020 Long-term prepaid expenses 3,434,375 3,834,831 Net defined benefit assets 825.892 557,091 Deferred income tax assets 5.061.687 5.321.450 Other non-current assets. 4.360,259 1.572,027 Total assets 301,752,090 262,174,324 Liabilities and Equity Current liabilities Trade payables 9,083.907 6,485.039 Short-term borrowings 15,767.619 12,746,789 Other payables 13,899,633 11.525.910 Advances received 1.249.174 1.358,878 Withholdings 793,582 685.028 Accrued expenses 13.996.273 12.527.300 Income tax payable 7.408,348 2,837.353 Current portion of long-term liabilities 278,619 1.232.817 Provisions 4294.820 4.597.417 Other current liabilities 403,239 351.176 1,249,174 1,358,878 Advances received 793,582 685,028 Withholdings Accrued expenses 13.996.273 12,527,300 Income tax payable 7,408,348 2,837,353 278,619 1,232,817 Current portion of long-term liabilities Provisions 4,294,820 4.597,417 Other current liabilities 403,139 351,176 Liabilities held-for-sale 356,388 Total current liabilities 67,175,114 54,704,095 Non-current liabilities Debentures 953.361 58,542 Long-term borrowings 1.814.446 1,244,238 Long-term other payables 2,043,729 3,317,054 Net defined benefit liabilities 389.922 173,656 Deferred income tax liabilities 11.710,781 7,293,514 Provisions 464.324 358,126 Other non-current liabilities 2,708,985 2,062,066 Total liabilities 87,260,662 69,211,291 Equity attributable to owners of the parent Preference shares 119.467 119.467 Ordinary shares 778,047 778,047 Share premium 4.403,893 4.403,893 Retnined earnings 215,811,200 193,086,317 Other components of equity (13,899.191) (11.934,586) Accumulated other comprehensive income attributable to assets held for sale (28,810) 207,213,416 186,424,328 Non-controlling interests 7.278,012 6,538,705 Total equity 214,491,428 192,963,033 Total liabilities and equity 301,752,090 262,174,324 The above consolidated statement of financial position should be red in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS 2017 2016 For the year ended December 31 (In millions of Korean won) Revenue Cost of sales Gross profit Selling and administrative expenses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures Financial income Financial expense Profit before income tax Income tax expense Profit for the period KRW 239,575,376 129,290,661 110,284,715 56,639,677 53,645,038 3,010,657 1,419.648 201,442 9,737,391 8,978,913 56,195,967 14.009.220 42,186,747 KRW 201,866,745 120,277,715 81,589,030 52,348,358 29,240,672 3,238,261 2,463,814 19,501 11,385,645 10,706,613 30,713,652 7,987.560 22,726,092 Profit attributable to owners of the parent Profit attributable to non-controlling interests 41.344.569 842,178 22.415.655 310,437 Earnings per share -Basic Diluted 299,868 299.868 157.967 157.967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 2017 2016 KRW 42,186,747 KRW 22,726,092 414,247 (6,347) 963,602 50,438 For the year ended December 31 (In millions of Korean won) Profit for the period Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period Comprehensive income attributable to: Owners of the parent Non-controlling interests (23,839) (130.337) 1,131,536 511,207 (49,256) (6,334,987) (37.121) (5,502,257) 36,684,490 1,991,400 24,717,492 35.887.505 796,985 24,310,814 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Accumulated other comprehensive income Equity attributable to attributable sets bed- to owners for sale of the parent 23,797 172,876,767 22,415,655 Non controlling interests Total 6,183,038 179,059,805 310.437 22,726,092 (23,797) (111.503) 87,664 (23,839) 212 35 (79.934) 1.160.316 (79.899) 1.131.536 (28,780) Other Preference Ordinary Share Retained Components In millions of Korean won shares shares premium enrnings of equity Balance as at January 1, 2016 119,467 778,047 4,403,893 185,132,014 (17,580,451) Profit for the period 22,415,655 Changes in value of available-for-sale financial assets, net of tax (87.706) Share of other comprehensive income (loss) of associates and joint ventures Det of tax (80.146) Foreign currency translation, net of tax 1.160.316 Remeasurement of net defined benefit liabilities, net of tax 926,280 Classified as held-for-sale 29,022 Total comprehensive Income (loss) 22,415,655 1,947,766 Dividends (3.061.361) Capital transaction under common control (37) Changes in consolidated entities Acquisition of treasury stock 17.707938) Retirement of treasury stock (11.399.991) 11.399.991 Others 926,280 37,322 963,602 (29.022) (52,607) 24,310,814 (3,061 361 (37) 406,678 (65.161) 12.272 1.790 24,717,492 (3,126 522) 12235 1.790 (7.707.938) 17.707.938 6.08 6,083 88 6,171 (14.461.352) 3.698,099 778,047 4.403.893 193,086,317 (11934,586) 111344.569 (28.810) (10,763,253) 186,424,328 41.344.569 (51,011) (10,814.264) 6,538.705 192,963,033 842.178 +2.186.747 Total transactions with owners Balance as at December 31, 2016 119.467 Profit for the period Changes in value of available for sale financial assets, net of tax Share of other comprehensive income class of associates and joint ventures 489 150 489.150 22.057 51207 6,083 88 6,171 Others 6,083 (14,461,352) 3,698,099 778,047 4,403,893 193,086,317 (11934,586) 41.344,569 (28,810) (10,763,253) 186,424,328 41,344,569 (51,011) (10,814,264) 6,538,705 192,963,033 842,178 42,186,747 489,150 489,150 22.057 511,207 (54,300) 6,289,926) (54,300) (6,261,116) (1303) (55,603) (73,871) (6.334 987) 28,810 Total transactions with owners Balance as at December 31, 2016 119,467 Profit for the period Changes in value of available for sale financial assets, net of tax Share of other comprehensive incomo (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Remeasurement of net defined benefit liabilities, net of tax Gain (loss) on valuation of derivatives Total comprehensive income (loss) Dividends Capital transaction under common control Changes in consolidated entities Acquisition of treasury stock Retirement of treasury stock Others 406,322 406,323 7,924 414,247 (37.121) (37,121) 28,810 41,3-44,569 (5.485,874) (6,747,123) (2.992) (2.699) (8.350,424) (11.872,563) 11872,563 (37,121) 35,887.505 (6,747. 123) (2,992) (2,699) (8.350,424) 796,985 36,684,490 (64.277) (6.811.400) 15.114 12122 (9,352) (12.051) (8.250,424) 4.821 4.821 837 5,658 Total transactions with owners (18,619.686) 3,521,269 (15,098,417) (57,678) (15,156,095) Balance as at December 31, 2017 119,467 778,047 4,403,893 215,811,200 (13,899.191) 207.213.416 7.278.012 21:4491.228 The above consolidated statement of financial position should be read in conjunction with the accompanying notes SAMSUNG Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS 2017 2016 KRW KRW 42,186,747 36,211,232 (10,620,547) 67,777,432 1.581,117 (542,715) 173,305 (6,827,098) 62,162,041 22,726,092 30,754,471 (1.180,953) 52,299,610 1,405,085 (443,838) 256,851 (6,132,064) 47,385,644 387,627 499,856 For the year ended December 31 (In millions of Korean won) Cash flows from operating activities Profit for the period Adjustments Changes in assets and liabilities arising from operating activities Cash generated from operations Interest received Interest paid Dividends received Income tax paid Net cash inflow from operating activities Cash flows from investing activities Net decrease (increase) in short-term financial instruments Disposal of short-term available-for-sale financial assets Acquisition of short-term available for sale financial assets Disposal of long-term financial instruments Acquisition of long-term financial instruments Disposal of long-term available-for-sale financial assets Acquisition of long-term available-for-sale financial assets Acquisition of held-to-maturity financial assets Disposal of investment in associates and joint ventures Acquisition of investment in associates and joint ventures Disposal of property, plant and equipment Acquisition of property, plant and equipment Disposal of intangible assets Acquisition of Intangible assets Cash outflow from business combinations Cash inflow from business transfers Others Net onshollow inom investing divities (6,780,610) 3,010,003 (2,129.551) 789,862 (1.741.547) 2.010.356 (1.498,148) 1.750,221 (1.079,355) 191,826 (358,497) (106.751) 355.926 (25.293 308.354 42.792 234) 733 (983,740) (8,754.268) 1.248.834 28,455) (49,385216 2.280.203 (84,306) 270.874 (24.142.973) 6.944 (1.047.668) (622.050) 19.936 129.658.6753 (25,293) 308,354 (42,792,234) 733 (983,740) (8,754,268) 1,248,834 (28,455) (49,385,216) (84,306) 270,874 (24,142,973) 6,944 (1,047,668) (622,050) 19.936 (29,658,675) Acquisition of investment in associates and joint ventures Disposal of property, plant and equipment Acquisition of property, plant and equipment Disposal of intangible assets Acquisition of intangible assets Cash outflow from business combinations Cash inflow from business transfers Others Net cash outflow from investing activities Cash flows from financing activities Net increase in short-term borrowings Acquisition of treasury stock Proceeds from long-term borrowings and debentures Repayment of long-term borrowings and debentures Dividends paid Net increase in non-controlling interests Net cash out from financing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents Beginning of the period End of the period 2,730,676 (8,350,424) 998,311 (1.140,803) (6,804,297) 5,670 (12,560,867) (1,782,270) (1,566,312) 1,351,037 (7,707,938) 1,041,743 (252,846) (3,114,742) 13,232 (8,669,514) 417.243 9,474,698 32,111,442 30,545,130 22.636,744 32,111,442 The above consolidated statements of cash flows should be read in conjunction with the accompanying notes. I AA 06-3 Global Analysis LO P3 Review Samsung's income statement in Appendix A for the year ending December 31 2017, and Identify its net income for 2017 Required: 1. Review Samsung's balance sheet data in Appendix A as of December 31, 2017 and December 31, 2016. What amounts (in W millions) does Samsung report for inventory at each of these balance sheet dates? 2. Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported inventory cost at each of these two balance sheet dates Compute Samsung's 2017 net income under variable costing Hint Refer to Exhibit 1911 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Review Samsung's balance sheet data in Appendix A as of December 31, 2017, and December 31, 2016. What amounts (in W millions) does Samsung report for Inventory at each of these balance sheet dates? millions December 31 2017 December 31 2016 millions Review Samsung's income statement in Appendix A for the yed! Required: 1. Review Samsung's balance sheet data in Appendix A as of December 31, 2017, and December 31, 2016. What amounts (in W millions) does Samsung report for inventory at each of these balance sheet dates? 2 Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported inventory cost at each of these two balance sheet dates. Compute Samsung's 2017 net income under variable costing. Hint Refer to Exhibit 19.11 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume Samsung uses absorption costing for financial reporting and its fixed overhead costs equal 10% of the total reported Inventory cost at each of these two balance sheet dates. Compute Samsung's net income under variable costing. Hint: Refer to Exhibit 19.11. (Round your answer to one decimal place.) Variable costing income Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) KRW KRW Assets Current assets 30,545,130 32,111,442 Cash and cash equivalents 49,447,696 52,432,411 Short-term financial instruments 3,191,375 3,638,460 Short-term available-for-sale financial assets 27,695,995 24,279,211 Trade receivables 4,108,961 3,521,197 Non-trade receivables Advance payments 1,753,673 1,439.938 3,835,219 3,502,083 Prepaid expenses Inventories 24,983,355 18,353,503 1,421,060 1,315,653 Other current assets Assets held-for-sale 835,806 Total current assets 146,982,464 141,429,704 Non-current assets Long-term available-for-sale financial assets 7,752,180 6,804,276 Held-to-maturity financial assets 106,751 Investment in associates and joint ventures 6,802.351 5.837,884 Property, plant and equipment 111,665,648 91.473,041 Intangible assets 14,760,483 5,344,020 Long-term prepaid expenses 3,434,375 3,834,831 Net defined benefit assets 825.892 557,091 Deferred income tax assets 5.061.687 5.321.450 Other non-current assets. 4.360,259 1.572,027 Total assets 301,752,090 262,174,324 Liabilities and Equity Current liabilities Trade payables 9,083.907 6,485.039 Short-term borrowings 15,767.619 12,746,789 Other payables 13,899,633 11.525.910 Advances received 1.249.174 1.358,878 Withholdings 793,582 685.028 Accrued expenses 13.996.273 12.527.300 Income tax payable 7.408,348 2,837.353 Current portion of long-term liabilities 278,619 1.232.817 Provisions 4294.820 4.597.417 Other current liabilities 403,239 351.176 1,249,174 1,358,878 Advances received 793,582 685,028 Withholdings Accrued expenses 13.996.273 12,527,300 Income tax payable 7,408,348 2,837,353 278,619 1,232,817 Current portion of long-term liabilities Provisions 4,294,820 4.597,417 Other current liabilities 403,139 351,176 Liabilities held-for-sale 356,388 Total current liabilities 67,175,114 54,704,095 Non-current liabilities Debentures 953.361 58,542 Long-term borrowings 1.814.446 1,244,238 Long-term other payables 2,043,729 3,317,054 Net defined benefit liabilities 389.922 173,656 Deferred income tax liabilities 11.710,781 7,293,514 Provisions 464.324 358,126 Other non-current liabilities 2,708,985 2,062,066 Total liabilities 87,260,662 69,211,291 Equity attributable to owners of the parent Preference shares 119.467 119.467 Ordinary shares 778,047 778,047 Share premium 4.403,893 4.403,893 Retnined earnings 215,811,200 193,086,317 Other components of equity (13,899.191) (11.934,586) Accumulated other comprehensive income attributable to assets held for sale (28,810) 207,213,416 186,424,328 Non-controlling interests 7.278,012 6,538,705 Total equity 214,491,428 192,963,033 Total liabilities and equity 301,752,090 262,174,324 The above consolidated statement of financial position should be red in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS 2017 2016 For the year ended December 31 (In millions of Korean won) Revenue Cost of sales Gross profit Selling and administrative expenses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures Financial income Financial expense Profit before income tax Income tax expense Profit for the period KRW 239,575,376 129,290,661 110,284,715 56,639,677 53,645,038 3,010,657 1,419.648 201,442 9,737,391 8,978,913 56,195,967 14.009.220 42,186,747 KRW 201,866,745 120,277,715 81,589,030 52,348,358 29,240,672 3,238,261 2,463,814 19,501 11,385,645 10,706,613 30,713,652 7,987.560 22,726,092 Profit attributable to owners of the parent Profit attributable to non-controlling interests 41.344.569 842,178 22.415.655 310,437 Earnings per share -Basic Diluted 299,868 299.868 157.967 157.967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 2017 2016 KRW 42,186,747 KRW 22,726,092 414,247 (6,347) 963,602 50,438 For the year ended December 31 (In millions of Korean won) Profit for the period Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period Comprehensive income attributable to: Owners of the parent Non-controlling interests (23,839) (130.337) 1,131,536 511,207 (49,256) (6,334,987) (37.121) (5,502,257) 36,684,490 1,991,400 24,717,492 35.887.505 796,985 24,310,814 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Accumulated other comprehensive income Equity attributable to attributable sets bed- to owners for sale of the parent 23,797 172,876,767 22,415,655 Non controlling interests Total 6,183,038 179,059,805 310.437 22,726,092 (23,797) (111.503) 87,664 (23,839) 212 35 (79.934) 1.160.316 (79.899) 1.131.536 (28,780) Other Preference Ordinary Share Retained Components In millions of Korean won shares shares premium enrnings of equity Balance as at January 1, 2016 119,467 778,047 4,403,893 185,132,014 (17,580,451) Profit for the period 22,415,655 Changes in value of available-for-sale financial assets, net of tax (87.706) Share of other comprehensive income (loss) of associates and joint ventures Det of tax (80.146) Foreign currency translation, net of tax 1.160.316 Remeasurement of net defined benefit liabilities, net of tax 926,280 Classified as held-for-sale 29,022 Total comprehensive Income (loss) 22,415,655 1,947,766 Dividends (3.061.361) Capital transaction under common control (37) Changes in consolidated entities Acquisition of treasury stock 17.707938) Retirement of treasury stock (11.399.991) 11.399.991 Others 926,280 37,322 963,602 (29.022) (52,607) 24,310,814 (3,061 361 (37) 406,678 (65.161) 12.272 1.790 24,717,492 (3,126 522) 12235 1.790 (7.707.938) 17.707.938 6.08 6,083 88 6,171 (14.461.352) 3.698,099 778,047 4.403.893 193,086,317 (11934,586) 111344.569 (28.810) (10,763,253) 186,424,328 41.344.569 (51,011) (10,814.264) 6,538.705 192,963,033 842.178 +2.186.747 Total transactions with owners Balance as at December 31, 2016 119.467 Profit for the period Changes in value of available for sale financial assets, net of tax Share of other comprehensive income class of associates and joint ventures 489 150 489.150 22.057 51207 6,083 88 6,171 Others 6,083 (14,461,352) 3,698,099 778,047 4,403,893 193,086,317 (11934,586) 41.344,569 (28,810) (10,763,253) 186,424,328 41,344,569 (51,011) (10,814,264) 6,538,705 192,963,033 842,178 42,186,747 489,150 489,150 22.057 511,207 (54,300) 6,289,926) (54,300) (6,261,116) (1303) (55,603) (73,871) (6.334 987) 28,810 Total transactions with owners Balance as at December 31, 2016 119,467 Profit for the period Changes in value of available for sale financial assets, net of tax Share of other comprehensive incomo (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Remeasurement of net defined benefit liabilities, net of tax Gain (loss) on valuation of derivatives Total comprehensive income (loss) Dividends Capital transaction under common control Changes in consolidated entities Acquisition of treasury stock Retirement of treasury stock Others 406,322 406,323 7,924 414,247 (37.121) (37,121) 28,810 41,3-44,569 (5.485,874) (6,747,123) (2.992) (2.699) (8.350,424) (11.872,563) 11872,563 (37,121) 35,887.505 (6,747. 123) (2,992) (2,699) (8.350,424) 796,985 36,684,490 (64.277) (6.811.400) 15.114 12122 (9,352) (12.051) (8.250,424) 4.821 4.821 837 5,658 Total transactions with owners (18,619.686) 3,521,269 (15,098,417) (57,678) (15,156,095) Balance as at December 31, 2017 119,467 778,047 4,403,893 215,811,200 (13,899.191) 207.213.416 7.278.012 21:4491.228 The above consolidated statement of financial position should be read in conjunction with the accompanying notes SAMSUNG Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS 2017 2016 KRW KRW 42,186,747 36,211,232 (10,620,547) 67,777,432 1.581,117 (542,715) 173,305 (6,827,098) 62,162,041 22,726,092 30,754,471 (1.180,953) 52,299,610 1,405,085 (443,838) 256,851 (6,132,064) 47,385,644 387,627 499,856 For the year ended December 31 (In millions of Korean won) Cash flows from operating activities Profit for the period Adjustments Changes in assets and liabilities arising from operating activities Cash generated from operations Interest received Interest paid Dividends received Income tax paid Net cash inflow from operating activities Cash flows from investing activities Net decrease (increase) in short-term financial instruments Disposal of short-term available-for-sale financial assets Acquisition of short-term available for sale financial assets Disposal of long-term financial instruments Acquisition of long-term financial instruments Disposal of long-term available-for-sale financial assets Acquisition of long-term available-for-sale financial assets Acquisition of held-to-maturity financial assets Disposal of investment in associates and joint ventures Acquisition of investment in associates and joint ventures Disposal of property, plant and equipment Acquisition of property, plant and equipment Disposal of intangible assets Acquisition of Intangible assets Cash outflow from business combinations Cash inflow from business transfers Others Net onshollow inom investing divities (6,780,610) 3,010,003 (2,129.551) 789,862 (1.741.547) 2.010.356 (1.498,148) 1.750,221 (1.079,355) 191,826 (358,497) (106.751) 355.926 (25.293 308.354 42.792 234) 733 (983,740) (8,754.268) 1.248.834 28,455) (49,385216 2.280.203 (84,306) 270.874 (24.142.973) 6.944 (1.047.668) (622.050) 19.936 129.658.6753 (25,293) 308,354 (42,792,234) 733 (983,740) (8,754,268) 1,248,834 (28,455) (49,385,216) (84,306) 270,874 (24,142,973) 6,944 (1,047,668) (622,050) 19.936 (29,658,675) Acquisition of investment in associates and joint ventures Disposal of property, plant and equipment Acquisition of property, plant and equipment Disposal of intangible assets Acquisition of intangible assets Cash outflow from business combinations Cash inflow from business transfers Others Net cash outflow from investing activities Cash flows from financing activities Net increase in short-term borrowings Acquisition of treasury stock Proceeds from long-term borrowings and debentures Repayment of long-term borrowings and debentures Dividends paid Net increase in non-controlling interests Net cash out from financing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents Beginning of the period End of the period 2,730,676 (8,350,424) 998,311 (1.140,803) (6,804,297) 5,670 (12,560,867) (1,782,270) (1,566,312) 1,351,037 (7,707,938) 1,041,743 (252,846) (3,114,742) 13,232 (8,669,514) 417.243 9,474,698 32,111,442 30,545,130 22.636,744 32,111,442 The above consolidated statements of cash flows should be read in conjunction with the accompanying notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started