Answered step by step

Verified Expert Solution

Question

1 Approved Answer

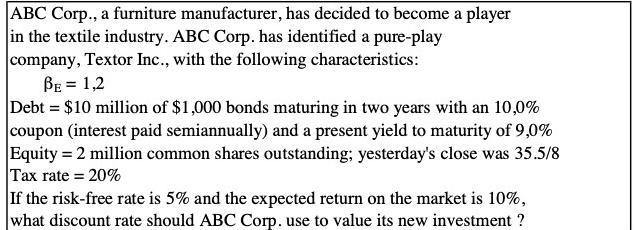

ABC Corp., a furniture manufacturer, has decided to become a player in the textile industry. ABC Corp. has identified a pure-play company, Textor Inc.,

ABC Corp., a furniture manufacturer, has decided to become a player in the textile industry. ABC Corp. has identified a pure-play company, Textor Inc., with the following characteristics: BE = 1,2 Debt = $10 million of $1,000 bonds maturing in two years with an 10,0% coupon (interest paid semiannually) and a present yield to maturity of 9,0% Equity = 2 million common shares outstanding; yesterday's close was 35.5/8 Tax rate = 20% If the risk-free rate is 5% and the expected return on the market is 10%, what discount rate should ABC Corp. use to value its new investment ?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To value ABC Corps investment in Textor Inc we need to calculate the cost of equity and the cost of debt and then use these costs to determine the discount rate that ABC Corp should use Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started