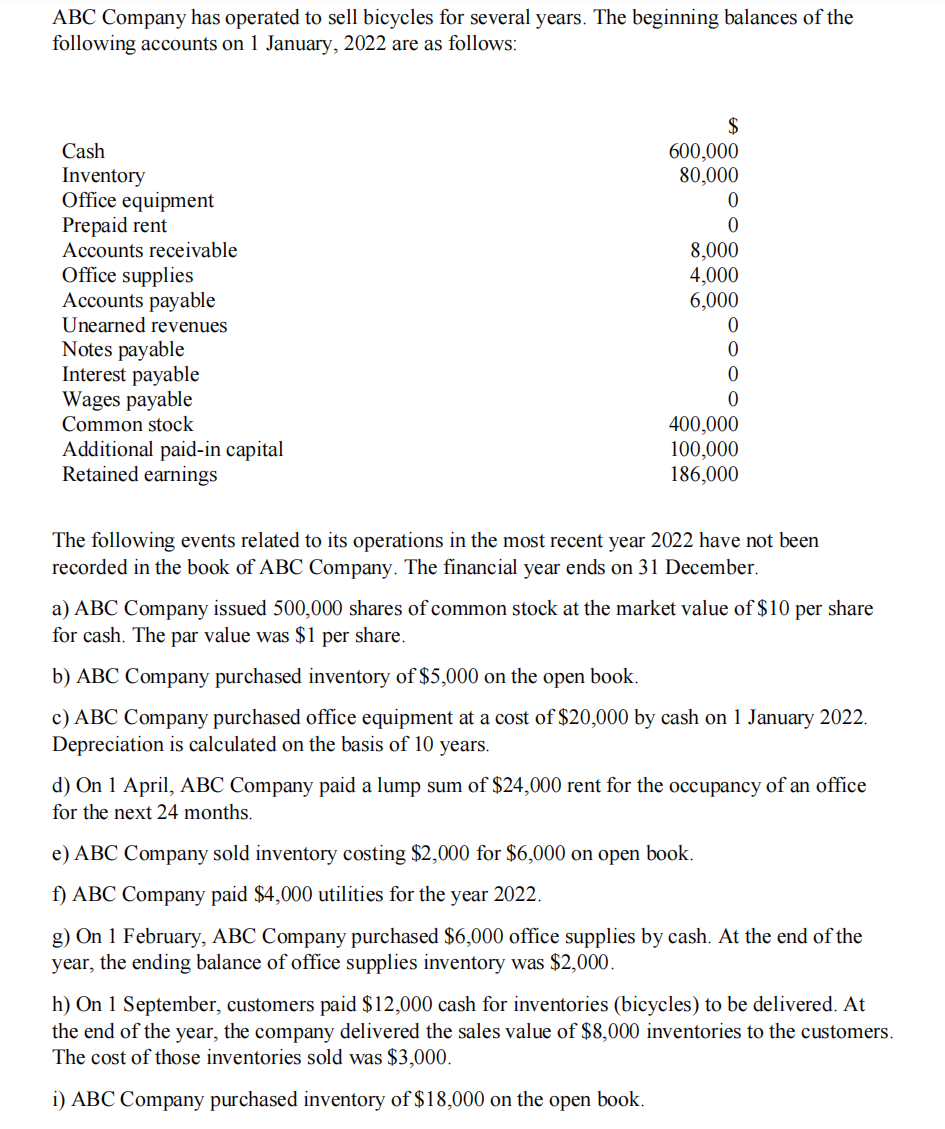

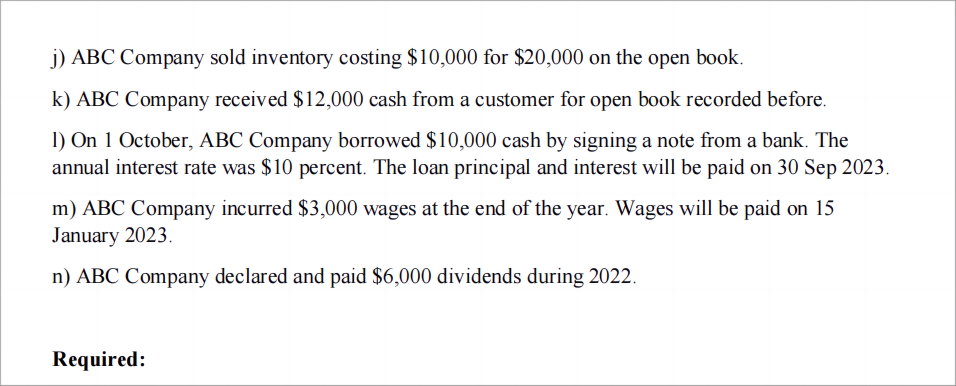

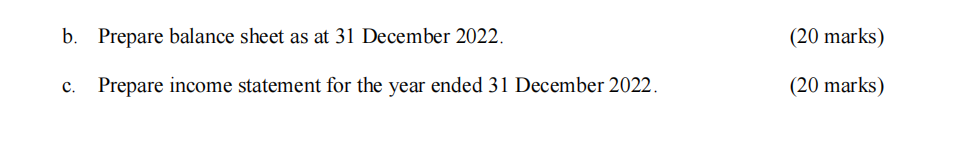

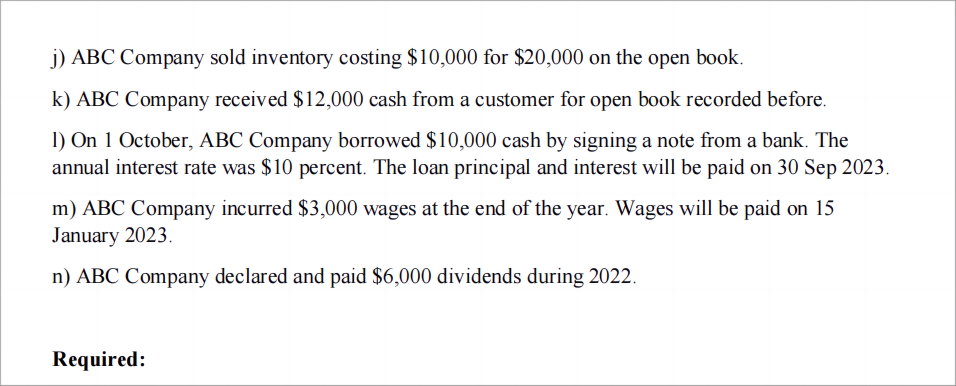

ABC Company has operated to sell bicycles for several years. The beginning balances of the following accounts on 1 January, 2022 are as follows: The following events related to its operations in the most recent year 2022 have not been recorded in the book of ABC Company. The financial year ends on 31 December. a) ABC Company issued 500,000 shares of common stock at the market value of $10 per share for cash. The par value was $1 per share. b) ABC Company purchased inventory of $5,000 on the open book. c) ABC Company purchased office equipment at a cost of $20,000 by cash on 1 January 2022 . Depreciation is calculated on the basis of 10 years. d) On 1 April, ABC Company paid a lump sum of $24,000 rent for the occupancy of an office for the next 24 months. e) ABC Company sold inventory costing $2,000 for $6,000 on open book. f) ABC Company paid $4,000 utilities for the year 2022 . g) On 1 February, ABC Company purchased $6,000 office supplies by cash. At the end of the year, the ending balance of office supplies inventory was $2,000. h) On 1 September, customers paid $12,000 cash for inventories (bicycles) to be delivered. At the end of the year, the company delivered the sales value of $8,000 inventories to the customers. The cost of those inventories sold was $3,000. i) ABC Company purchased inventory of $18,000 on the open book. j) ABC Company sold inventory costing $10,000 for $20,000 on the open book. k) ABC Company received $12,000 cash from a customer for open book recorded before. 1) On 1 October, ABC Company borrowed $10,000 cash by signing a note from a bank. The annual interest rate was $10 percent. The loan principal and interest will be paid on 30 Sep 2023. m) ABC Company incurred $3,000 wages at the end of the year. Wages will be paid on 15 January 2023. n) ABC Company declared and paid $6,000 dividends during 2022. b. Prepare balance sheet as at 31 December 2022 . (20 marks) c. Prepare income statement for the year ended 31 December 2022. (20 marks) ABC Company has operated to sell bicycles for several years. The beginning balances of the following accounts on 1 January, 2022 are as follows: The following events related to its operations in the most recent year 2022 have not been recorded in the book of ABC Company. The financial year ends on 31 December. a) ABC Company issued 500,000 shares of common stock at the market value of $10 per share for cash. The par value was $1 per share. b) ABC Company purchased inventory of $5,000 on the open book. c) ABC Company purchased office equipment at a cost of $20,000 by cash on 1 January 2022 . Depreciation is calculated on the basis of 10 years. d) On 1 April, ABC Company paid a lump sum of $24,000 rent for the occupancy of an office for the next 24 months. e) ABC Company sold inventory costing $2,000 for $6,000 on open book. f) ABC Company paid $4,000 utilities for the year 2022 . g) On 1 February, ABC Company purchased $6,000 office supplies by cash. At the end of the year, the ending balance of office supplies inventory was $2,000. h) On 1 September, customers paid $12,000 cash for inventories (bicycles) to be delivered. At the end of the year, the company delivered the sales value of $8,000 inventories to the customers. The cost of those inventories sold was $3,000. i) ABC Company purchased inventory of $18,000 on the open book. j) ABC Company sold inventory costing $10,000 for $20,000 on the open book. k) ABC Company received $12,000 cash from a customer for open book recorded before. 1) On 1 October, ABC Company borrowed $10,000 cash by signing a note from a bank. The annual interest rate was $10 percent. The loan principal and interest will be paid on 30 Sep 2023. m) ABC Company incurred $3,000 wages at the end of the year. Wages will be paid on 15 January 2023. n) ABC Company declared and paid $6,000 dividends during 2022. b. Prepare balance sheet as at 31 December 2022 . (20 marks) c. Prepare income statement for the year ended 31 December 2022. (20 marks)