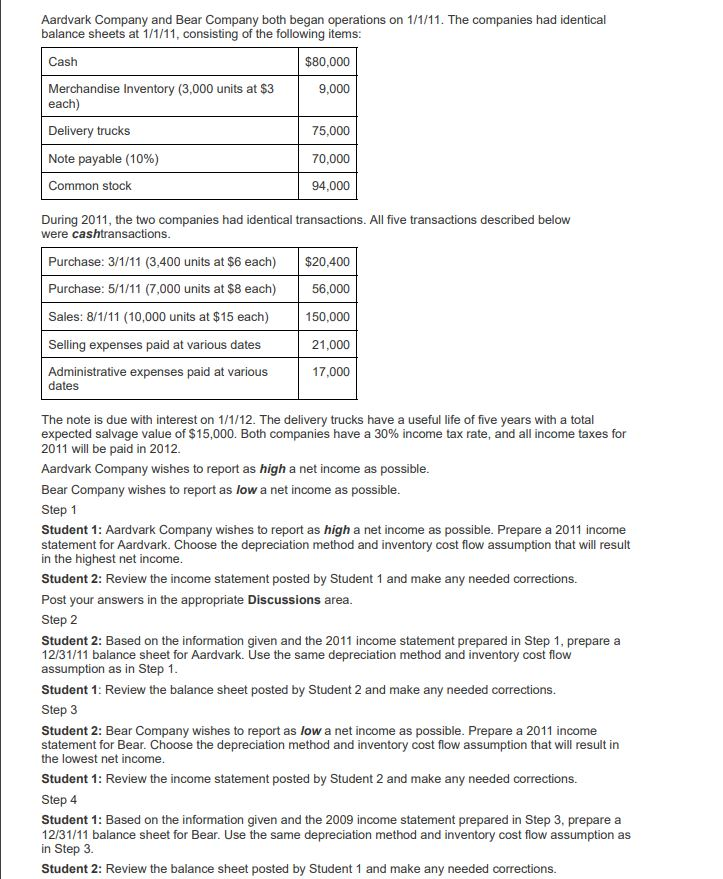

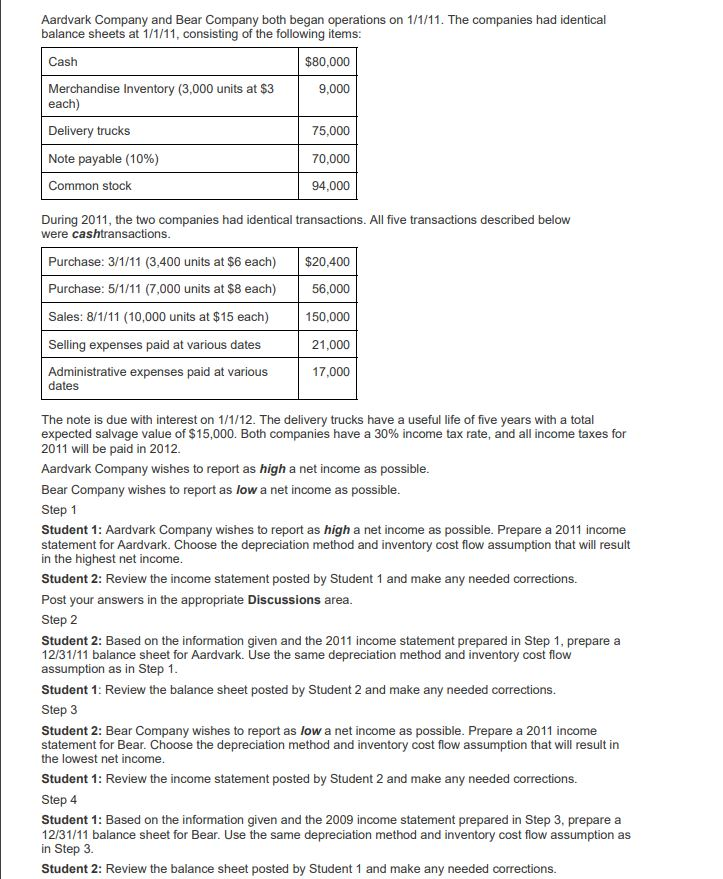

Aardvark Company and Bear Company both began operations on 1/1/11. The companies had identical balance sheets at 1/1/11, consisting of the following items Cash $80,000 Merchandise Inventory (3,000 units at $3 9,000 each Delivery trucks Note payable (10%) Common stock 75,000 70,000 94,000 During 2011, the two companies had identical transactions. All five transactions described below were cashtransactions Purchase: 3/1/11 (3,400 units at $6 each) $20,400 Purchase: 5/1/11 (7,000 units at $8 each) 56,000 Sales: 8/1/11 (10,000 units at $15 each) Selling expenses paid at various dates Administrative expenses paid at various 150,000 21,000 17,000 dates The note is due with interest on 1/1/12. The delivery trucks have a useful life of five y expected salvage value of $15,000. Both companies have a 30% income tax rate, and all income taxes for 2011 will be paid in 2012. ears with a total Aardvark Company wishes to report as high a net income as possible Bear Company wishes to report as low a net income as possible Step 1 Student 1: Aardvark Company wishes to report as high a net income as possible. Prepare a 2011 income statement for Aardvark. Choose the depreciation method and inventory cost flow assumption that will result in the highest net income Student 2: Review the income statement posted by Student 1 and make any needed corrections. Post your answers in the appropriate Discussions area Step 2 Student 2: Based on the information given and the 2011 income statement prepared in Step 1, prepare a 12/31/11 balance sheet for Aardvark. Use the same depreciation method and inventory cost flow assumption as in Step 1 Student 1: Review the balance sheet posted by Student 2 and make any needed corrections. Step 3 Student 2: Bear Company wishes to report as low a net income as possible. Prepare a 2011 income statement for Bear. Choose the depreciation method and inventory cost flow assumption that will result in the lowest net income Student 1: Review the income statement posted by Student 2 and make any needed corrections. Step 4 Student 1: Based on the information given and the 2009 income statement prepared in Step 3, prepare a 12/31/11 balance sheet for Bear. Use the same depreciation method and inventory cost flow assumption as in Step 3. Student 2: Review the balance sheet posted by Student 1 and make any needed corrections