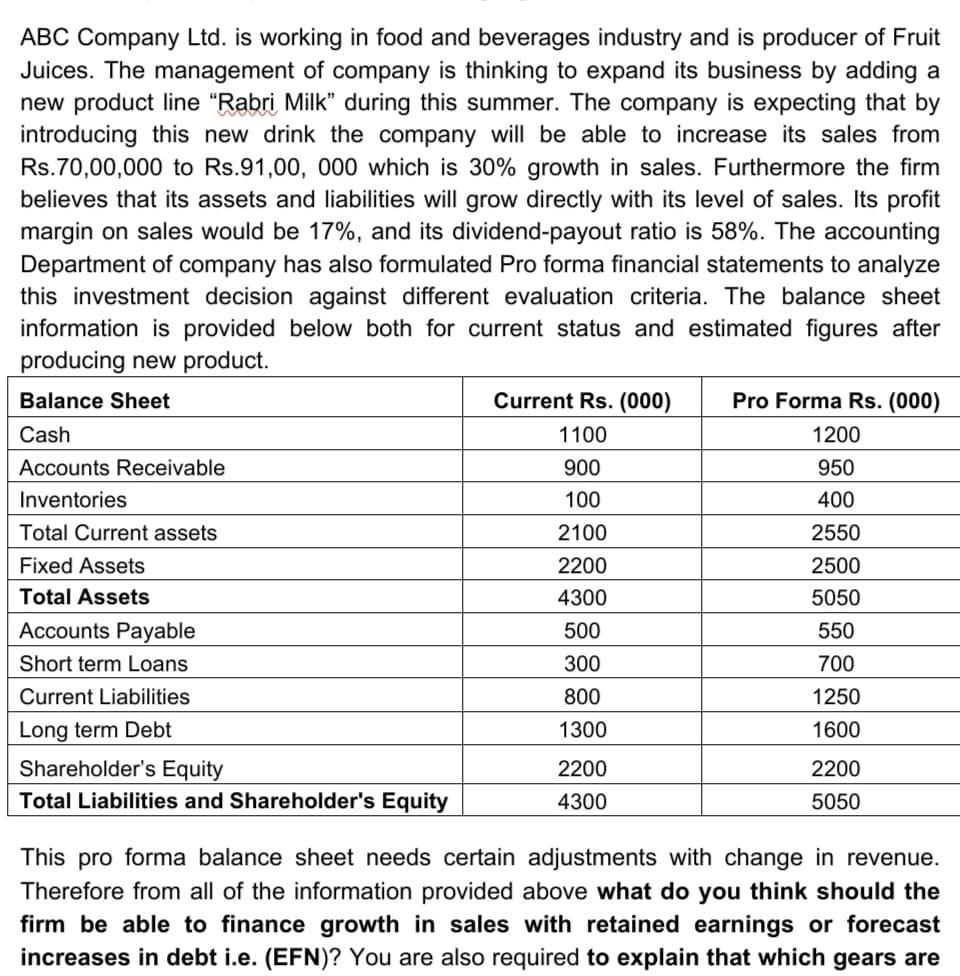

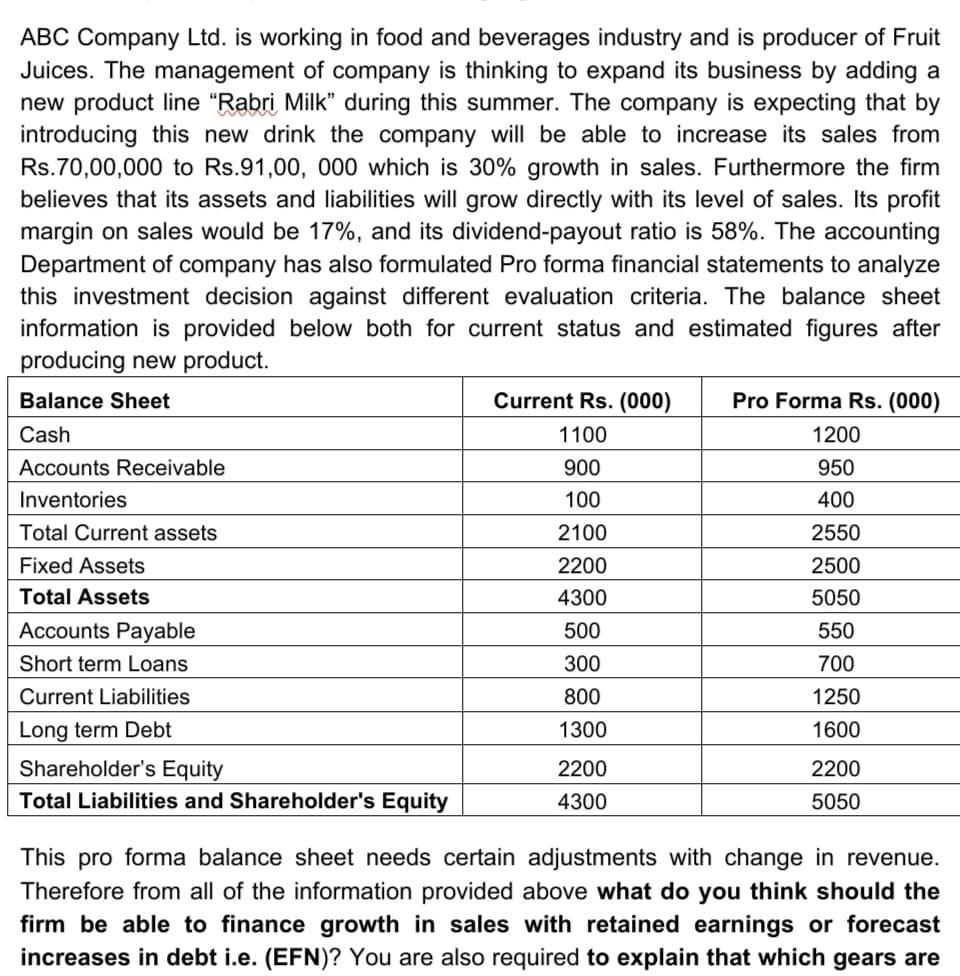

ABC Company Ltd. is working in food and beverages industry and is producer of Fruit Juices. The management of company is thinking to expand its business by adding a new product line Rabri Milk during this summer. The company is expecting that by introducing this new drink the company will be able to increase its sales from Rs.70,00,000 to Rs.91,00, 000 which is 30% growth in sales. Furthermore the firm believes that its assets and liabilities will grow directly with its level of sales. Its profit margin on sales would be 17%, and its dividend-payout ratio is 58%. The accounting Department of company has also formulated Pro forma financial statements to analyze this investment decision against different evaluation criteria. The balance sheet information is provided below both for current status and estimated figures after producing new product. Balance Sheet Current Rs. (000) Pro Forma Rs. (000) 1200 Cash 1100 Accounts Receivable 900 950 Inventories 100 400 Total Current assets 2100 2550 Fixed Assets 2200 2500 Total Assets 4300 5050 Accounts Payable 500 550 Short term Loans 300 700 Current Liabilities 800 1250 1300 1600 Long term Debt Shareholder's Equity Total Liabilities and Shareholder's Equity 2200 2200 4300 5050 This pro forma balance sheet needs certain adjustments with change in revenue. Therefore from all of the information provided above what do you think should the firm be able to finance growth in sales with retained earnings or forecast increases in debt i.e. (EFN)? You are also required to explain that which gears are ABC Company Ltd. is working in food and beverages industry and is producer of Fruit Juices. The management of company is thinking to expand its business by adding a new product line Rabri Milk during this summer. The company is expecting that by introducing this new drink the company will be able to increase its sales from Rs.70,00,000 to Rs.91,00, 000 which is 30% growth in sales. Furthermore the firm believes that its assets and liabilities will grow directly with its level of sales. Its profit margin on sales would be 17%, and its dividend-payout ratio is 58%. The accounting Department of company has also formulated Pro forma financial statements to analyze this investment decision against different evaluation criteria. The balance sheet information is provided below both for current status and estimated figures after producing new product. Balance Sheet Current Rs. (000) Pro Forma Rs. (000) 1200 Cash 1100 Accounts Receivable 900 950 Inventories 100 400 Total Current assets 2100 2550 Fixed Assets 2200 2500 Total Assets 4300 5050 Accounts Payable 500 550 Short term Loans 300 700 Current Liabilities 800 1250 1300 1600 Long term Debt Shareholder's Equity Total Liabilities and Shareholder's Equity 2200 2200 4300 5050 This pro forma balance sheet needs certain adjustments with change in revenue. Therefore from all of the information provided above what do you think should the firm be able to finance growth in sales with retained earnings or forecast increases in debt i.e. (EFN)? You are also required to explain that which gears are