Answered step by step

Verified Expert Solution

Question

1 Approved Answer

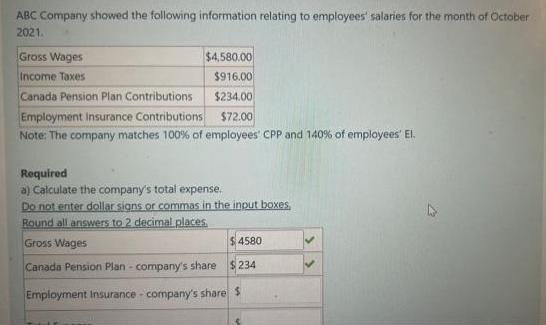

ABC Company showed the following information relating to employees' salaries for the month of October 2021. Gross Wages $4,580.00 $916.00] Income Taxes Canada Pension

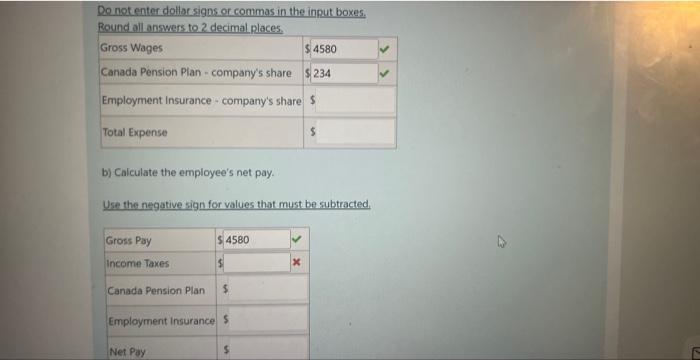

ABC Company showed the following information relating to employees' salaries for the month of October 2021. Gross Wages $4,580.00 $916.00] Income Taxes Canada Pension Plan Contributions $234.00 Employment Insurance Contributions $72.00 Note: The company matches 100% of employees' CPP and 140% of employees' El. Required a) Calculate the company's total expense. Do not enter dollar signs or commas in the input boxes, Round all answers to 2 decimal places. Gross Wages $4580 Canada Pension Plan - company's share $234 Employment Insurance company's share $ Do not enter dollar signs or commas in the input boxes, Round all answers to 2 decimal places, Gross Wages $4580 Canada Pension Plan - company's share $234 Employment Insurance company's share $ Total Expense b) Calculate the employee's net pay. Use the negative sign for values that must be subtracted, Gross Pay Income Taxes $4580 Canada Pension Plan $ Employment Insurance $ Net Pay $ S

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the companys total expense we need to add up all the expenses related to the employee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started