Question

Aaron has received a proposal from a stockbroker to invest AUD10,000 in a listed company called Tiger Eyes Limited (Tiger). The stockbroker holds a strong

Aaron has received a proposal from a stockbroker to invest AUD10,000 in a listed company called Tiger Eyes Limited (Tiger). The stockbroker holds a strong positive view on the future prospects of Tiger. Aaron would fund the investment using some of the cash in the bank.

Tiger has two listed securities:

Corporate bonds 6 years remaining term, 5% coupon (semi annual), face value AUD1000, market price AUD975 per bond. The yield on similar bonds is 4%.

Ordinary shares Projected earnings per share AUD8.25, market price AUD92.50 per share. The projected Price Earnings ratio for shares in similar companies is 10.0.

Aaron is a value driven long term investor. If an investment is made he will hold the position for at least 5 years. But he is cautious and is aware that the positive view of the stockbroker is just an opinion and the future is uncertain.

Aaron is comfortable in declining the proposal and not making an investment. He is also comfortable in making a small or large investment in bonds and/or shares. It all depends upon value and price.

Aaron has asked you to review this proposal and to prepare a recommendation. You MUST include reasons for your recommendation.

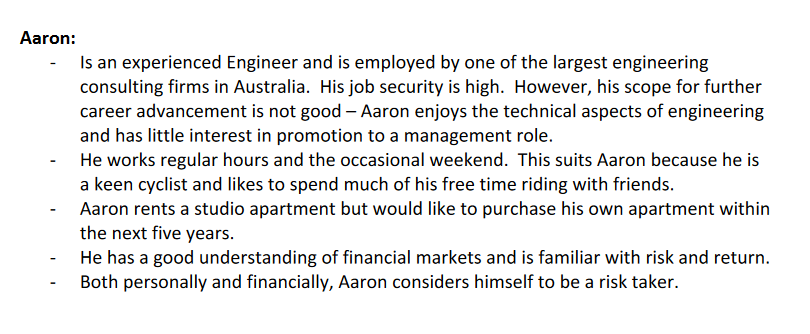

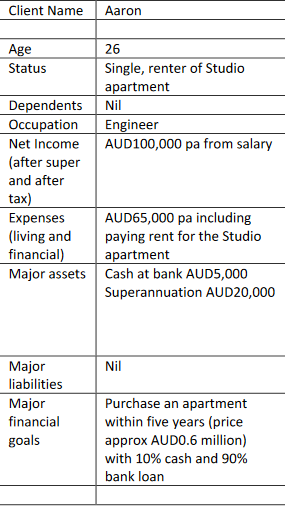

Aaron: Is an experienced Engineer and is employed by one of the largest engineering consulting firms in Australia. His job security is high. However, his scope for further career advancement is not good - Aaron enjoys the technical aspects of engineering and has little interest in promotion to a management role. He works regular hours and the occasional weekend. This suits Aaron because he is a keen cyclist and likes to spend much of his free time riding with friends. Aaron rents a studio apartment but would like to purchase his own apartment within the next five years. He has a good understanding of financial markets and is familiar with risk and return. - Both personally and financially, Aaron considers himself to be a risk taker. Client Name Aaron Age Status 26 Single, renter of Studio apartment Nil Engineer AUD100,000 pa from salary Dependents Occupation Net Income (after super and after tax) Expenses (living and financial) Major assets AUD65,000 pa including paying rent for the Studio apartment Cash at bank AUD5,000 Superannuation AUD20,000 Nil Major liabilities Major financial goals Purchase an apartment within five years (price approx AUDO.6 million) with 10% cash and 90% bank loanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started