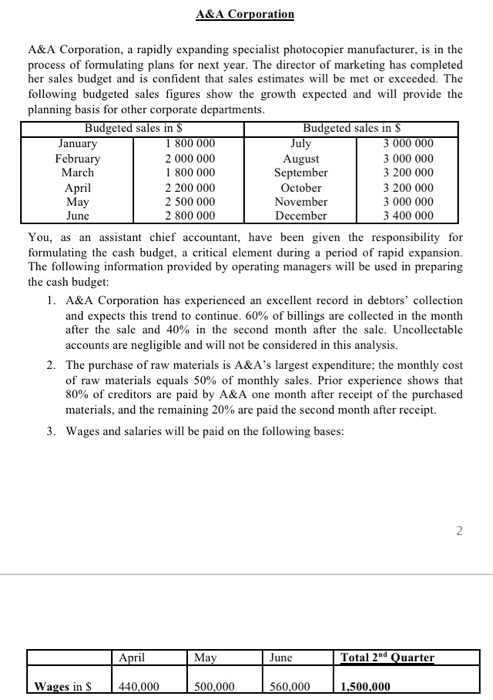

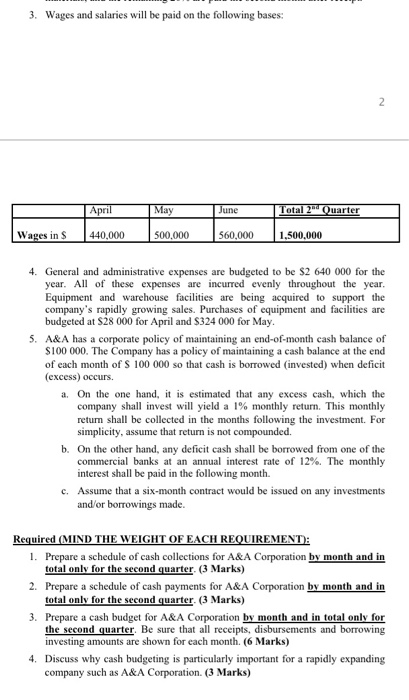

A&A Corporation A&A Corporation, a rapidly expanding specialist photocopier manufacturer, is in the process of formulating plans for next year. The director of marketing has completed her sales budget and is confident that sales estimates will be met or exceeded. The following budgeted sales figures show the growth expected and will provide the planning basis for other corporate departments. Budgeted sales in S Budgeted sales in S January 1 800 000 July 3 000 000 February 2 000 000 August 3 000 000 March 1 800 000 September 3 200 000 April 2 200 000 October 3 200 000 May 2 500 000 November 3 000 000 June 2 800 000 December 3 400 000 You, as an assistant chief accountant, have been given the responsibility for formulating the cash budget, a critical element during a period of rapid expansion The following information provided by operating managers will be used in preparing the cash budget 1. A&A Corporation has experienced an excellent record in debtors' collection and expects this trend to continue. 60% of billings are collected in the month after the sale and 40% in the second month after the sale. Uncollectable accounts are negligible and will not be considered in this analysis. 2. The purchase of raw materials is A&A's largest expenditure; the monthly cost of raw materials equals 50% of monthly sales. Prior experience shows that 80% of creditors are paid by A&A one month after receipt of the purchased materials, and the remaining 20% are paid the second month after receipt. 3. Wages and salaries will be paid on the following bases: April May June Total 2 Quarter Wages in S 440.000 500.000 560.000 1,500,000 3. Wages and salaries will be paid on the following bases: April May June Total 2 Quarter Wages in s | 440,000 500.000 560,000 1.500.000 4. General and administrative expenses are budgeted to be $2 640 000 for the year. All of these expenses are incurred evenly throughout the year, Equipment and warehouse facilities are being acquired to support the company's rapidly growing sales. Purchases of equipment and facilities are budgeted at S28 000 for April and $324 000 for May. 5. A&A has a corporate policy of maintaining an end-of-month cash balance of $100 000. The Company has a policy of maintaining a cash balance at the end of each month of S 100 000 so that cash is borrowed invested) when deficit (excess) occurs. a. On the one hand, it is estimated that any excess cash, which the company shall invest will yield a 1% monthly return. This monthly return shall be collected in the months following the investment. For simplicity, assume that return is not compounded. b. On the other hand, any deficit cash shall be borrowed from one of the commercial banks at an annual interest rate of 12%. The monthly interest shall be paid in the following month. c. Assume that a six-month contract would be issued on any investments and/or borrowings made. Required (MIND THE WEIGHT OF EACH REQUIREMENT: 1. Prepare a schedule of cash collections for A&A Corporation by month and in total only for the second quarter. (3 Marks) 2. Prepare a schedule of cash payments for A&A Corporation by month and in total only for the second quarter. (3 Marks) 3. Prepare a cash budget for A&A Corporation by month and in total only for the second quarter. Be sure that all receipts, disbursements and borrowing investing amounts are shown for cach month. (6 Marks) 4. Discuss why cash budgeting is particularly important for a rapidly expanding company such as A&A Corporation