Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abbot Equipment Repair has a September 30 year end. The company adjusts and closes its accounts on an annual basis. On August 31, 2021, the

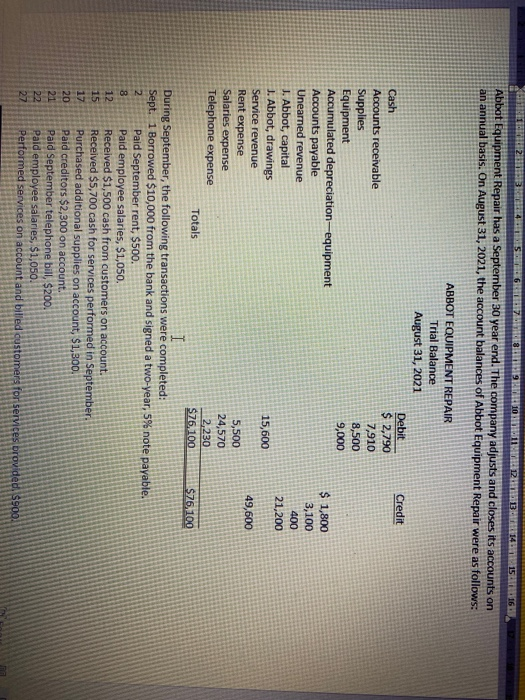

Abbot Equipment Repair has a September 30 year end. The company adjusts and closes its accounts on an annual basis. On August 31, 2021, the account balances of Abbot Equipment Repair were as follows:

ABBOT EQUIPMENT REPAIR

Trial Balance

August 31, 2021

Debit Credit

Cash $ 2,790

Accounts receivable 7,910

Supplies 8,500

Equipment 9,000

Accumulated depreciationequipment $ 1,800

Accounts payable 3,100

Unearned revenue 400

J. Abbot, capital 21,200

J. Abbot, drawings 15,600

Service revenue 49,600

Rent expense 5,500

Salaries expense 24,570

Telephone expense 2,230

Totals$76,100 $76,100

During September, the following transactions were completed:

Sept. 1 Borrowed $10,000 from the bank and signed a two-year, 5% note payable.

2 Paid September rent, $500.

8 Paid employee salaries, $1,050.

12 Received $1,500 cash from customers on account.

15 Received $5,700 cash for services performed in September.

17 Purchased additional supplies on account, $1,300.

20 Paid creditors $2,300 on account.

21 Paid September telephone bill, $200.

22 Paid employee salaries, $1,050.

27 Performed services on account and billed customers for services provided, $900.

29 Received $550 from customers for services to be provided in the future.

30 Paid J. Abbot $800 cash for personal use.

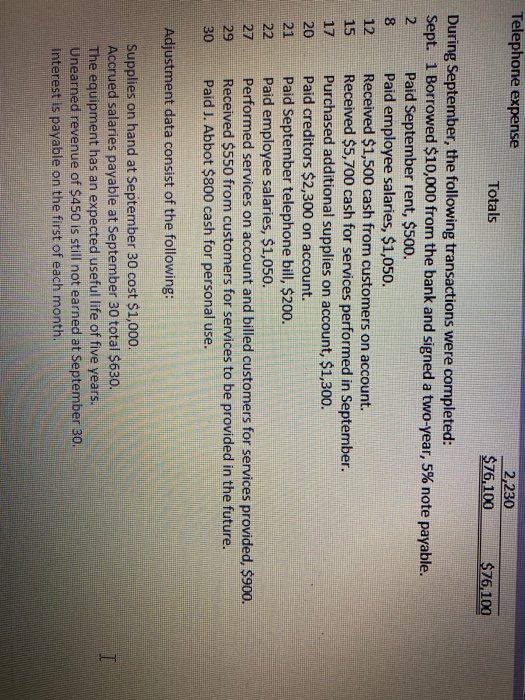

Adjustment data consist of the following:

Supplies on hand at September 30 cost $1,000.

Accrued salaries payable at September 30 total $630.

The equipment has an expected useful life of five years.

Unearned revenue of $450 is still not earned at September 30.

Interest is payable on the first of each month.

Instructions

a. Prepare T accounts and enter the August 31 balances.

b. Journalize the September transactions.

c. Post to T accounts.

d. Prepare a trial balance at September 30.

e. Journalize and post adjusting entries.

f. Prepare an adjusted trial balance at September 30.

g. Prepare an income statement and a statement of owner's equity, and a classified balance sheet.

h. Prepare and post-closing entries.

i. Prepare post-closing trial balance at September 30.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started