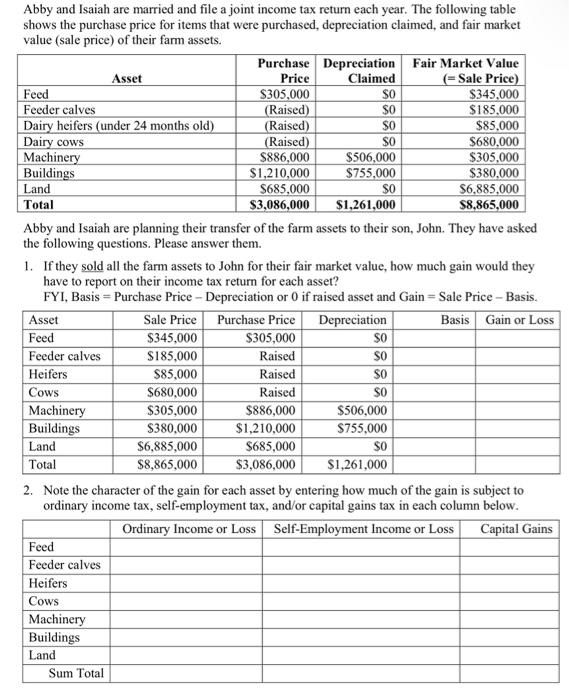

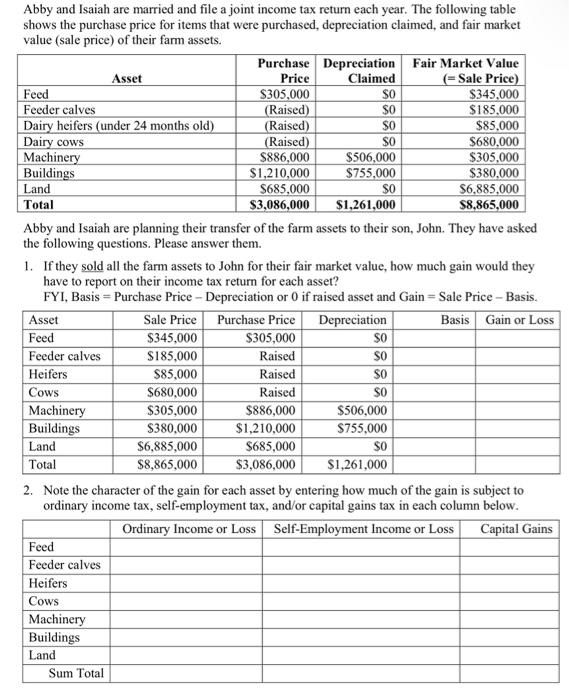

Abby and Isaiah are married and file a joint income tax return each year. The following table shows the purchase price for items that were purchased, depreciation claimed, and fair market value (sale price) of their farm assets.

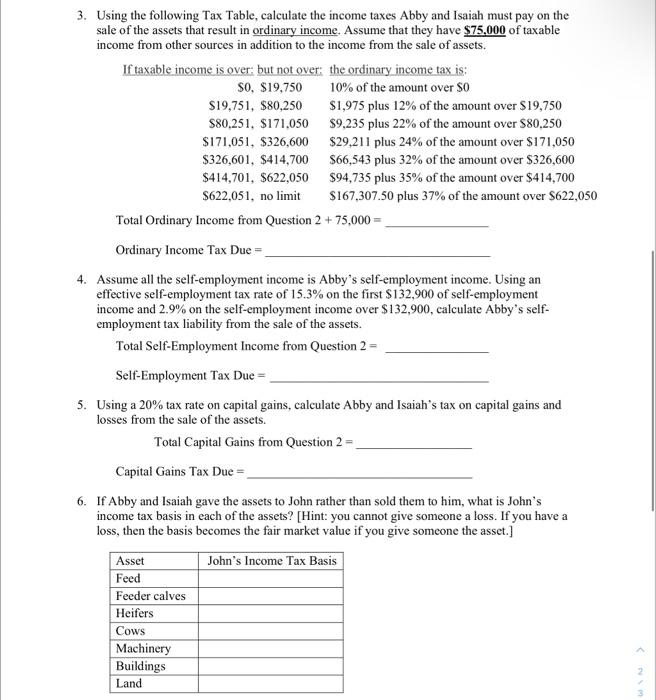

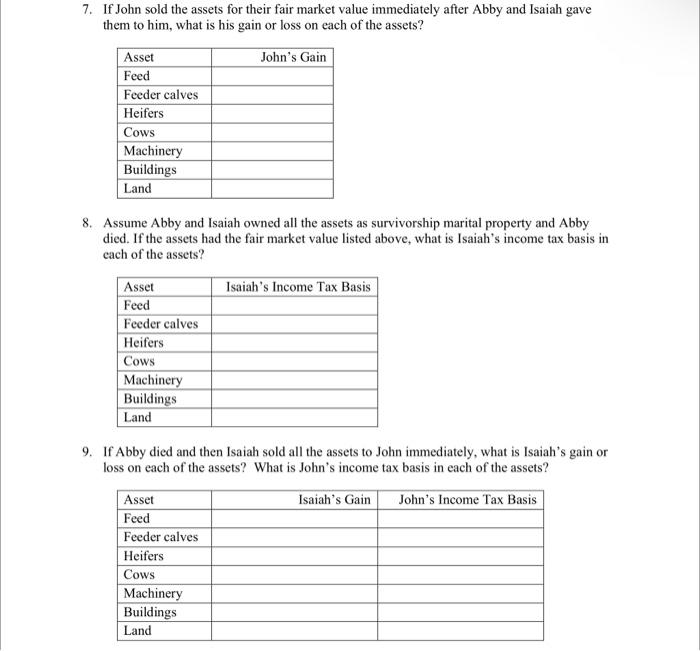

Abby and Isaiah are married and file a joint income tax return each year. The following table shows the purchase price for items that were purchased, depreciation claimed, and fair market value (sale price) of their farm assets. Abby and Isaiah are planning their transfer of the farm assets to their son, John. They have asked the following questions. Please answer them. 1. If they sold all the farm assets to John for their fair market value, how much gain would they have to report on their income tax return for each asset? FYI, Basis = Purchase Price Depreciation or 0 if raised asset and Gain = Sale Price Basis. 2. Note the character of the gain for each asset by entering how much of the gain is subject to ordinary income tax, self-employment tax, and/or capital gains tax in each column below. 3. Using the following Tax Table, calculate the income taxes Abby and Isaiah must pay on the sale of the assets that result in ordinary income. Assume that they have $75,000 of taxable income from other sources in addition to the income from the sale of assets. If ta Total Ordinary Income from Question 2+75,000= Ordinary Income Tax Due = 4. Assume all the self-employment income is Abby's self-employment income. Using an effective self-employment tax rate of 15.3% on the first $132,900 of self-employment income and 2.9% on the self-employment income over $132,900, calculate Abby's selfemployment tax liability from the sale of the assets. Total Self-Employment Income from Question 2 = Self-Employment Tax Due = 5. Using a 20\% tax rate on capital gains, calculate Abby and Isaiah's tax on capital gains and losses from the sale of the assets. Total Capital Gains from Question 2 = Capital Gains Tax Due = 6. If Abby and Isaiah gave the assets to John rather than sold them to him, what is John's income tax basis in each of the assets? [Hint: you cannot give someone a loss. If you have a loss, then the basis becomes the fair market value if you give someone the asset.] 7. If John sold the assets for their fair market value immediately after Abby and Isaiah gave them to him, what is his gain or loss on each of the assets? 8. Assume Abby and Isaiah owned all the assets as survivorship marital property and Abby died. If the assets had the fair market value listed above, what is Isaiah's income tax basis in each of the assets? 9. If Abby died and then Isaiah sold all the assets to John immediately, what is Isaiah's gain or loss on each of the assets? What is John's income tax basis in each of the assets