Question

Abbey Ltd produces and sells kitchen cupboards to its customers using a process costing system. The cupboards are processed through two production departments: assembly and

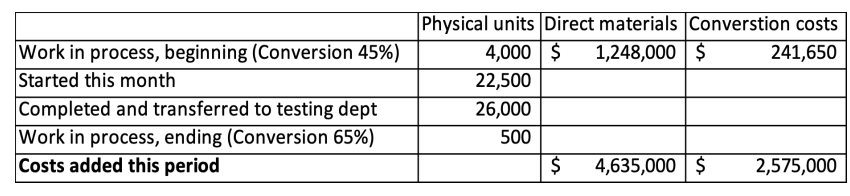

Abbey Ltd produces and sells kitchen cupboards to its customers using a process costing system. The cupboards are processed through two production departments: assembly and testing. The process costing system has single direct cost category (direct materials) and single conversion costs (labour and overhead costs). Direct materials are added at the beginning of the process, and the conversion costs are added evenly during the process. The management of Abbey Ltd is looking at the use of weighted average or first-in-first-out method of process costing. At this stage the management team wants to focus on the assembly department and, therefore, require you to prepare a Process cost report (in a tabular form) for October, of the Assembly department using a) Weighted average method (15%), b) FIFO method (15%) and c) give brief comments on which method is better than another (5%). Data for the assembly department for October are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started