Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Bank originates a pool of containing 100 three-year fixed-rate mortgages with loan amount of $100,000 each. All mortgages in the pool carry a rate

ABC Bank originates a pool of containing 100 three-year fixed-rate mortgages with loan amount of $100,000 each. All mortgages in the pool carry a rate of 6% with annual payments. The servicing fee is charged 0.5%. ABC Bank would like to sell the pool to investors via Mortgage Pass Through (MPT) security. Suppose that 100,000 shares will be issued and the market interest rate is 5.5%.

how to get the accumulated value for part 3 and 4??

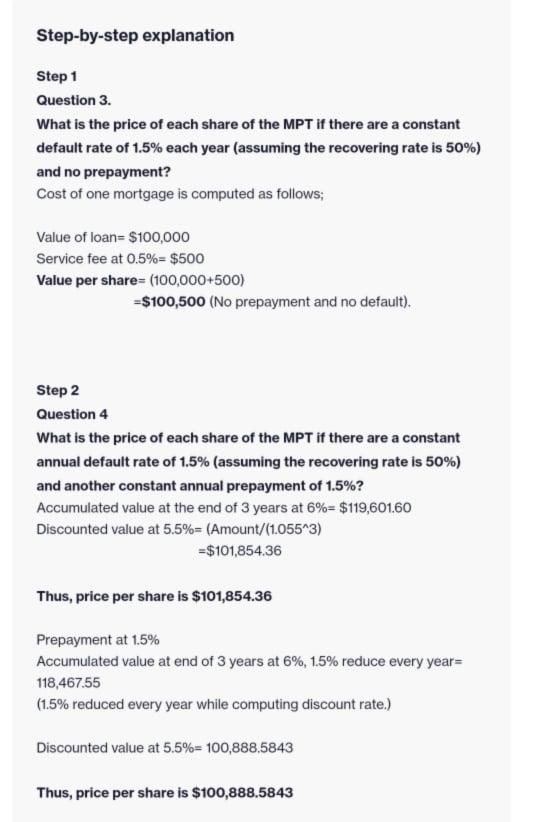

Step-by-step explanation Step 1 Question 3. What is the price of each share of the MPT if there are a constant default rate of 1.5% each year (assuming the recovering rate is 50%) and no prepayment? Cost of one mortgage is computed as follows; Value of loan= $100,000 Service fee at 0.5%= $500 Value per share= (100,000+500) =$100,500 (No prepayment and no default). Step 2 Question 4 What is the price of each share of the MPT if there are a constant annual default rate of 1.5% (assuming the recovering rate is 50%) and another constant annual prepayment of 1.5%? Accumulated value at the end of 3 years at 6%= $119,601.60 Discounted value at 5.5%= (Amount/(1.055-3) =$101,854.36 Thus, price per share is $101,854.36 Prepayment at 1.5% Accumulated value at end of 3 years at 6%, 1.5% reduce every year= 118,467.55 (1.5% reduced every year while computing discount rate.) Discounted value at 5.5%= 100,888.5843 Thus, price per share is $100,888.5843 Step-by-step explanation Step 1 Question 3. What is the price of each share of the MPT if there are a constant default rate of 1.5% each year (assuming the recovering rate is 50%) and no prepayment? Cost of one mortgage is computed as follows; Value of loan= $100,000 Service fee at 0.5%= $500 Value per share= (100,000+500) =$100,500 (No prepayment and no default). Step 2 Question 4 What is the price of each share of the MPT if there are a constant annual default rate of 1.5% (assuming the recovering rate is 50%) and another constant annual prepayment of 1.5%? Accumulated value at the end of 3 years at 6%= $119,601.60 Discounted value at 5.5%= (Amount/(1.055-3) =$101,854.36 Thus, price per share is $101,854.36 Prepayment at 1.5% Accumulated value at end of 3 years at 6%, 1.5% reduce every year= 118,467.55 (1.5% reduced every year while computing discount rate.) Discounted value at 5.5%= 100,888.5843 Thus, price per share is $100,888.5843

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started