Answered step by step

Verified Expert Solution

Question

1 Approved Answer

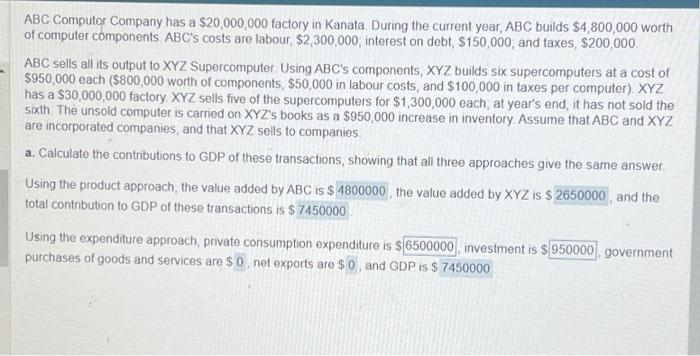

ABC Computer Company has a $20,000,000 factory in Kanata. During the current year, ABC builds $4,800,000 worth of computer components. ABC's costs are labour, $2,300,000;

ABC Computer Company has a $20,000,000 factory in Kanata. During the current year, ABC builds $4,800,000 worth of computer components. ABC's costs are labour, $2,300,000; interest on debt, $150,000, and taxes, $200,000. ABC sells all its output to XYZ Supercomputer. Using ABC's components, XYZ builds six supercomputers at a cost of $950,000 each ($800,000 worth of components, $50,000 in labour costs, and $100,000 in taxes per computer). XYZ has a $30,000,000 factory. XYZ sells five of the supercomputers for $1,300,000 each; at year's end, it has not sold the sixth. The unsold computer is carried on XYZ's books as a $950,000 increase in inventory. Assume that ABC and XYZ are incorporated companies, and that XYZ sells to companies. a. Calculate the contributions to GDP of these transactions, showing that all three approaches give the same answer. Using the product approach, the value added by ABC is $4800000, the value added by XYZ is $2650000, and the total contribution to GDP of these transactions is $7450000 Using the expenditure approach, private consumption expenditure is $6500000, investment is $950000, government purchases of goods and services are $ 0, net exports are $0, and GDP is $7450000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started