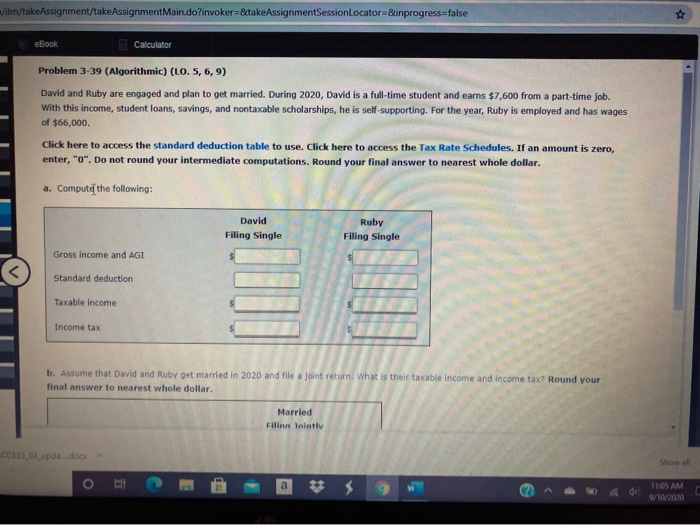

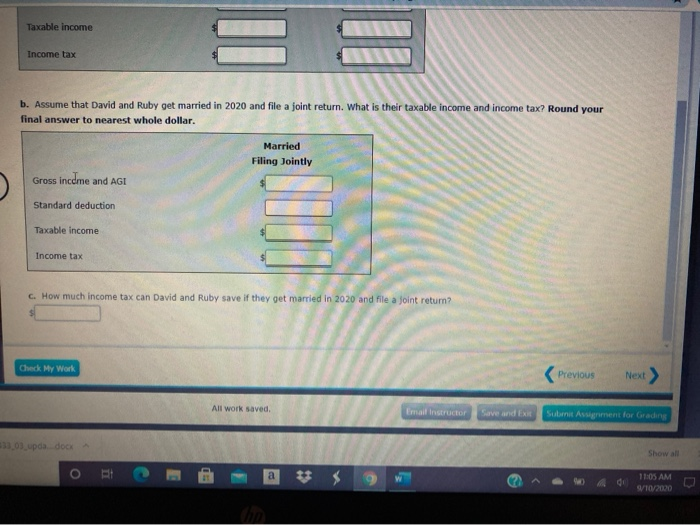

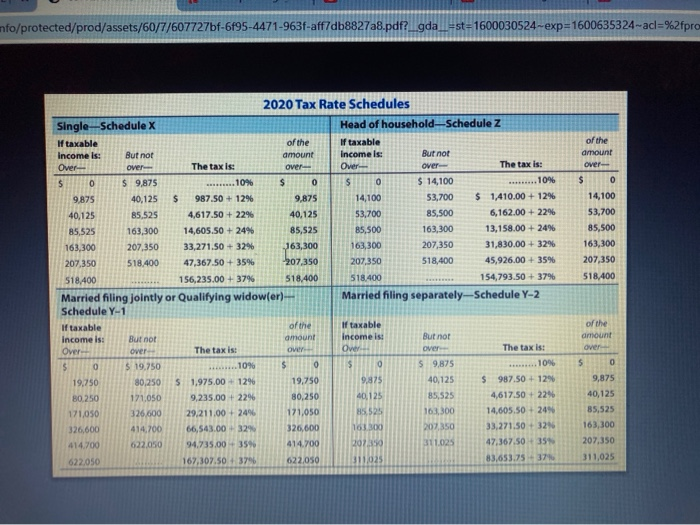

Vilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Calculator Problem 3-39 (Algorithmic) (LO. 5, 6,9) David and Ruby are engaged and plan to get married. During 2020, David is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Ruby is employed and has wages of $66,000 Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "o". Do not round your intermediate computations. Round your final answer to nearest whole dollar. a. Compute the following: David Filing Single Ruby Filing Single Gross income and AGI Standard deduction Taxable income Income tax b. Assume that David and Ruby get married in 2020 and file a joint retum. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing lointly CCM)01.pda.doc a 11:05 AM 9/10/2020 Taxable income Income tax b. Assume that David and Ruby get married in 2020 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing Jointly Gross income and AGI Standard deduction Taxable income Income tax C. How much income tax can David and Ruby save if they get married in 2020 and file a joint return? Check My Work Previous Next All work saved Email Instructor Save and Submit Assignment for Grading 133.03 upda doci Show all o a 11:05 AM 10/2000 enfo/protected/prod/assets/60/7/607727bf-695-4471-963f-aff7db8827a8.pdf?_gda_=st=1600030524 -exp=1600635324-acl=%2fpro ......10 of the amount over $ 0 14,100 53,700 85,500 163,300 207,350 518,400 2020 Tax Rate Schedules Single-Schedule X Head of household Schedule z If taxable of the If taxable Income is: But not amount Income is: But not Over- over The tax is: over Over over The tax is: $ 0 $ 9,875 .. 10% $ 0 $ 0 $ 14,100 9,875 40,125 $ 987.50 + 12% 9.875 14,100 53,700 $ 1,410,00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 +22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00+ 24% 163,300 207,350 33,271.50 + 32% 363,300 163,300 207,350 31,830.00+ 32% 207,350 518.400 47,367.50+ 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00+ 37% 518,400 518.400 154,793.50 +37% Married filing jointly or Qualifying widower) Married filing separately-Schedule Y-2 Schedule Y-1 If taxable of the If taxable Income is: But not amount Income is: But not Over over The tax is: Over over The tax is: $ 0 $ 19.750 $ 0 $ 0 $ 9,875 19,750 80,250 $ 1,975.00 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171.050 9,235.00 +2296 80,250 40,125 85,525 4,617.50 + 229 171,050 326600 29.211.00 + 24% 171.050 5,525 163,300 14,605.50 + 249 326,600 414.700 66,543.00 32% 326,600 10100 207 350 33,271.50 + 32 414.700 622.050 94.735.00 - 35% 414.700 2021 311025 47.367.50+ 35 622.050 167,307.50 +3796 622.050 311025 83,653.75 -37 over 10% ... 10% of the amount over 5 0 9,875 40,125 85,525 163,300 207,350 311,025 Vilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Calculator Problem 3-39 (Algorithmic) (LO. 5, 6,9) David and Ruby are engaged and plan to get married. During 2020, David is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Ruby is employed and has wages of $66,000 Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "o". Do not round your intermediate computations. Round your final answer to nearest whole dollar. a. Compute the following: David Filing Single Ruby Filing Single Gross income and AGI Standard deduction Taxable income Income tax b. Assume that David and Ruby get married in 2020 and file a joint retum. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing lointly CCM)01.pda.doc a 11:05 AM 9/10/2020 Taxable income Income tax b. Assume that David and Ruby get married in 2020 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing Jointly Gross income and AGI Standard deduction Taxable income Income tax C. How much income tax can David and Ruby save if they get married in 2020 and file a joint return? Check My Work Previous Next All work saved Email Instructor Save and Submit Assignment for Grading 133.03 upda doci Show all o a 11:05 AM 10/2000 enfo/protected/prod/assets/60/7/607727bf-695-4471-963f-aff7db8827a8.pdf?_gda_=st=1600030524 -exp=1600635324-acl=%2fpro ......10 of the amount over $ 0 14,100 53,700 85,500 163,300 207,350 518,400 2020 Tax Rate Schedules Single-Schedule X Head of household Schedule z If taxable of the If taxable Income is: But not amount Income is: But not Over- over The tax is: over Over over The tax is: $ 0 $ 9,875 .. 10% $ 0 $ 0 $ 14,100 9,875 40,125 $ 987.50 + 12% 9.875 14,100 53,700 $ 1,410,00 + 12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 +22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00+ 24% 163,300 207,350 33,271.50 + 32% 363,300 163,300 207,350 31,830.00+ 32% 207,350 518.400 47,367.50+ 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00+ 37% 518,400 518.400 154,793.50 +37% Married filing jointly or Qualifying widower) Married filing separately-Schedule Y-2 Schedule Y-1 If taxable of the If taxable Income is: But not amount Income is: But not Over over The tax is: Over over The tax is: $ 0 $ 19.750 $ 0 $ 0 $ 9,875 19,750 80,250 $ 1,975.00 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171.050 9,235.00 +2296 80,250 40,125 85,525 4,617.50 + 229 171,050 326600 29.211.00 + 24% 171.050 5,525 163,300 14,605.50 + 249 326,600 414.700 66,543.00 32% 326,600 10100 207 350 33,271.50 + 32 414.700 622.050 94.735.00 - 35% 414.700 2021 311025 47.367.50+ 35 622.050 167,307.50 +3796 622.050 311025 83,653.75 -37 over 10% ... 10% of the amount over 5 0 9,875 40,125 85,525 163,300 207,350 311,025