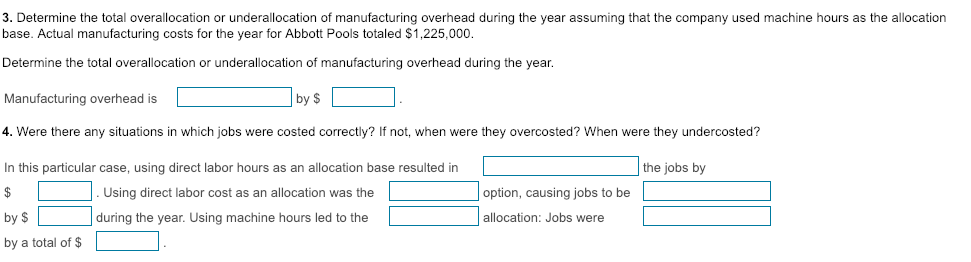

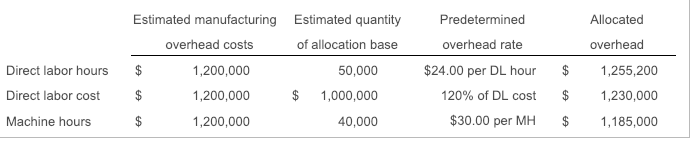

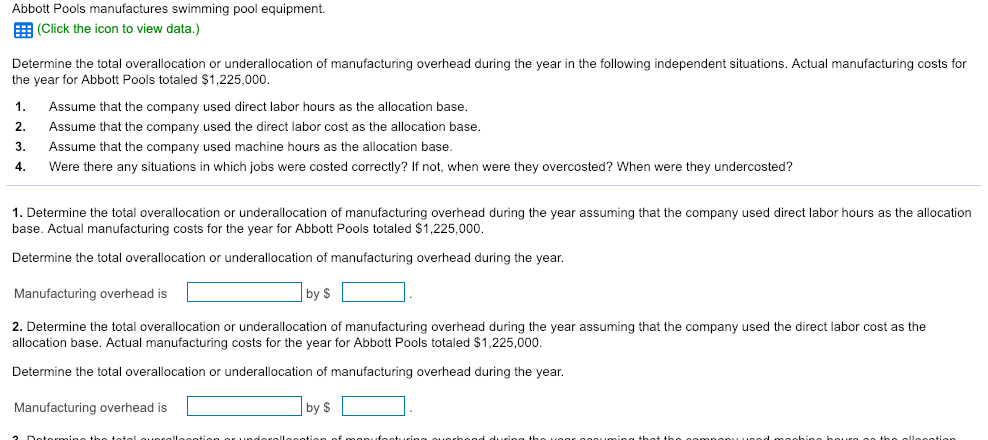

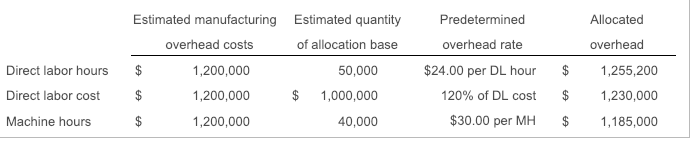

Abbott Pools manufactures swimming pool equipment EE (Click the icon to view data.) Determine the total overallocation or underallocation of manufacturing overhead during the year in the following independent situations. Actual manufacturing costs for the year for Abbott Pools totaled $1,225,000 1. Assume that the company used direct labor hours as the allocation base. 2. Assume that the company used the direct labor cost as the allocation base 3. Assume that the company used machine hours as the allocation base. 4. Were there any situations in which jobs were costed correctly? If not, when were they overcosted? When were they undercosted? 1. Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used direct labor hours as the allocation base. Actual manufacturing costs for the year for Abbott Pools totaled $1,225,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead isby o 2. Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used the direct labor cost as the sor Aot Pole 1o1i7e 91 2 allocation base. Actual manufacturing costs for the year for Abbott Pools totaled $1,225,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead is by S . Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used machine hours as the allocation base. Actual manufacturing costs forthe year for Abbott Pools totaled $1,225,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead is 4. Were there any situations in which jobs were costed correctly? If not, when were they overcosted? When were they undercosted? In this particular case, using direct labor hours as an allocation base resulted in by $ the jobs by Using direct labor cost as an allocation was the during the year. Using machine hours led to the option, causing jobs to be allocation: Jobs were by $ by a total of $ Estimated manufacturing Estimated quantity Predetermined Allocated overhead costs 1,200,000 ,200,000 1,200,000 of allocation base overhead rate overhead Direct labor hours Direct labor cost Machine hours $ 50,000 $1,000,000 40,000 $24.00 per DL hour1,255,200 120% of DL cost $ 1,230,000 $30.00 per MH 1,185,000 $