Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Co. ascertains the cost of product monthly. Company has Gristmill Department which is main production cost center, Maintenance and Repair and Cafeteria Department which

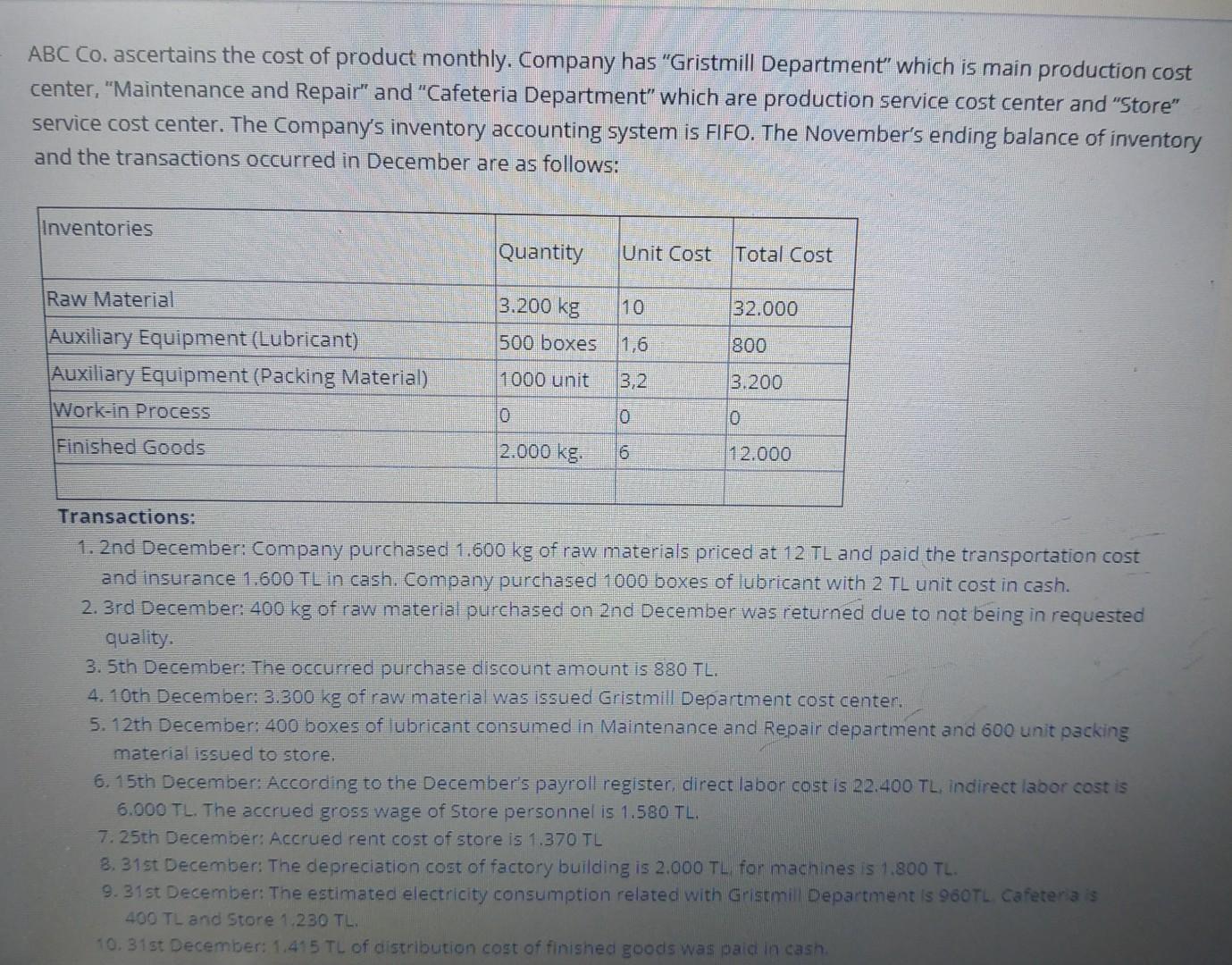

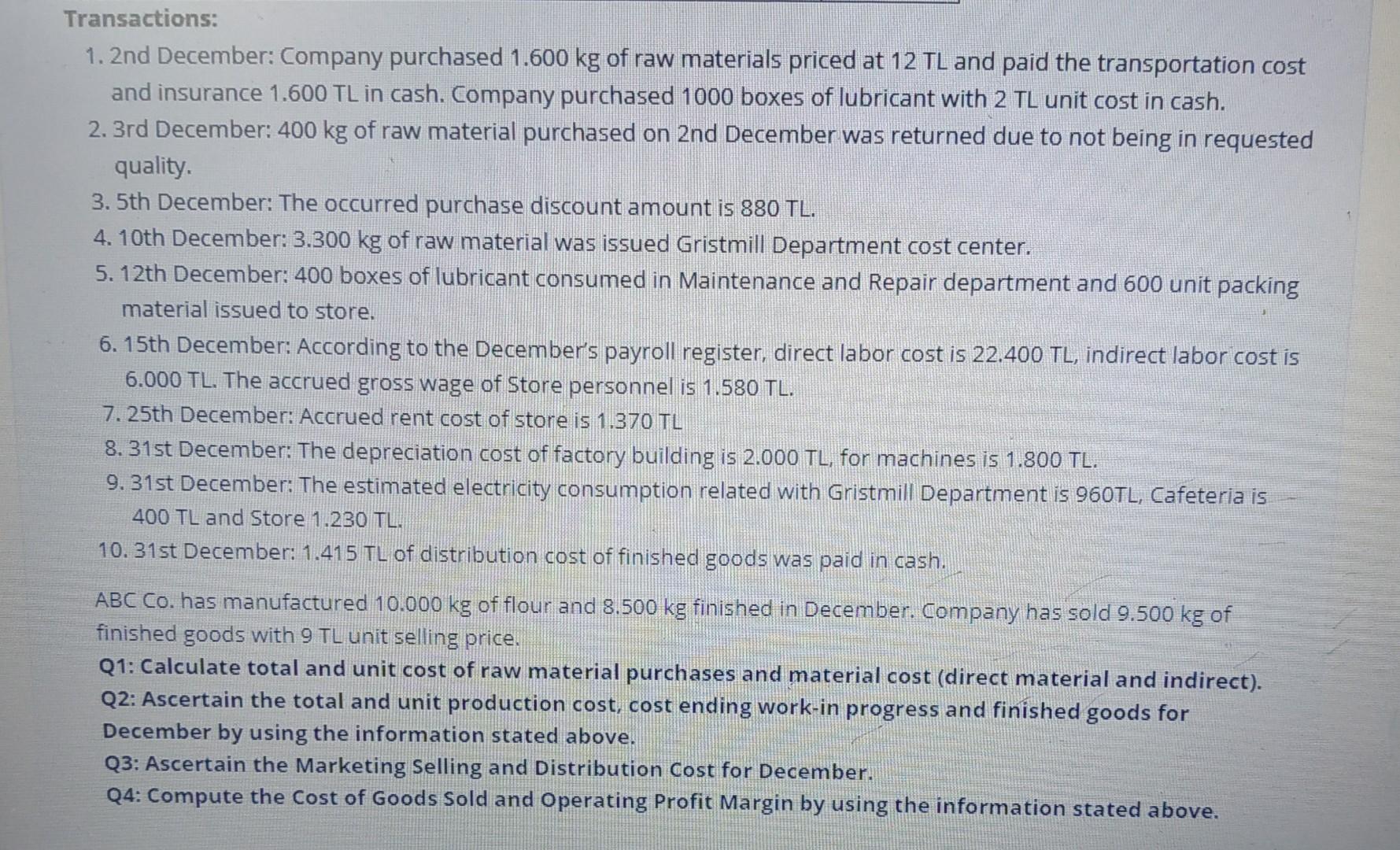

ABC Co. ascertains the cost of product monthly. Company has "Gristmill Department which is main production cost center, "Maintenance and Repair" and "Cafeteria Department which are production service cost center and "Store" service cost center. The Company's inventory accounting system is FIFO. The November's ending balance of inventory and the transactions occurred in December are as follows: Inventories Quantity Unit Cost Total Cost Raw Material 10 32.000 3.200 kg 500 boxes 1,6 800 Auxiliary Equipment (Lubricant) Auxiliary Equipment (Packing Material) Work-in Process 1000 unit 3,2 3.200 Finished Goods 2.000 kg 16 12.000 Transactions: 1. 2nd December: Company purchased 1.600 kg of raw materials priced at 12 TL and paid the transportation cost and insurance 1.600 TL in cash. Company purchased 1000 boxes of lubricant with 2 TL unit cost in cash. 2. 3rd December: 400 kg of raw material purchased on 2nd December was returned due to not being in requested quality. 3. 5th December: The occurred purchase discount amount is 880 TL. 4. 10th December: 3.300 kg of raw material was issued Gristmill Department cost center. 5. 12th December: 400 boxes of lubricant consumed in Maintenance and Repair department and 600 unit packing material issued to store, 6.15 December: According to the December's payroll register, direct labor cost is 22.400 TL, indirect labor cost is 6.000 TL. The accrued gross wage of Store personnel is 1.580 TL. 7.25th December: Accrued rent cost of store is 1.370 TL 8. 31st December: The depreciation cost of factory building is 2.000 TL for machines is 1.800 TL 9.31st December: The estimated electricity consumption related with Gristmill Department is 960TL Cafeteriais 400 TL and Store 1.230 TL. 10. 31st December: 1.415 TL of distribution cost of finished goods was paid in cash Transactions: 1.2nd December: Company purchased 1.600 kg of raw materials priced at 12 TL and paid the transportation cost and insurance 1.600 TL in cash. Company purchased 1000 boxes of lubricant with 2 TL unit cost in cash. 2. 3rd December: 400 kg of raw material purchased on 2nd December was returned due to not being in requested quality. 3.5th December: The occurred purchase discount amount is 880 TL. 4. 10th December: 3.300 kg of raw material was issued Gristmill Department cost center. 5. 12th December: 400 boxes of lubricant consumed in Maintenance and Repair department and 600 unit packing material issued to store. 6.15th December: According to the December's payroll register, direct labor cost is 22.400 TL, indirect labor cost is 6.000 TL. The accrued gross wage of Store personnel is 1.580 TL. 7.25th December: Accrued rent cost of store is 1.370 TL 8. 31st December: The depreciation cost of factory building is 2.000 TL, for machines is 1.800 TL. 9.31st December: The estimated electricity consumption related with Gristmill Department is 960TL, Cafeteria is 400 TL and Store 1.230 TL. 10.31st December: 1.415 TL of distribution cost of finished goods was paid in cash. ABC Co. has manufactured 10.000 kg of flour and 8.500 kg finished in December. Company has sold 9.500 kg of finished goods with 9 TL unit selling price. Q1: Calculate total and unit cost of raw material purchases and material cost (direct material and indirect). Q2: Ascertain the total and unit production cost, cost ending work-in progress and finished goods for December by using the information stated above. Q3: Ascertain the Marketing Selling and Distribution Cost for December. Q4: Compute the cost of Goods Sold and Operating Profit Margin by using the information stated above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started