Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aarons Errands, Inc. employs a team of special couriers who deliver highly confidential documents to locations around the world. Payroll information for the payroll period

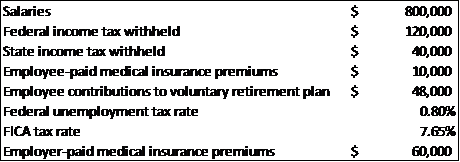

Aarons Errands, Inc. employs a team of special couriers who deliver highly confidential documents to locations around the world. Payroll information for the payroll period ending January 31 is shown below. None of the employees cumulative wages have exceeded the social security or Federal unemployment ceilings for the period in question. Federal unemployment is paid by the employer, not the employee.

- Show the calculation of the employees net pay (that is, the amount that will be credited to salaries payable).

- What is the total amount that the January 31 payroll will cost Aarons Errands, Inc., including total salaries and related expenses? Please show your calculation.

- Show the journal entries that Aarons Errands will use to record payroll on January 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started