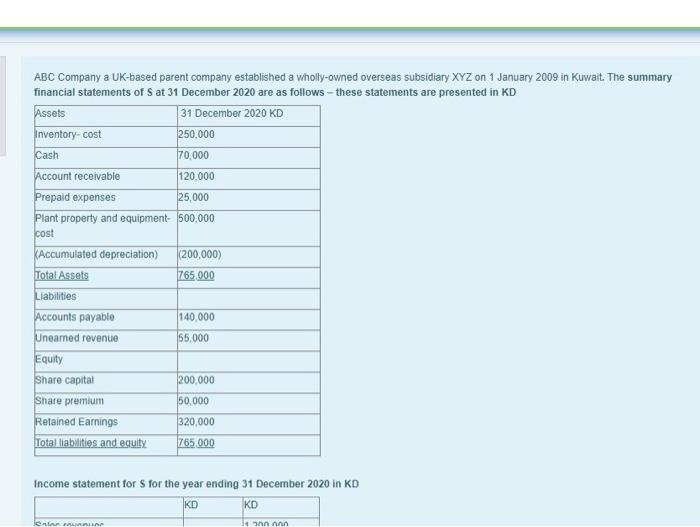

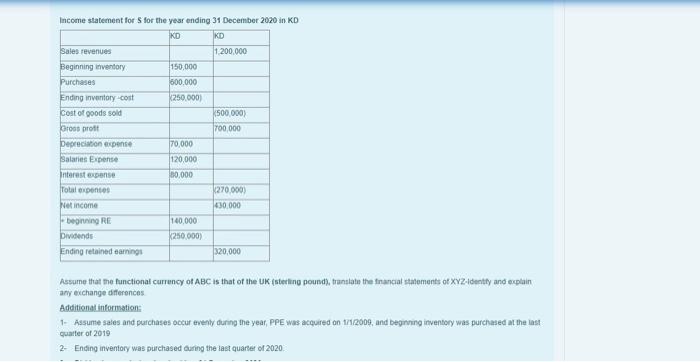

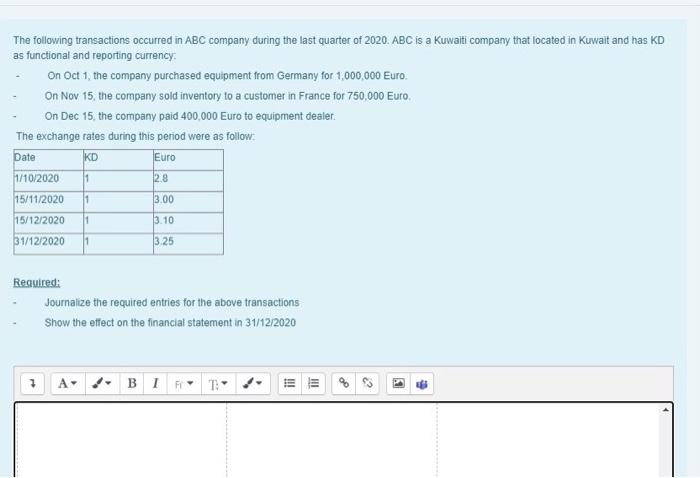

ABC Company a UK-based parent company established a wholly-owned overseas subsidiary XYZ on 1 January 2009 in Kuwait. The summary financial statements of Sat 31 December 2020 are as follows-these statements are presented in KD Assets Inventory-cost 250,000 Cash 70,000 31 December 2020 KD Account receivable 120.000 Prepaid expenses 25,000 Plant property and equipment- 500.000 cost KAccumulated depreciation) (200,000) Total Assets 765.000 Liabilities Accounts payable 140.000 Uneamed revenue 55,000 Equity Share capital 200.000 Share premium 50.000 Retained Earnings 320,000 Total liabilities and equity 765.000 Income statement for S for the year ending 31 December 2020 in KD KD KD CA FALAR 4 Income statement for Sfor the year ending 31 December 2020 in KD KD KD 1.200.000 150,000 500.000 250.000 500,000) 700.000 Sales revenues Beginning inventory Purchases Ending inventory cost Cost of goods sold roos prott Depreciation expense Salaries Expense Interest expense Total pontos Net income - beginning RE Dividends Ending retained earnings 70,000 120,000 50.000 270.000) 430,000 140,000 k250,000) 320,000 Assume that the functional currency of ABC is that of the UK sterling pound), translate the financial statements of XYZ-Identity and explain any exchange differences Additional information 1- Assume sales and purchases occur eventy during the year, PPE was acquired on 171/2009, and beginning inventory was purchased at the last quarter of 2019 2 Ending inventory was purchased during the last quarter of 2020. The following transactions occurred in ABC company during the last quarter of 2020. ABC is a Kuwalti company that located in Kuwait and has KD as functional and reporting currency: On Oct 1, the company purchased equipment from Germany for 1,000,000 Euro On Nov 15, the company sold inventory to a customer in France for 750,000 Euro On Dec 15, the company paid 400,000 Euro to equipment dealer. The exchange rates during this period were as follow Date KD Euro 1/10/2020 11 2.8 15/11/2020 1 3.00 15/12/2020 11 3.10 31/12/2020 3.25 Required: Journalize the required entries for the above transactions Show the effect on the financial statement in 31/12/2020 A- BIF fii HII ABC Company a UK-based parent company established a wholly-owned overseas subsidiary XYZ on 1 January 2009 in Kuwait. The summary financial statements of Sat 31 December 2020 are as follows-these statements are presented in KD Assets Inventory-cost 250,000 Cash 70,000 31 December 2020 KD Account receivable 120.000 Prepaid expenses 25,000 Plant property and equipment- 500.000 cost KAccumulated depreciation) (200,000) Total Assets 765.000 Liabilities Accounts payable 140.000 Uneamed revenue 55,000 Equity Share capital 200.000 Share premium 50.000 Retained Earnings 320,000 Total liabilities and equity 765.000 Income statement for S for the year ending 31 December 2020 in KD KD KD CA FALAR 4 Income statement for Sfor the year ending 31 December 2020 in KD KD KD 1.200.000 150,000 500.000 250.000 500,000) 700.000 Sales revenues Beginning inventory Purchases Ending inventory cost Cost of goods sold roos prott Depreciation expense Salaries Expense Interest expense Total pontos Net income - beginning RE Dividends Ending retained earnings 70,000 120,000 50.000 270.000) 430,000 140,000 k250,000) 320,000 Assume that the functional currency of ABC is that of the UK sterling pound), translate the financial statements of XYZ-Identity and explain any exchange differences Additional information 1- Assume sales and purchases occur eventy during the year, PPE was acquired on 171/2009, and beginning inventory was purchased at the last quarter of 2019 2 Ending inventory was purchased during the last quarter of 2020. The following transactions occurred in ABC company during the last quarter of 2020. ABC is a Kuwalti company that located in Kuwait and has KD as functional and reporting currency: On Oct 1, the company purchased equipment from Germany for 1,000,000 Euro On Nov 15, the company sold inventory to a customer in France for 750,000 Euro On Dec 15, the company paid 400,000 Euro to equipment dealer. The exchange rates during this period were as follow Date KD Euro 1/10/2020 11 2.8 15/11/2020 1 3.00 15/12/2020 11 3.10 31/12/2020 3.25 Required: Journalize the required entries for the above transactions Show the effect on the financial statement in 31/12/2020 A- BIF fii HII