Answered step by step

Verified Expert Solution

Question

1 Approved Answer

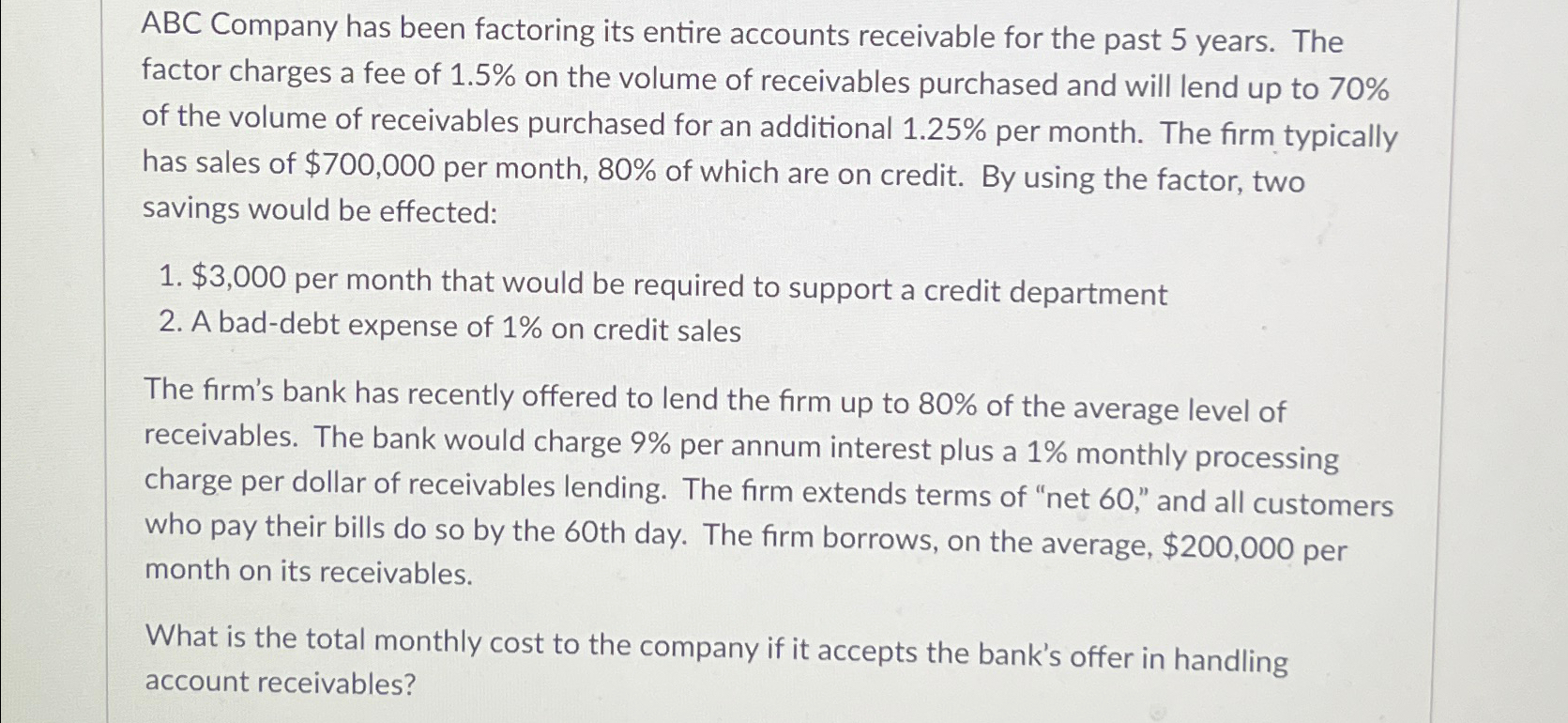

ABC Company has been factoring its entire accounts receivable for the past 5 years. The factor charges a fee of 1 . 5 % on

ABC Company has been factoring its entire accounts receivable for the past years. The factor charges a fee of on the volume of receivables purchased and will lend up to of the volume of receivables purchased for an additional per month. The firm typically has sales of $ per month, of which are on credit. By using the factor, two savings would be effected:

$ per month that would be required to support a credit department

A baddebt expense of on credit sales

The firm's bank has recently offered to lend the firm up to of the average level of receivables. The bank would charge per annum interest plus a monthly processing charge per dollar of receivables lending. The firm extends terms of "net and all customers who pay their bills do so by the th day. The firm borrows, on the average, $ per month on its receivables.

What is the total monthly cost to the company if it accepts the bank's offer in handling account receivables?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started