Answered step by step

Verified Expert Solution

Question

1 Approved Answer

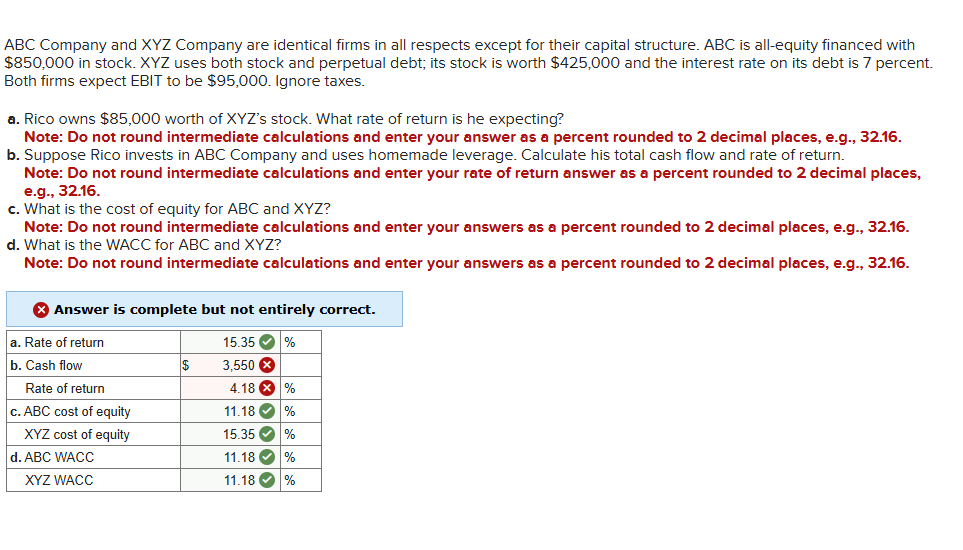

ABC Company and x Y Z Company are identical firms in all respects except for their capital structure. ABC is all - equity financed with

ABC Company and Company are identical firms in all respects except for their capital structure. ABC is allequity financed with

$ in stock. XYZ uses both stock and perpetual debt; its stock is worth $ and the interest rate on its debt is percent.

Both firms expect EBIT to be $ Ignore taxes.

a Rico owns $ worth of s stock. What rate of return is he expecting?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

b Suppose Rico invests in ABC Company and uses homemade leverage. Calculate his total cash flow and rate of return.

Note: Do not round intermediate calculations and enter your rate of return answer as a percent rounded to decimal places,

eg

c What is the cost of equity for ABC and

Note: Do not round intermediate calculations and enter your answers as a percent rounded to decimal places, eg

d What is the WACC for ABC and XYZ

Note: Do not round intermediate calculations and enter your answers as a percent rounded to decimal places, eg

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started