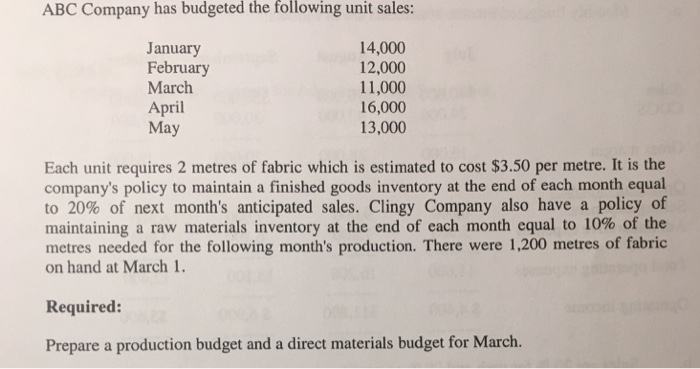

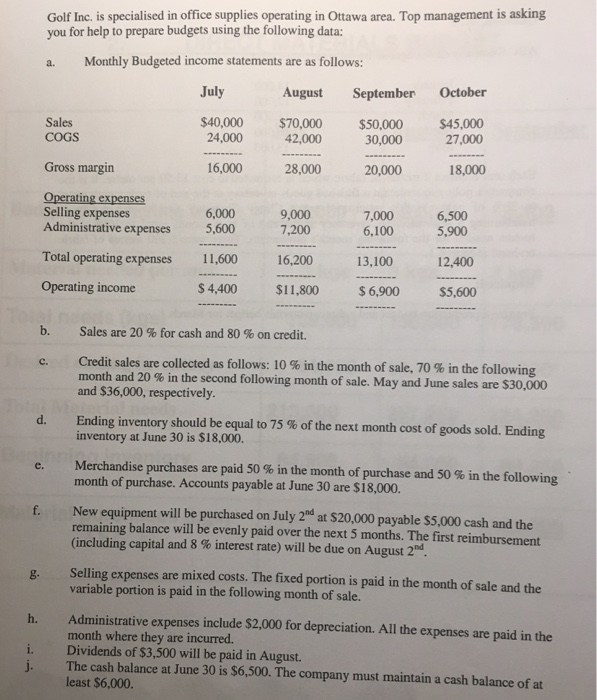

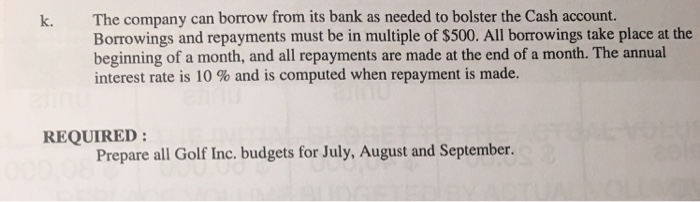

ABC Company has budgeted the following unit sales: January February March April May 4,000 12,000 11,000 16,000 13,000 Each unit requires 2 metres of fabric which is estimated to cost $3.50 per metre. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated sales. Clingy Company also have a policy of maintaining a raw materials inventory at the end of each month equal to 10% of the metres needed for the following month's production. There were 1,200 metres of fabric on hand at March 1. Required: Prepare a production budget and a direct materials budget for March. Golf Inc. is specialised in office supplies operating in Ottawa area. Top management is asking you for help to prepare budgets using the following data: a. Monthly Budgeted income statements are as follows July August September October $40,000 $70,000 $50,000 $45,000 27,000 18,000 Sales COGS 24,000 42,000 30,000 Gross margin 16,000 28,000 20,000 6.000 1200 5,600 Selling expenses 7,000 6,100 6,500 5,900 Administrative expenses Total operating expenses Operating income 7,200 11,600 16.200 13,100 12,400 $4,400 $11,800 $6,900 $5,600 b. Sales are 20 % for cash and 80 % on credit. Credit sales are collected as follows: 10 % in the month of sale, 70 % in the following month and 20 % in the second following month of sale. May and June sales are S30.000 and $36,000, respectively c. Ending inventory should be equal to 75 % of the next month cost of goods sold. Ending inventory at June 30 is $18,000. d. Merchandise purchases are paid 50 % in the month of purchase and 50 % in the following month of purchase. Accounts payable at June 30 are $18,000. e. New equipment will be purchased on July 2ad at $20,000 payable $5,000 cash and the remaining balance will be evenly paid over the next 5 months. The first reimbursement (including capital and 8 % interest rate) will be due on August 2nd. f. g. Selling expenses are mixed costs. The fixed portion is paid in the month of sale and the h. Administrative expenses include $2,000 for depreciation. All the expenses are paid in the i. Dividends of $3,500 will be paid in August. variable portion is paid in the following month of sale. month where they are incurred. The cash balance at June 30 is $6,500. The company must maintain a cash balance of at least $6,000. j. The company can borrow from its bank as needed to bolster the Cash account. Borrowings and repayments must be in multiple of $500. All borrowings take place at the beginning of a month, and all repayments are made at the end of a month. The annual interest rate is 10 % and is computed when repayment is made. k. REQUIRED: Prepare all Golf Inc. budgets for July, August and September