Answered step by step

Verified Expert Solution

Question

1 Approved Answer

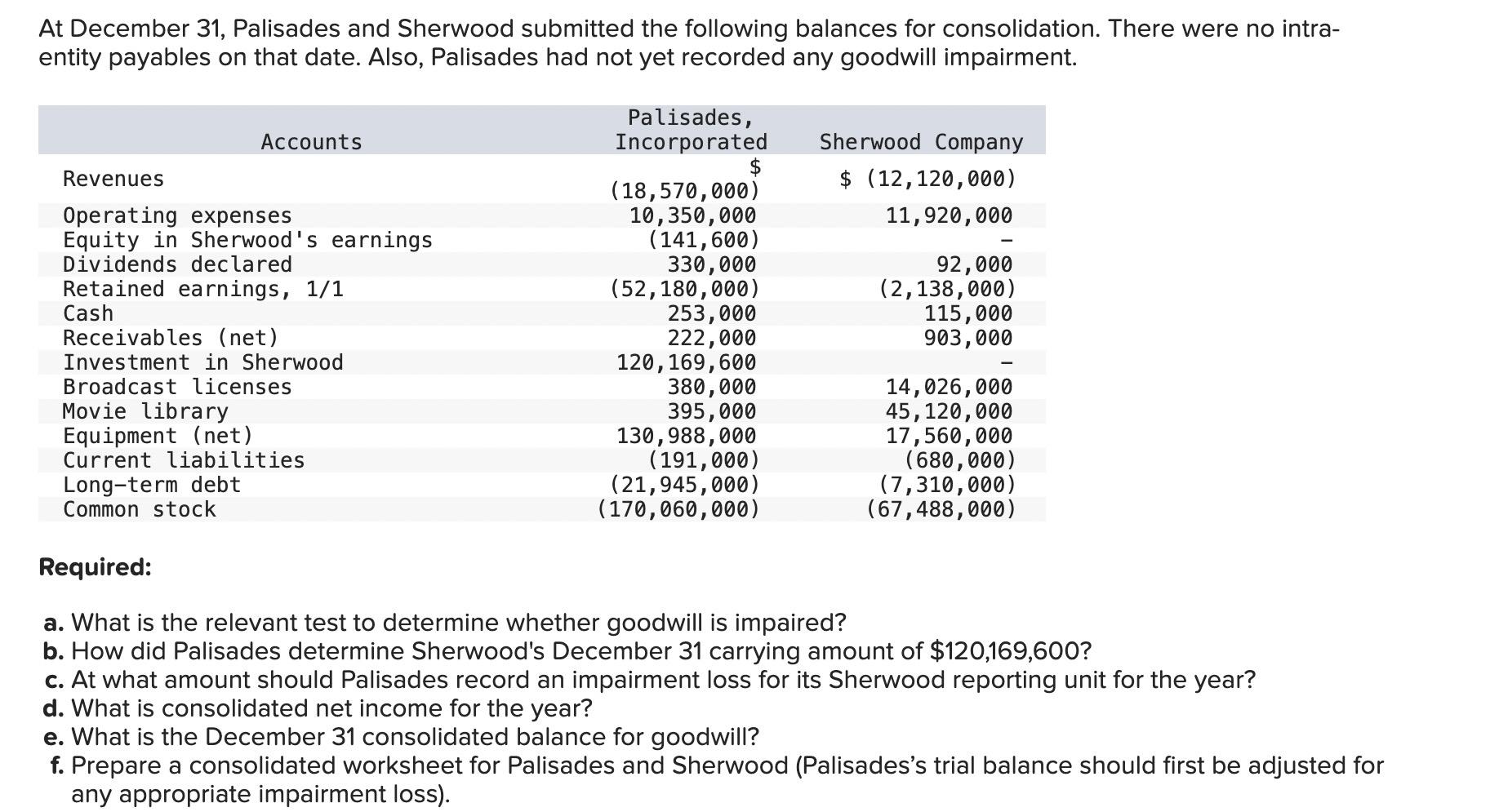

At December 31, Palisades and Sherwood submitted the following balances for consolidation. There were no intra- entity payables on that date. Also, Palisades had

At December 31, Palisades and Sherwood submitted the following balances for consolidation. There were no intra- entity payables on that date. Also, Palisades had not yet recorded any goodwill impairment. Cash Accounts Palisades, Incorporated Sherwood Company $ Revenues $ (12,120,000) (18,570,000) Operating expenses 10,350,000 11,920,000 Equity in Sherwood's earnings (141,600) Dividends declared 330,000 92,000 Retained earnings, 1/1 (52,180,000) (2,138,000) 253,000 115,000 222,000 903,000 120,169,600 380,000 14,026,000 395,000 45,120,000 130,988,000 17,560,000 (191,000) (21,945,000) (170,060,000) (680,000) (7,310,000) (67,488,000) Receivables (net) Investment in Sherwood Broadcast licenses Movie library Equipment (net) Current liabilities Long-term debt Common stock Required: a. What is the relevant test to determine whether goodwill is impaired? b. How did Palisades determine Sherwood's December 31 carrying amount of $120,169,600? c. At what amount should Palisades record an impairment loss for its Sherwood reporting unit for the year? d. What is consolidated net income for the year? e. What is the December 31 consolidated balance for goodwill? f. Prepare a consolidated worksheet for Palisades and Sherwood (Palisades's trial balance should first be adjusted for any appropriate impairment loss).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a consolidated worksheet for Palisades and Sherwood we need to adjust the trial balances ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started